Weekly EIA Status Reports are so boring

Unless they point to screaming deficits

We’ve been pointing at distillate markets in recent months as Ground Zero for the global hydrocarbon shortage. Global middle distillate inventories have been plunging.

Europe, Singapore, US distillate inventories

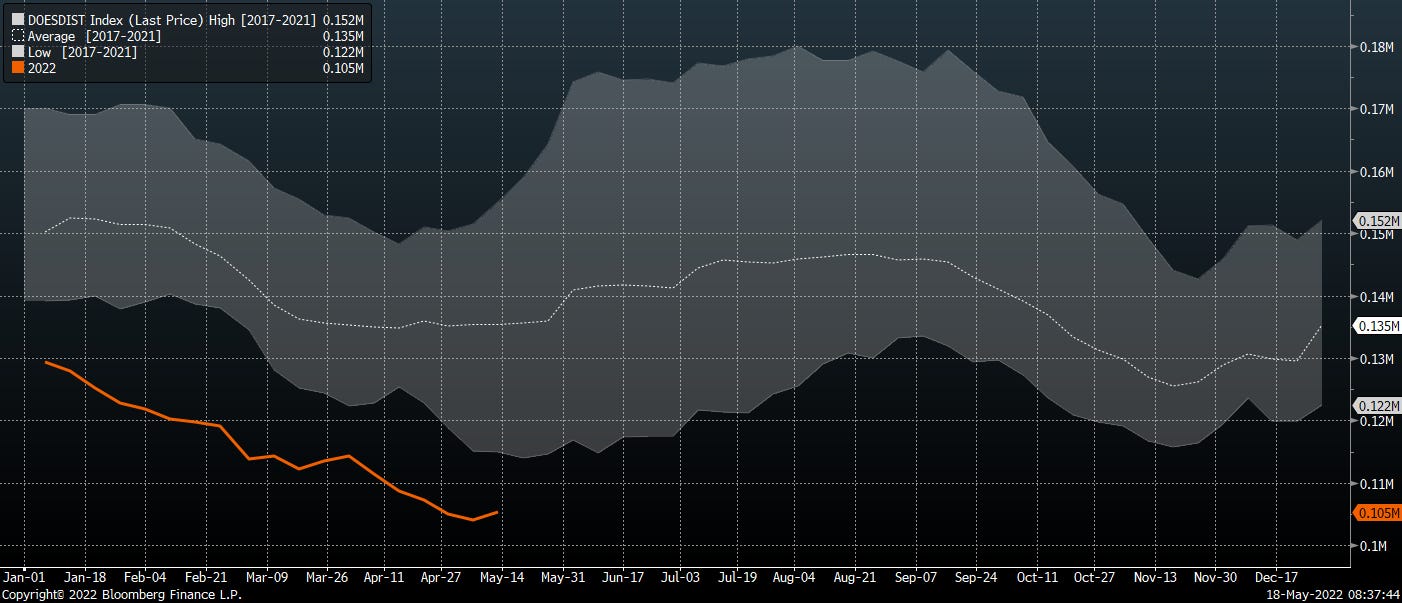

The same situation has been playing out in the US where inventories are well below seasonal norms.

US Distillate Inventory

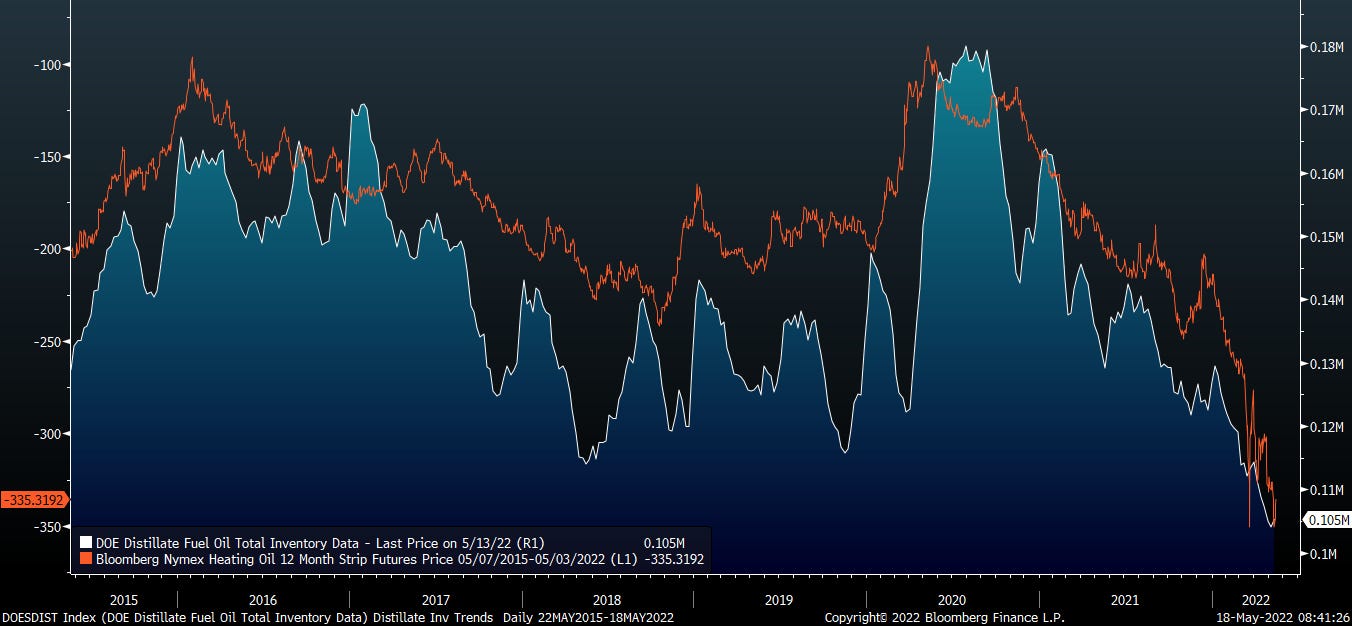

Prices inversely track inventories. The inventory deficit has led to distillate price strength.

Distillate price (inverted) vs distillate inventory

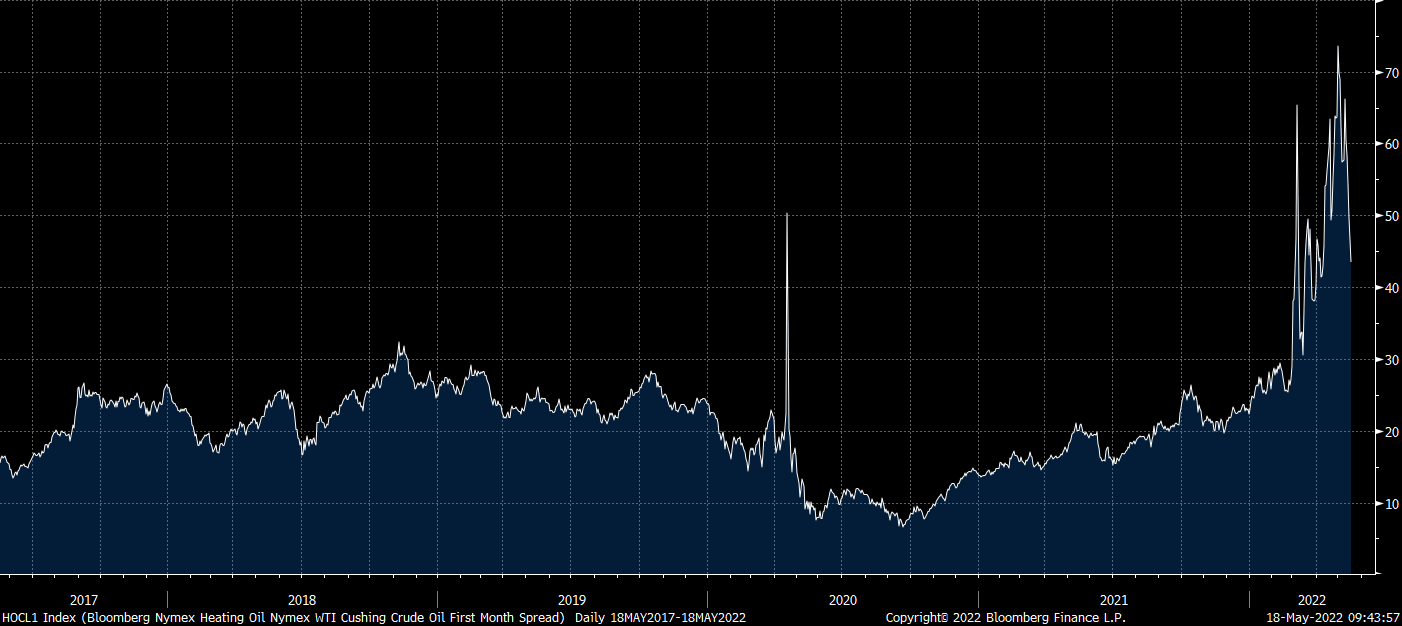

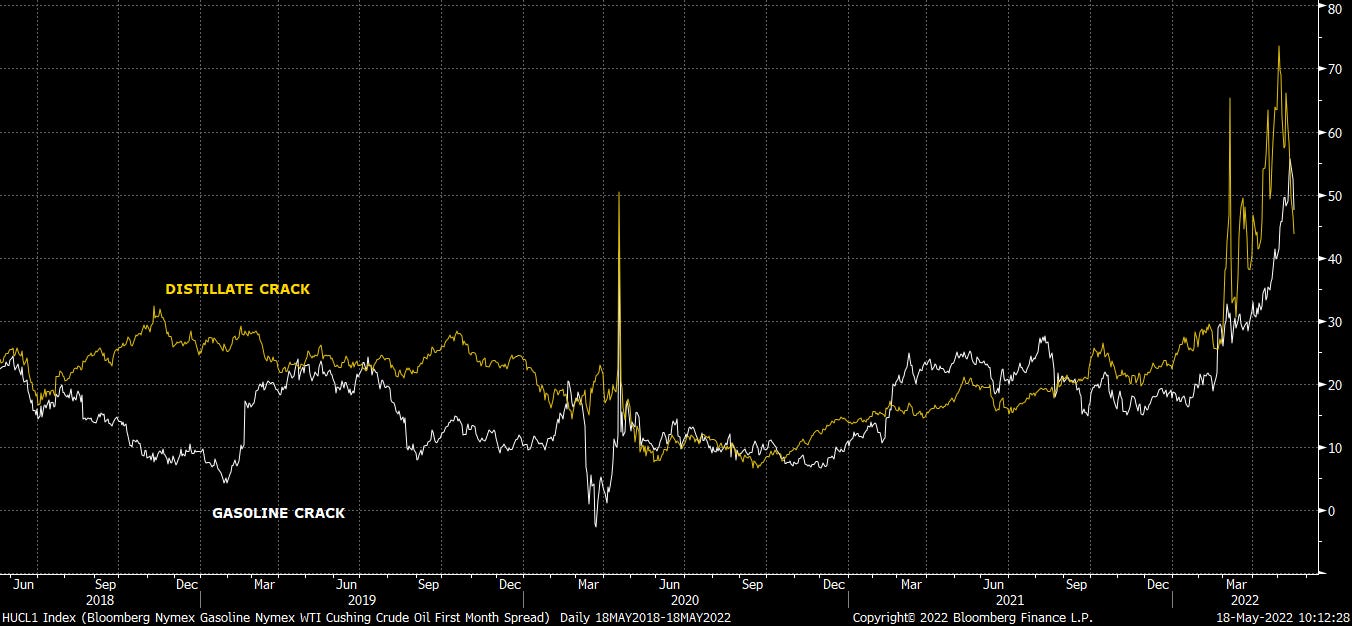

The generic distillate crack (spread between crude oil and distillate) has skyrocketed in response to the storage deficit. Like all flagpoles, it’s correcting after a near instantaneous vertical ascent.

Generic distillate crack

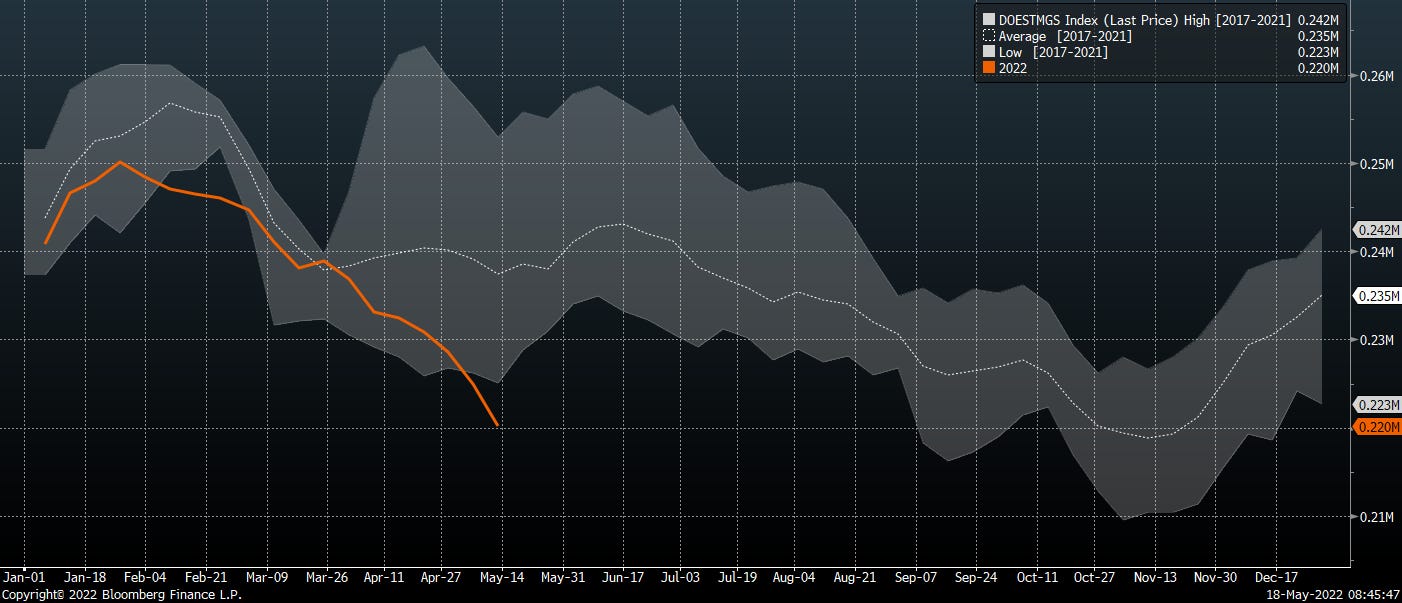

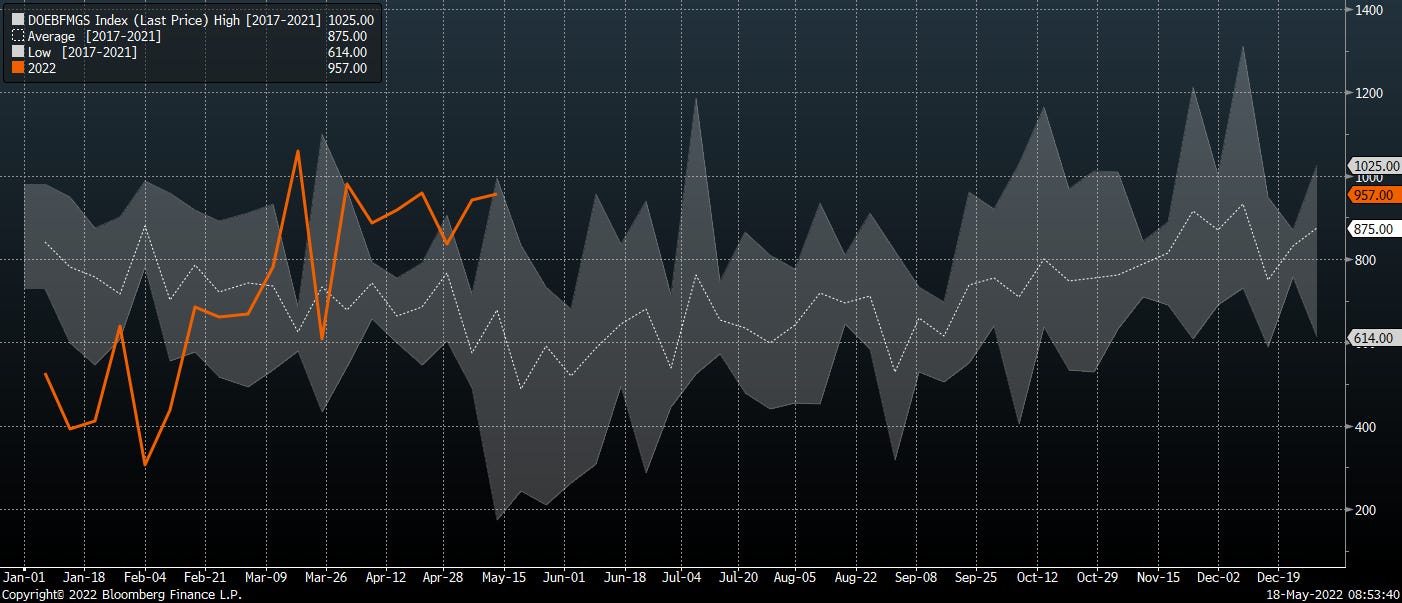

That was distillate. But now it’s gasoline at the front of mind. In just the past few weeks, motor gasoline inventories have sharply deviated from normal levels to a sizeable deficit relative to seasonal norms.

Total MoGas Inventory

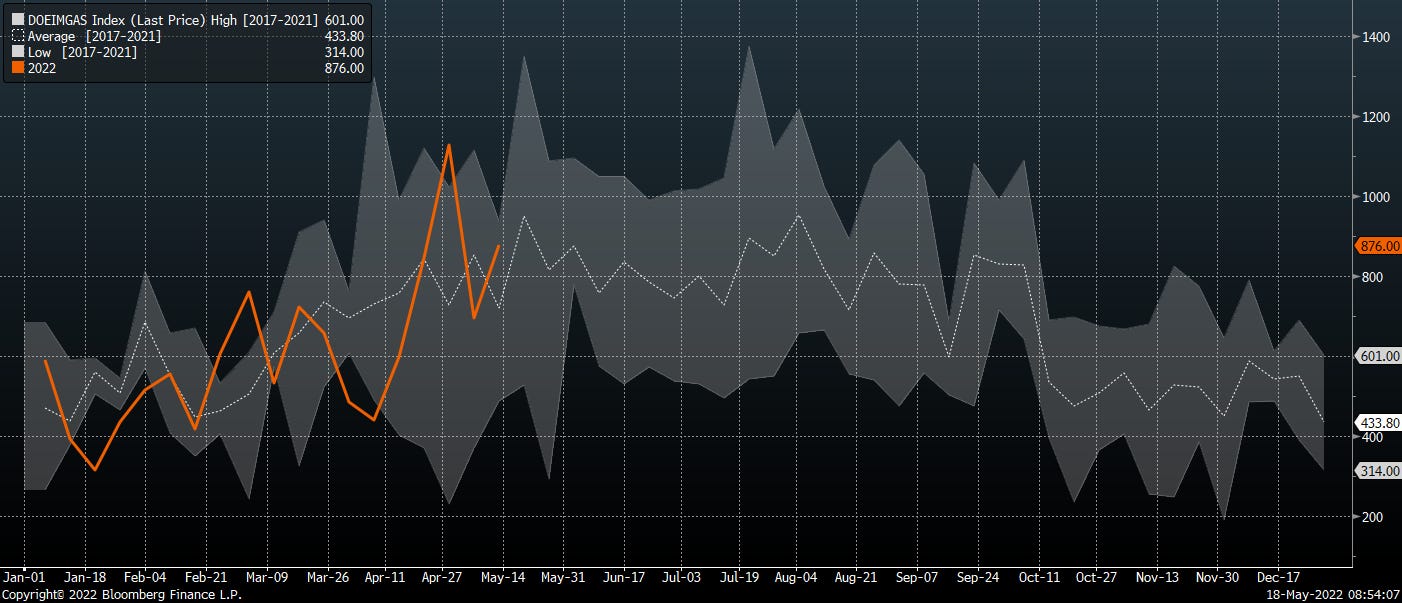

As demand accelerates going into summer driving season.

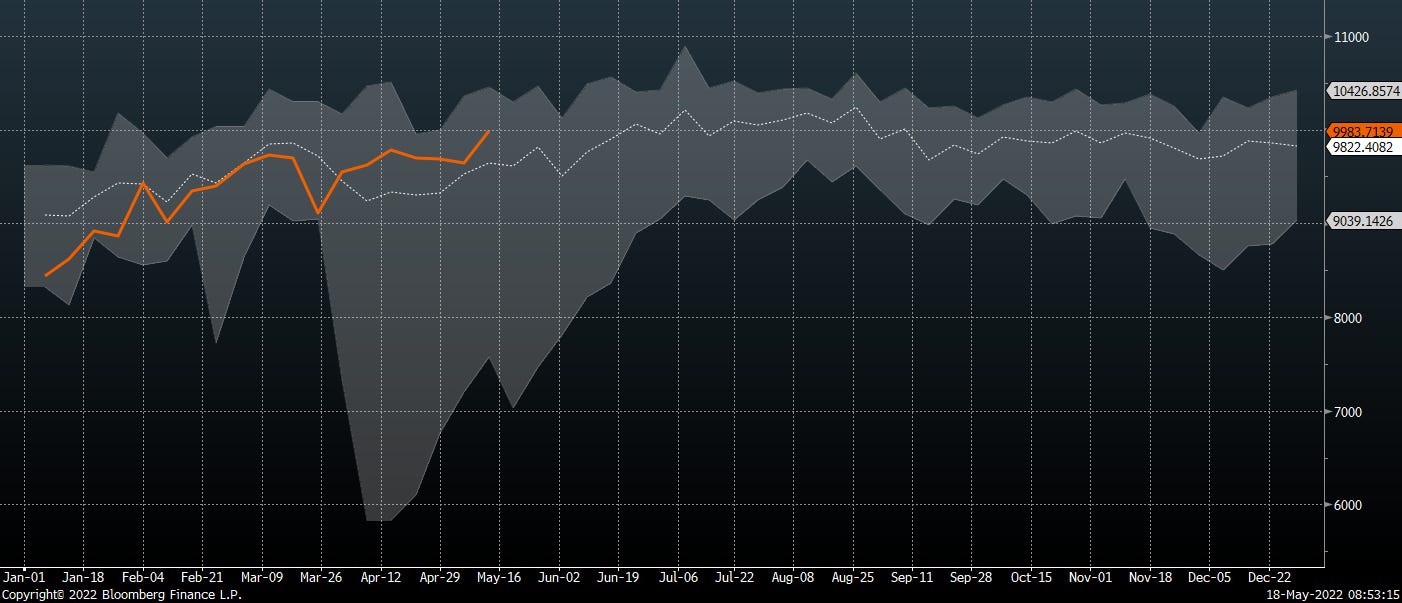

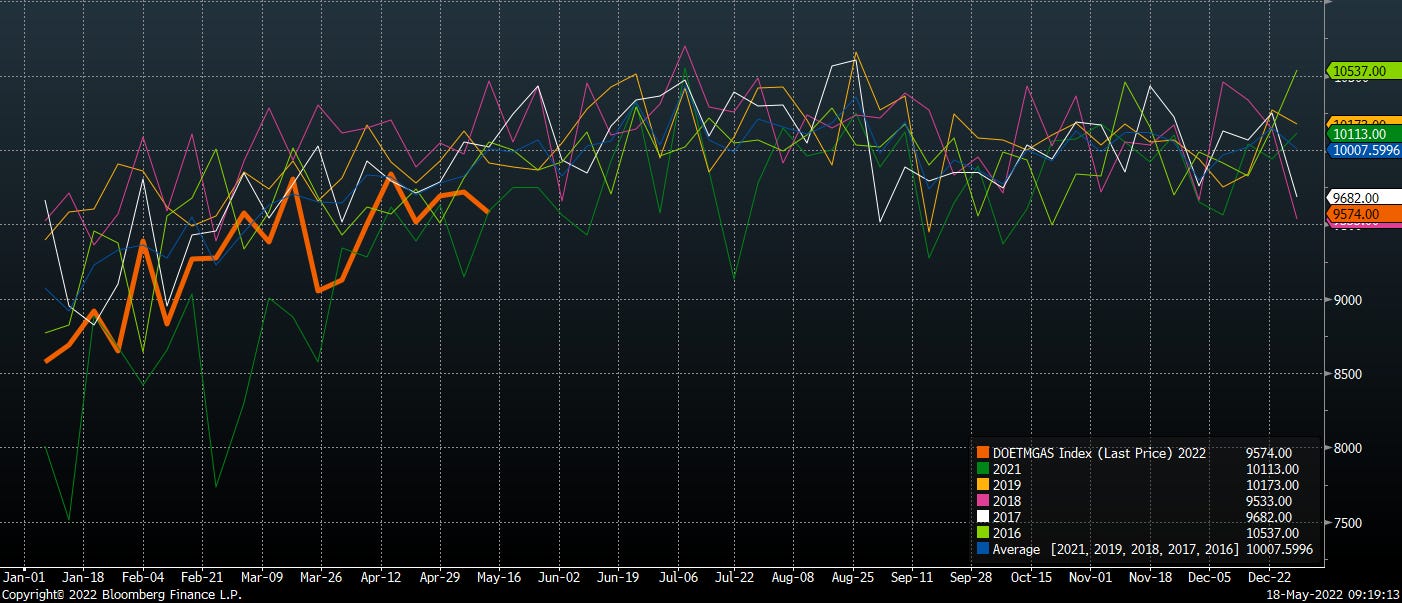

Gasoline implied demand

Even stripping out the demand-crushing 2020 lockdowns, we see that for now, gasoline demand is pretty darn robust. Total demand is today approaching the ex-2020 5yr normal level.

‘22 vs 2016-2021 (ex-2020) demand

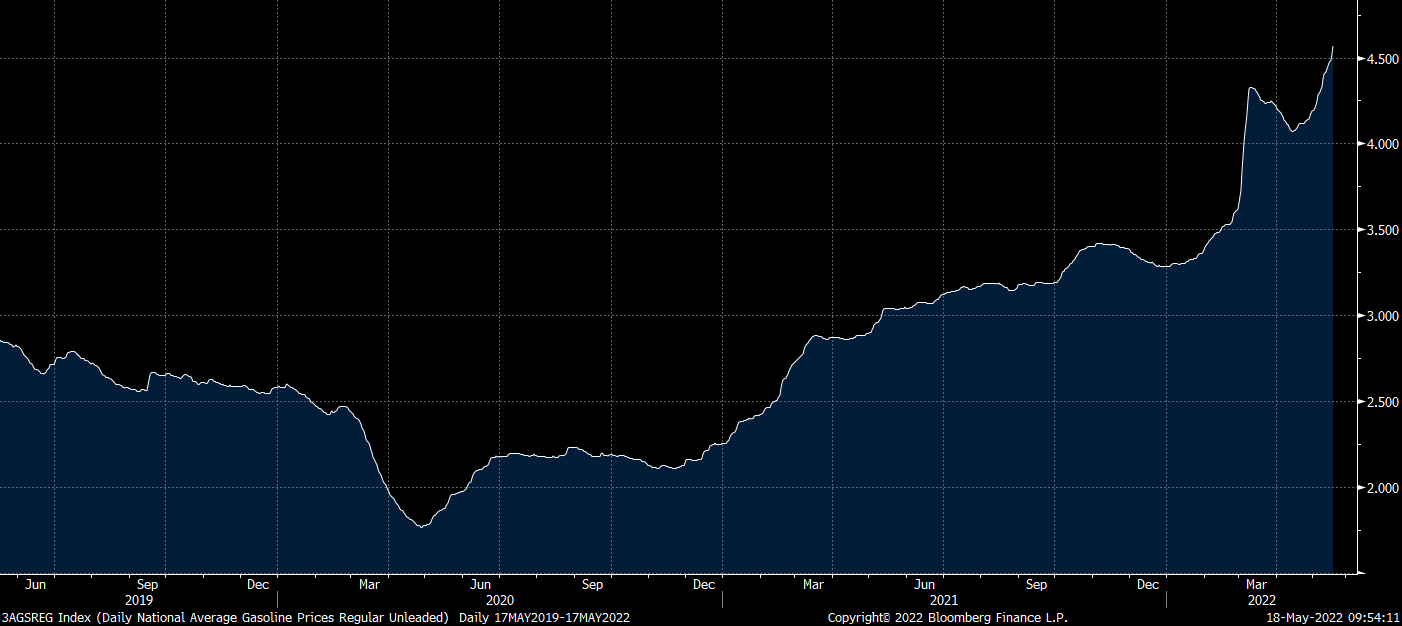

No doubt, demand destruction is occurring today with the average retail price near $4.60/gallon. This is a bizarre counterfactual though. Demand is theoretically destroyed, so it’s just going up less than it would otherwise. It’s still going up.

This in our mind is a testament to the underlying strength of demand.

AAA daily avg unleaded gasoline price $/gal

As we’ve pointed out in natural gas notes, this energy cycle is different from priors in a few key respects: capital discipline and net imports. Just as upstream producers are exercising capex restraint in the face of higher prices, so too are refiners who are not spending capital to increase capacity.

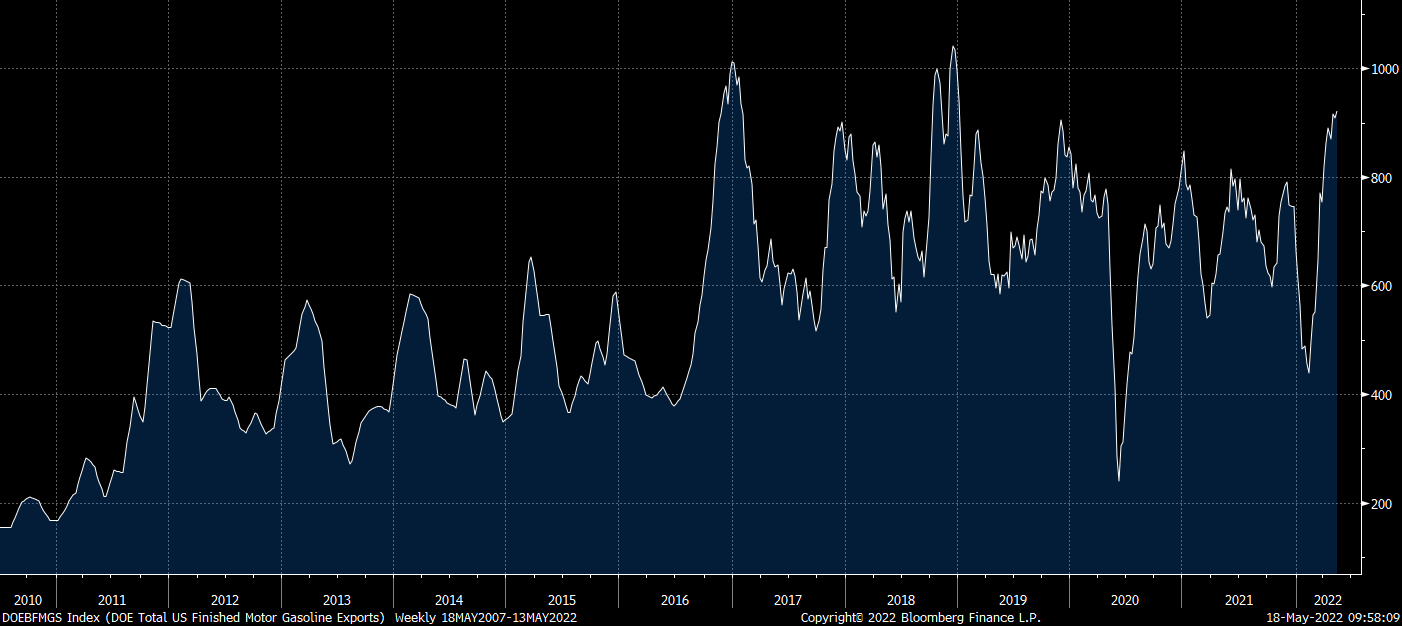

Even more important in the short term are the import/export dynamics. The US is sending huge amounts of refined products abroad.

US gasoline exports

Well above seasonal norms.

Gasoline exports 2022 vs 5yr

While imports are trending in line with historical levels.

Gasoline imports 2022 vs 5yr

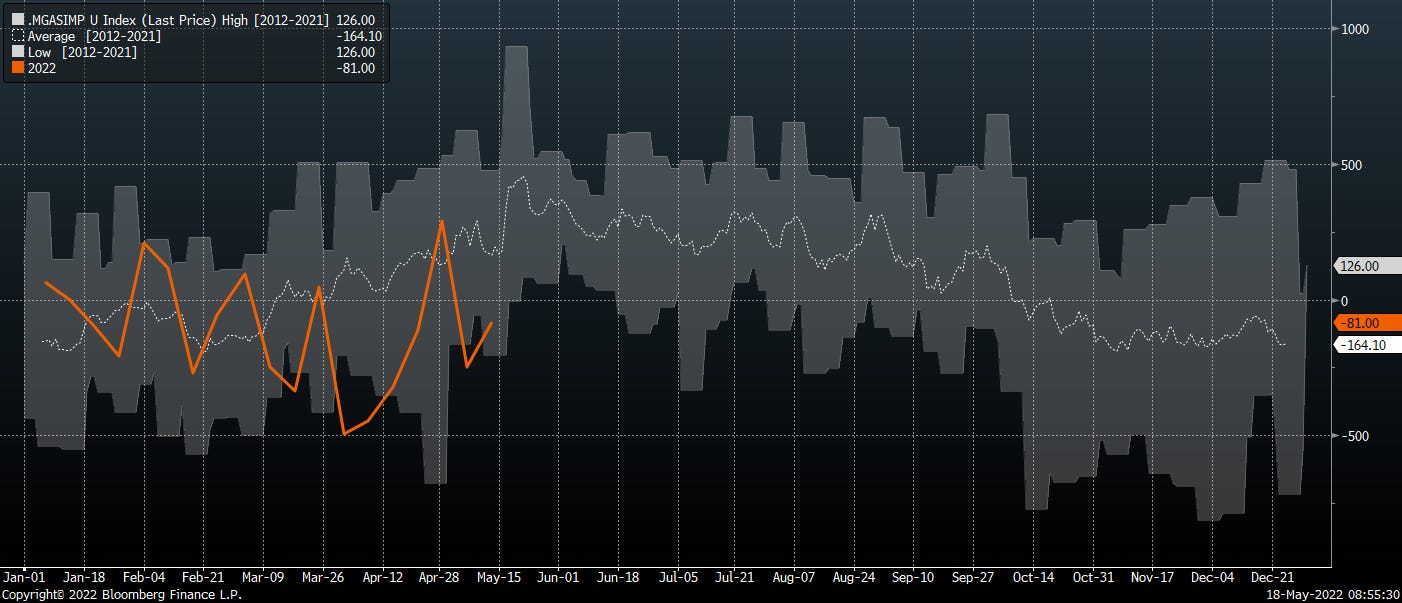

The net result finds the US a net exporter going into peak gasoline demand season - a material change from its historical position as a net gasoline importer.

Net mogas imports

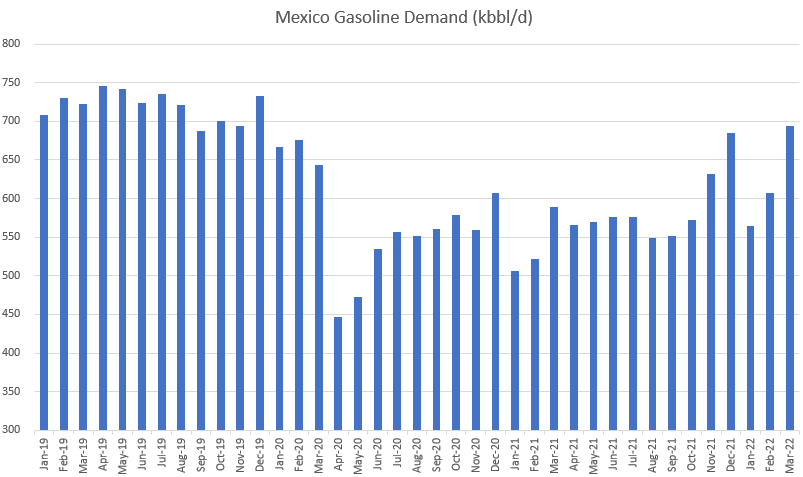

Our neighbors to the south continue to call for our refined products, particularly gasoline.

US mogas exports to Mexico & Brazil

Mexican gasoline demand has nearly recovered to 2019 levels.

Mexico gasoline demand

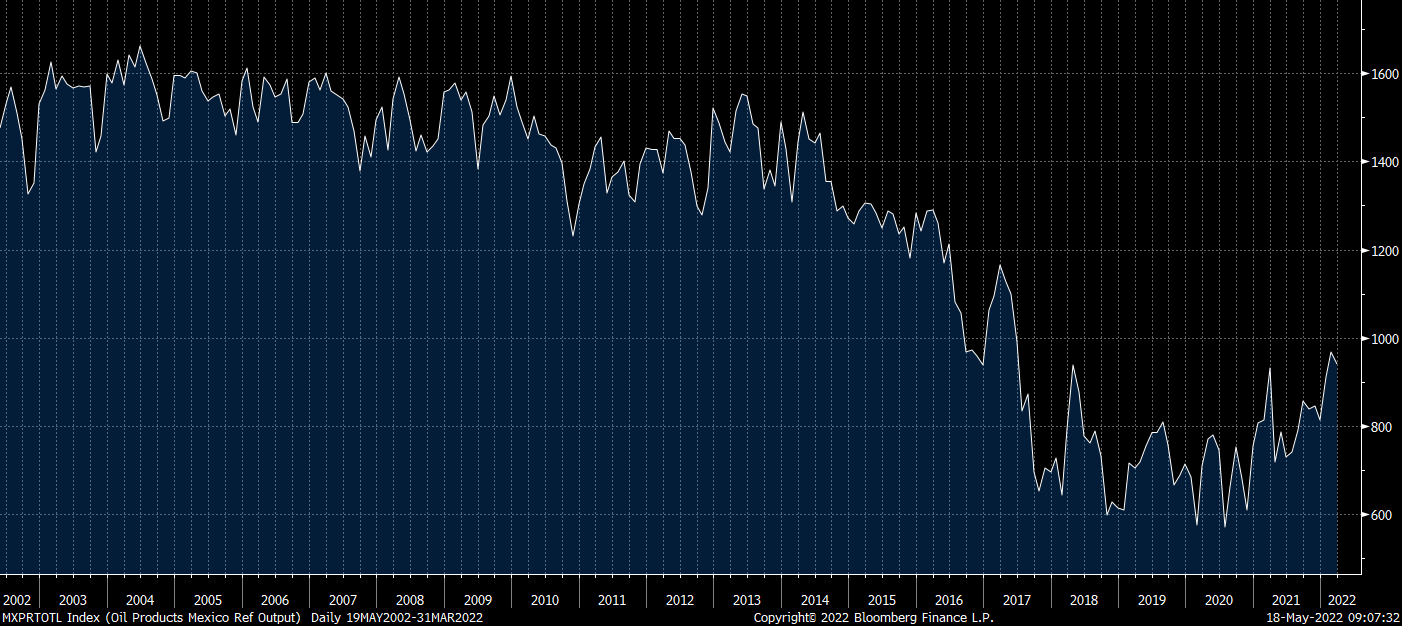

While the country’s domestic capacity to produce gasoline, off the lows, is materially below decade-ago levels.

Pemex Refinery Output

The market is calling for refiners to address inventory shortfalls in both of their primary products: gasoline and distillate. Refinery configuration limits large swings in product yields, but there is a little discretion at the margin.

Refiners are in fact ramping gasoline production into driving season, but absolute levels are below recent years.

MoGas production

Measured as percentage of available capacity, they’re running hard for this time of year, even on a 10yr lookback period.

Refinery utilization % capacity

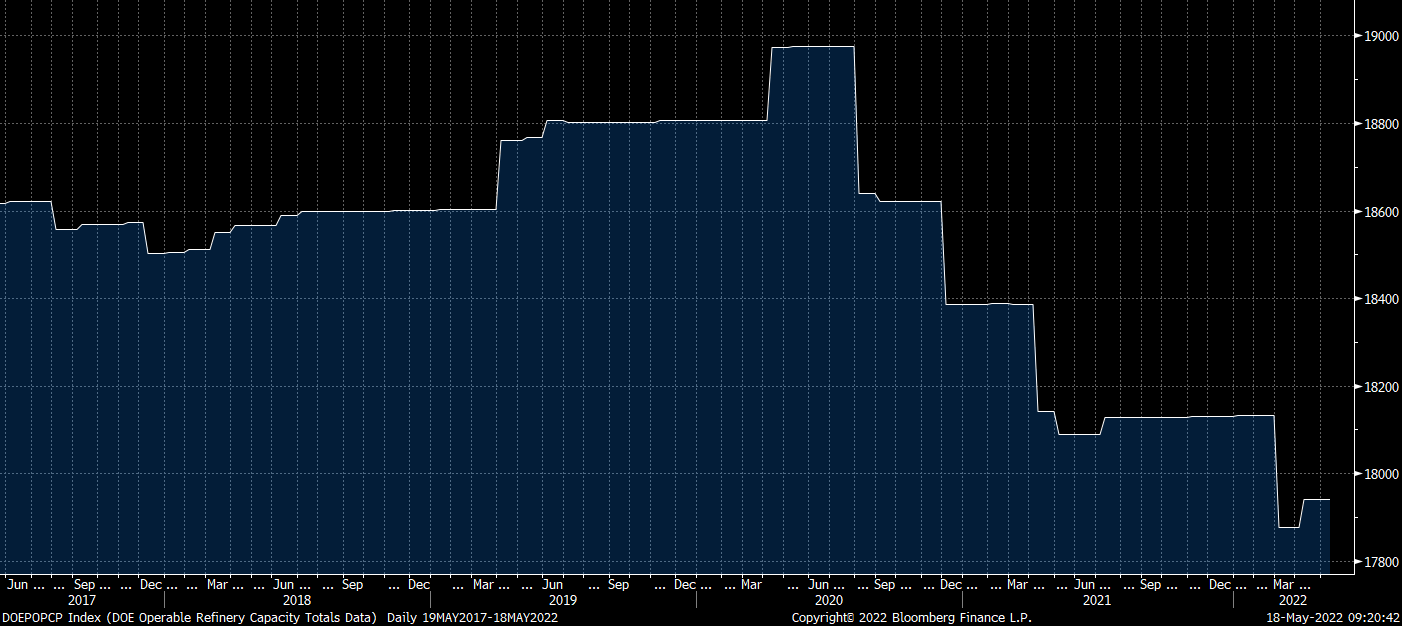

But the entire industry has shrunk productive capacity in the last two years. They’re running harder, but on a smaller base.

US refinery capacity

Refiners should this summer run as hard as they safely can to capture the outsized cracks. Gasoline and distillate cracks are running neck and neck today.

Generic distillate & gasoline cracks

But with little in the way of excess capacity apart from those refineries undergoing seasonal maintenance, there’s not much upside to refined product volumes.

US refinery outage

Gasoline inventories are set to draw aggressively in the months ahead, putting total gasoline in storage at multi-decade lows. Just like distillate. The most likely recourse for remediation on the margin will be reduced exports and consumption, as a result of higher prices.

Shortage of Everything Energy

Gasoline joins the list of energy commodities in deficit.

Inventories are low. Supply cannot/will not respond. Demand must respond, ultimately, through price.

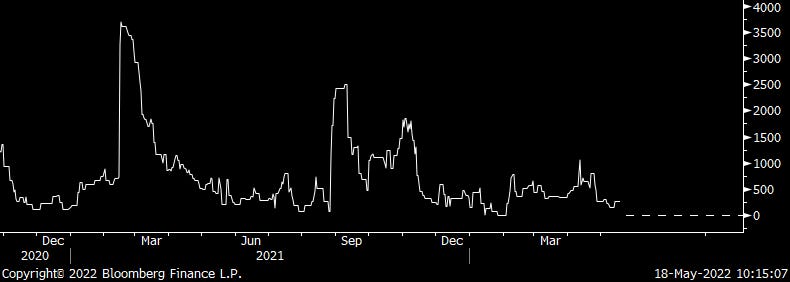

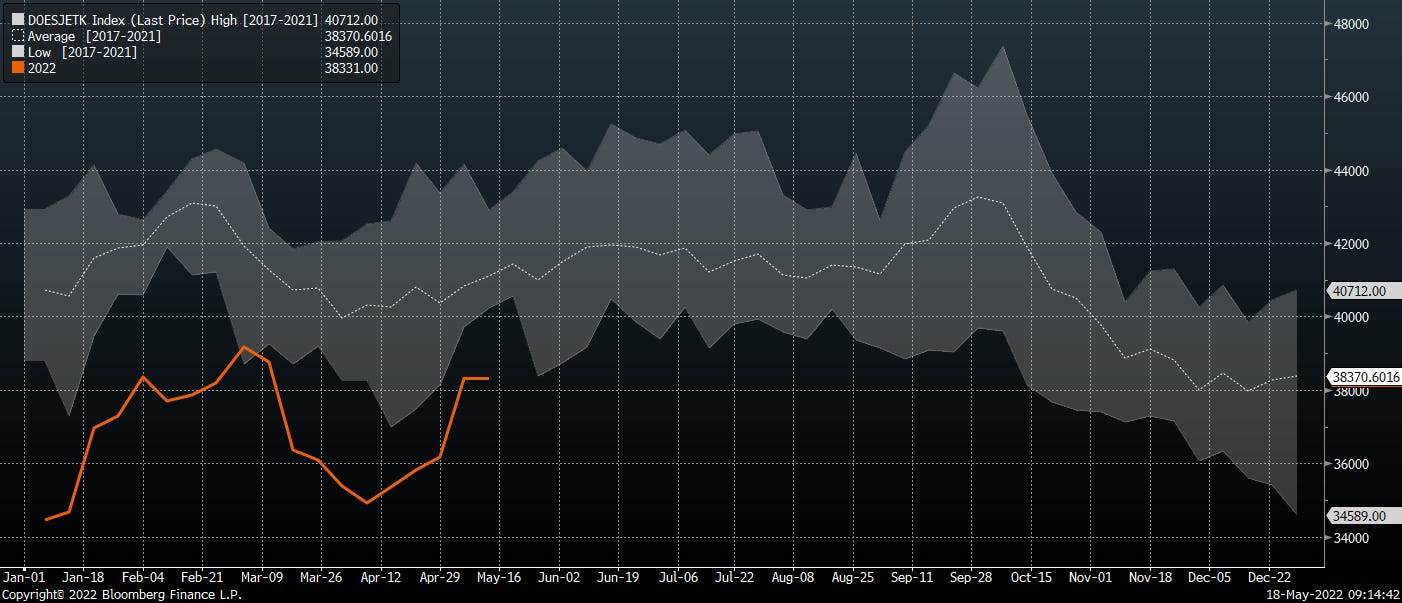

Jet Fuel Inventory - low

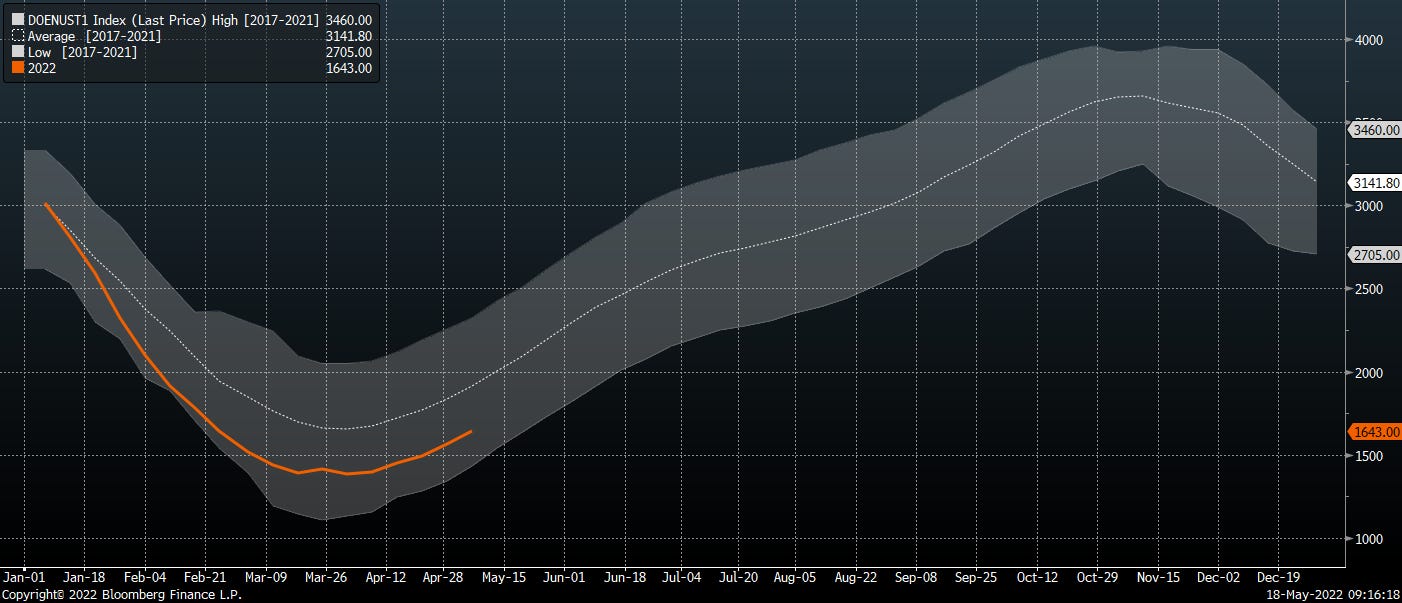

Natural Gas Inventory - low

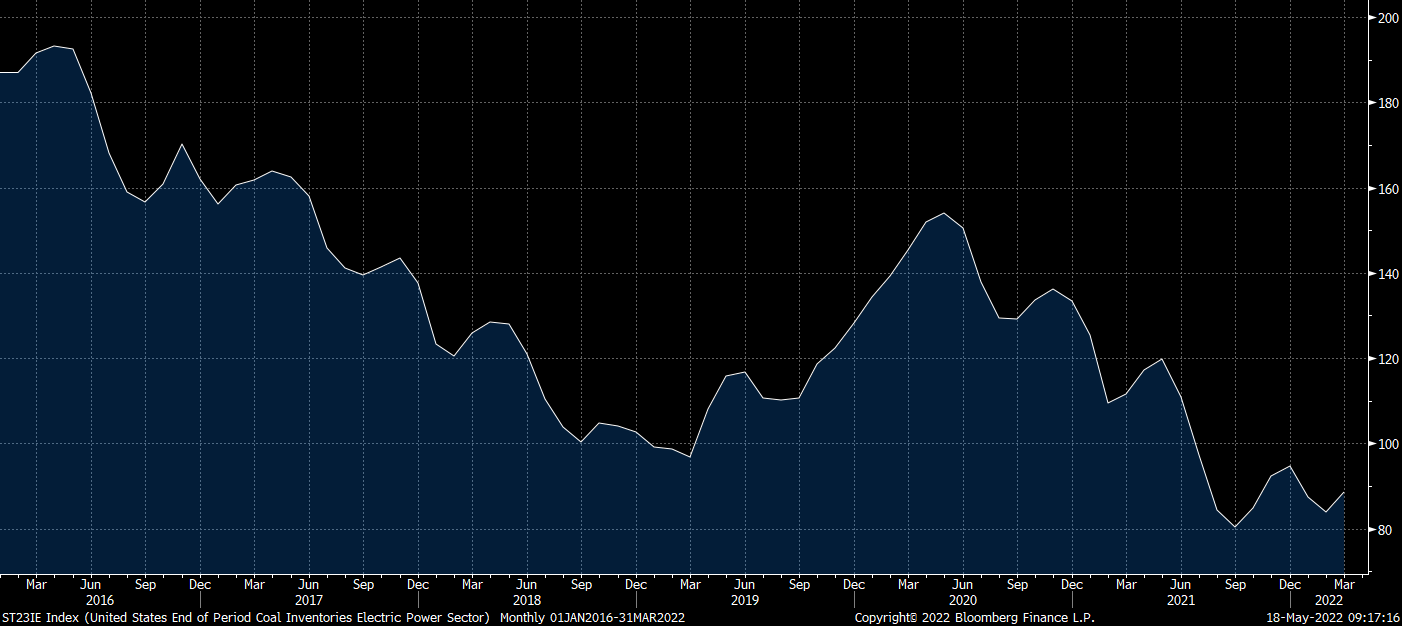

Coal Inventories (electric power sector) - low

Demand destruction is happening, but along a continuum, it’s not binary. Offsetting demand so far has been supply destruction in excess of demand destruction - different from prior cycles. Can prices go up if demand does not? It’s happening today.

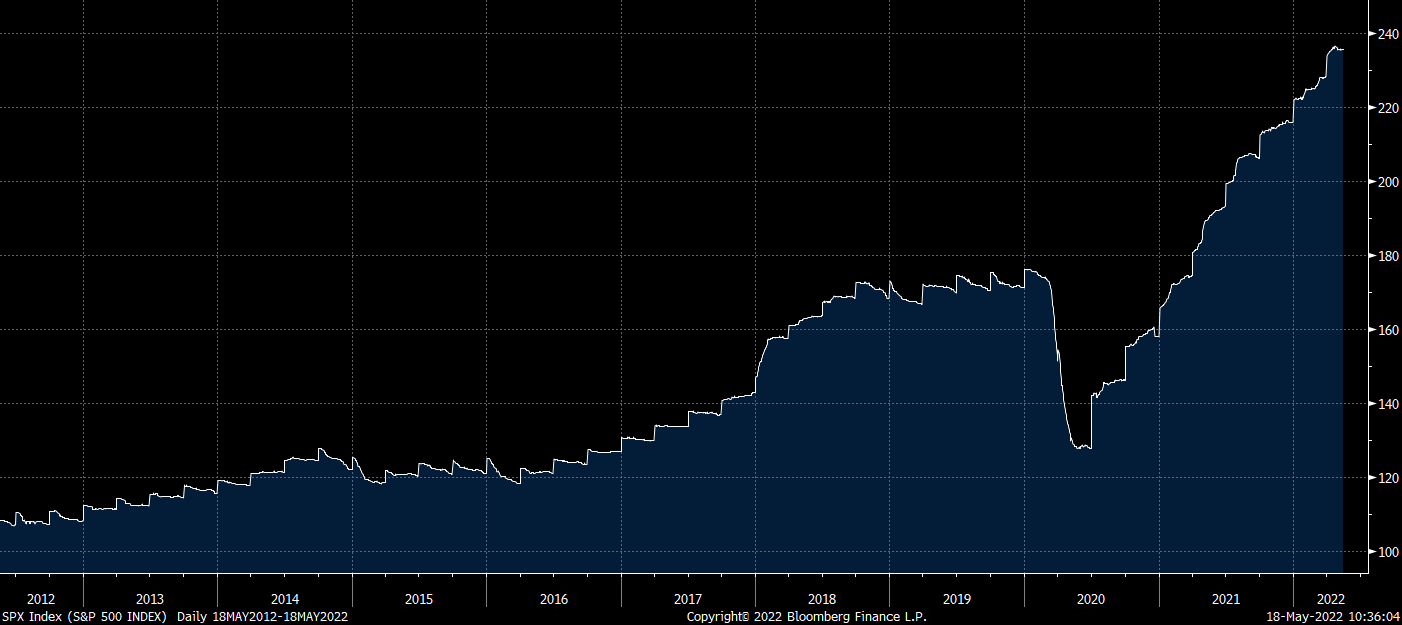

We have no idea how this dynamic gets capitalized in the market. But we believe there is more pain to come at the market level. Most of the 2022 declines in the tech-heavy S&P 500 have been attributable to multiple compression.

S&P 500 Price & P/E

The earnings cuts have only just begun. Lower earnings on a lower multiple will take the market down further.

S&P 500 NTM EPS

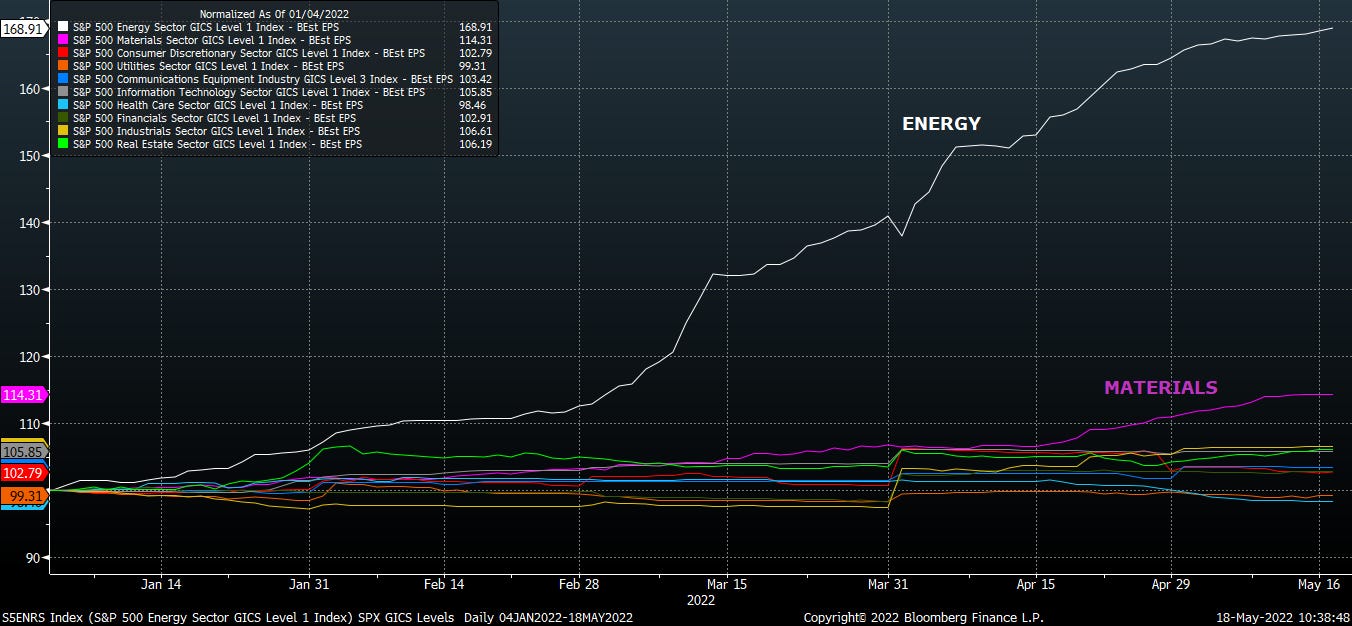

Might be worth parking some capital in the sector that has had, and will continue to have, positive earnings revisions in this overall fugly market.

That sector is Energy.

S&P 500 sector normalized YTD earnings revisions

Buena suerte.

Thank you! Always look forward to one of your posts.

When you coming back? I would like to know your thoughts on the energy trade currently.