The quote in the title of today’s post is legit. Below we cut and pasted it straight from Bloomberg for the sake of authenticity.

Tom Nimbley

We’re not into the “EPS was $xxx vs $yyy consensus and our $zzz estimate.” You can read that cut and paste elsewhere. We read the transcripts for the extemporaneous commentary management teams offer/stumble into during their earnings calls. Below are some our picks from a few of today’s calls (PBF, EQT, NESTE).

PBF

Why we care: Hat tip to low-key energy guru @jrnd98biz on Twitter who says CVI is the best refiner to listen to during earnings, because they’re out of fks to give with Icahn owning >70%. CVI is the most candid and PBF is the most entertaining. We listen to PBF because they are the most marginal of the marginal US refiners and they’re accents are a refreshing change of pace vs just about any other management team in Energy

What did we hear?

PBF confirms it is the 6th US refiner to announce a renewable diesel project, and surprises the market by announcing it’s already “started putting pilings in the ground” and looks for startup in 1H23

“we expect all the all the capital requirement is to manufacture 20,000 barrels a day of renewable Diesel with full pretreatment capability to come under $2 a gallon … this is a $600 million project all in … We've invested $50 million to date through the course of 2021. Over the next six quarters, the plan would be to continue just the remaining $550 million”

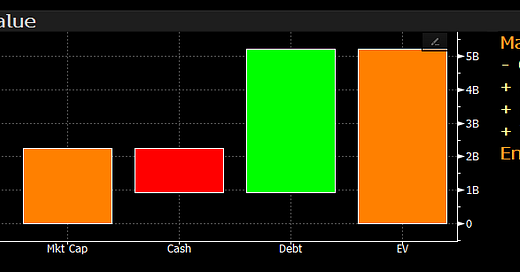

On its new renewable diesel project, it is “evaluating a number of different financing alternatives across the capital structure” which makes sense given its enterprise value

PBF management is still not a fan of the EPA’s RINs program or its Renewable Volume Obligations (RVOs). The ethanol RIN comment technically isn’t accurate. PBF is well aware that ethanol obligations can be satisfied with other renewable fuels.

“While the EPA Is 2020 and 2021 proposals appropriately reflect actual in generation the EPA proposed an unachievable RVO for ethanol RINs in 22.”

Nevertheless, a possible reason why the firm doesn’t like RINs is because it’s carrying a hefty RIN liability

“Our accrued RIN obligation at year-end, was approximately $550 million. We continue to carry a mark to market ring RIN position, which was valued at $450 million at year end with the remaining $100 million being fixed price purchase commitments that we expect to be satisfied during the first quarter of this year.”

But we admit, this is a more palatable way to express displeasure with its RIN liabilities & solicit sympathy

“The key piece is that an $800 million RIN expense is more than 35% above above what we pay just shy of 4,000 employees every year”

On natural gas pricing affecting crude slate decisions

“If the cost of hydrogen goes up precipitously, it gives you a rather significant economic advantage to switch crude slates, change your crude slates back out the highest sour crude and go to sweet crude”

Doesn’t quite seem like they’ve processed what happens when they (and everyone else) sends renewable diesel to California, where they’re already making and selling petroleum diesel

“We're selling all of our Diesel of those two refineries (Torrance & Martinez) on the West Coast”

EQT

Why we care: EQT is the largest natural gas producer in the United States. They’ve also suffered in the last year with a very underwater hedge book and bought winter calls before gas collapsed in 4Q21. Chip on their shoulder, they’ve recently introduced an aggressive capital return strategy comprised of a buyback and dividend. Lack of approval on MVP continues to hinder growth options and pressures outlook for regional basis differentials.

What did we hear?

Months after announcing it had begun contracting sales of Responsibly Sourced Gas (RSG) for premium pricing, EQT discloses premium of $16mm. On 1.2 Tcf gas.

“on our expansive RSG footprint, of which we've already certified approximately 4 Bcf a day, we have signed 10 deals encompassing roughly 1.2 Tcfe. In total, for around $16 million in premiums to date”

On our “cost deflation/capital efficiency is not the same as ‘underinvestment’ theme”

“The real results of our efforts are evident in our improving EURS, decreasing costs and limited inflationary pressures. We are now developing 20 to 30 wells sequentially from adjacent pads, with 300,000 to 400,000 lateral feet per combo on average. This modern approach to shale development leverages EQT's scale to drive down costs, maximize long-term asset value and minimize future well interference to drive multi-year consistent results”

The EQT investment thesis summarized:

“The story here is simple, one of disciplined maintenance program to produce approximately 2 Tcfe annually, implement our hedging philosophy that provides downside protection, while providing substantial upside participation, generate free cash flow that we can reward our shareholders with, and improve our balance sheet and pursuit of leverage of 1 to 1.5 times”

We believe EQT management believes they will have 30% free cash flow yield in 2023

“The story here is simple, one of disciplined maintenance program to produce approximately 2 Tcfe annually, implement our hedging philosophy that provides downside protection, while providing substantial upside participation, generate free cash flow that we can reward our shareholders with, and improve our balance sheet and pursuit of leverage of 1 to 1.5 times”

Aware of exposure to widening basis diffs, especially with delays to MVP, they assuage concerns by disclosing limited exposure to regional pricing. But they won’t disclose how they’ve hedged basis. Exactly how have they locked in their basis?

“we further lock in our basis with financial and physical hedges. For 2022, we only have in-basin price exposure on approximately 15% of our production.”

Revised down ‘22 free cash flow guidance for a number of reasons, but note sensitivity to basis diffs and MVP exposure

“So, when you factor that in -- I would say that, along with the fact that basis was wider and with MVP being pushed, those are probably the majority of the items that drive the delta between what we put out before and what we're putting out now.”

On sensitivity to continued delays in MVP

“So, when you net it out, it's, I'll call it, a modest negative for 2022. It's a little bit bigger negative 2023”

EQT’s pitch has been “maintenance mode” for production. Though this nugget suggests more upside risk to production. How would market receive a beat from the largest producer that committed to staying flat? We honestly don’t know

“we actually do risk our production. But I would just say, again, we put guidance out that, hopefully, we're going to meet or beat. And so, I think just stay tuned and you'll see how we execute this year.”

NESTE

Why we care: The renewable diesel sector is in the early stages of explosive growth that risks undermining every participant’s economics. As an early leader in the space with established, high-quality assets, we listen to NESTE to hear thoughts on developments on the ground.

To a lesser extent, we also listen to NESTE as they still have legacy petroleum refining exposure in Europe. As the marginal global refining region, we want to hear what they think of European refining conditions in general.

What did we hear?

Costs going up.

“fixed cost increase in the renewables area and you're rightfully said that we have done quite an impressive number of acquisitions, even during the pandemic, which of course add I mean to fixed costs. In addition to that, we are of course hiring people in preparation of the Singapore facility.”

Renewable fuels feedstocks are tight - and they have the best feedstock slate out there.

“And finally, I would note that the feedstock optimization continues and the share of waste and residues reached a very high share of 94%, which I'm very pleased with … at the same time the feedstock prices continued increasing.”

“Analyzing the waste and residues the market continues to be tight prices continue to be on a high level as demand continue to be solid and this means that on average, the prices increased by close to 10%. At the same time, it's good to note there were some differences regionally and by waste and residue type and in general, I could say North America was leading the price trend.”

High nat gas prices are flowing through refining margins.

"But high utility costs driven by natural gas and electricity prices offset a big part of the (oil products) margin improvements”