There are not enough BTUs

Y'all ready for it?

Let me hear you say “Rebirth!”

Y’all not ready for it.

Y’all ready for it?

Rebirth Brass Band, The Main Event

Change is here. Russia’s invasion of Ukraine and the West’s response have initiated a change in global commodity balances. Supply is being forced offline. Demand is shifting in response and in some cases manifests as a government-sponsored price insensitive mandate. Inventories are not a cushion but a psychological drag.

Buckle up.

Our framework assumes no peace, no victory, and no capitulation in the Russia-Ukraine conflict. The longer Russia persists, the more barbaric grows the conflict, the more steadfast grows the West in its imposition and maintenance of sanctions.

The following are our latest thoughts on the fallout in crude and natural gas markets after a torrid week of Russia-related news flow.

Russia shut-ins likely.

European bull in LNG china shop.

Not enough BTUs.

Crude Oil

Russia produces about 11 million bbl/d crude and liquids.

Russia crude oil production

The country exports about 5 mmbbl/d production abroad.

Russia crude oil production, exports, consumption (mmbbl/d)

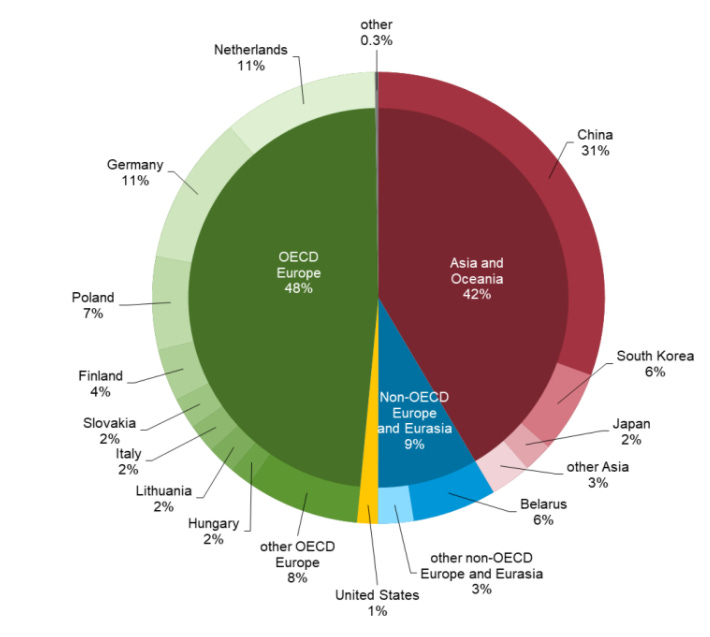

Some 60% of Russia’s crude exports are destined for the European Union.

Russia crude & condensate exports by destination (EIA)

When the US, EU, UK and allies announced sanctions on Russia following its invasion of Ukraine, they carefully and explicitly exempted energy from the list of verboten goods or services. Nevertheless, crude rallied on a combination of fears of potential future energy sanctions and widespread reports of crude buyers self-sanctioning.

Brent prompt month $/bbl

The reality on the ground wasn’t moving near as fast.

Russian production continued uninterrupted through the first week of March, at a stable average 11.0 mmbbl/d according to Kommersant.

Kpler reports crude oil exports holding steady at circa 5 mmbbl/d.

Major Russian port crude exports (mmbbl/d)

Inclusive of roughly 3 mmbbl/d of crude exports to OECD Europe.

Russian crude exports to OECD Europe (mmbbl/d)

The pain has yet to be felt in the physical crude market. Oil is actually still moving today.

Feeling relief on near-term availability, the market has faded the panic buying that set in following the severe sanctions announcements.

Brent/WTI timespreads

The risk is not in today’s barrels, but tomorrow’s.

There is growing concern that Russian crude flow issues will materialize in the coming weeks as the first post-invasion loading programs come to market. Old bookings are clearing. But new bookings have stopped.

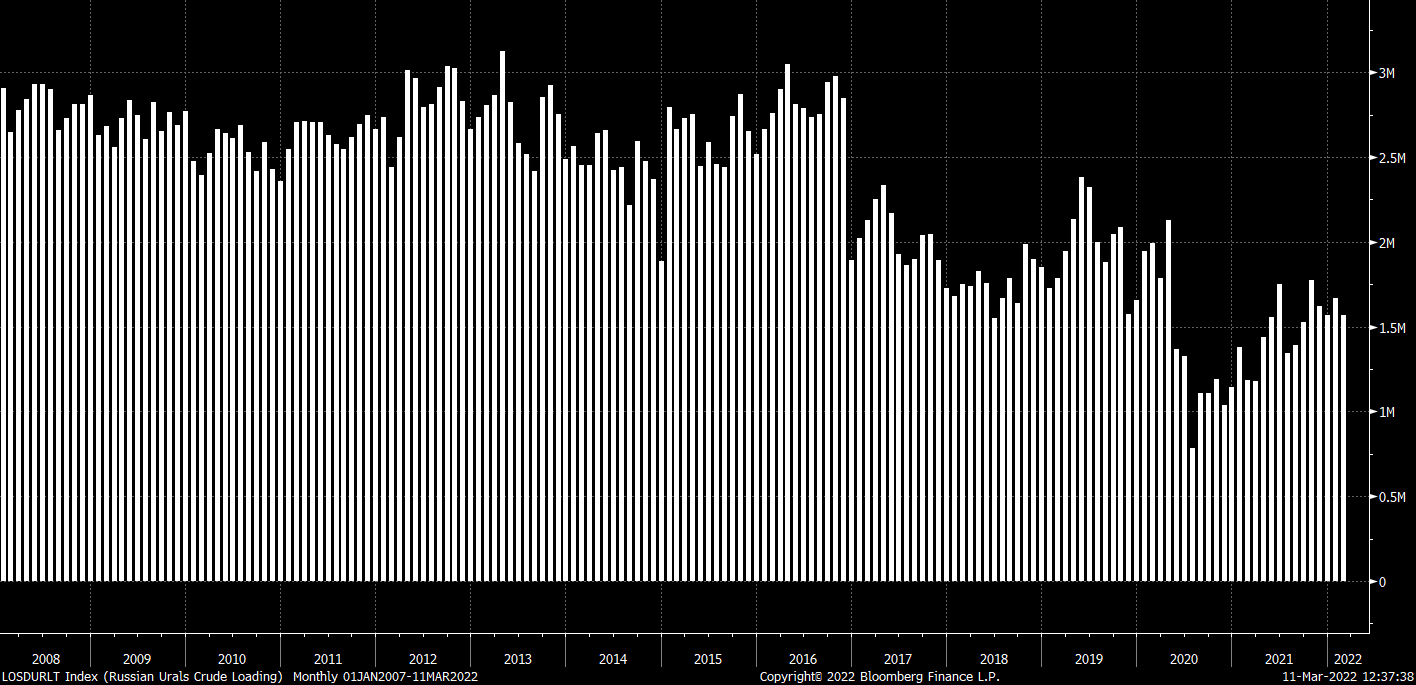

This chart will hook down, but no one knows how far down.

Russia Urals crude loadings (bbl/d)

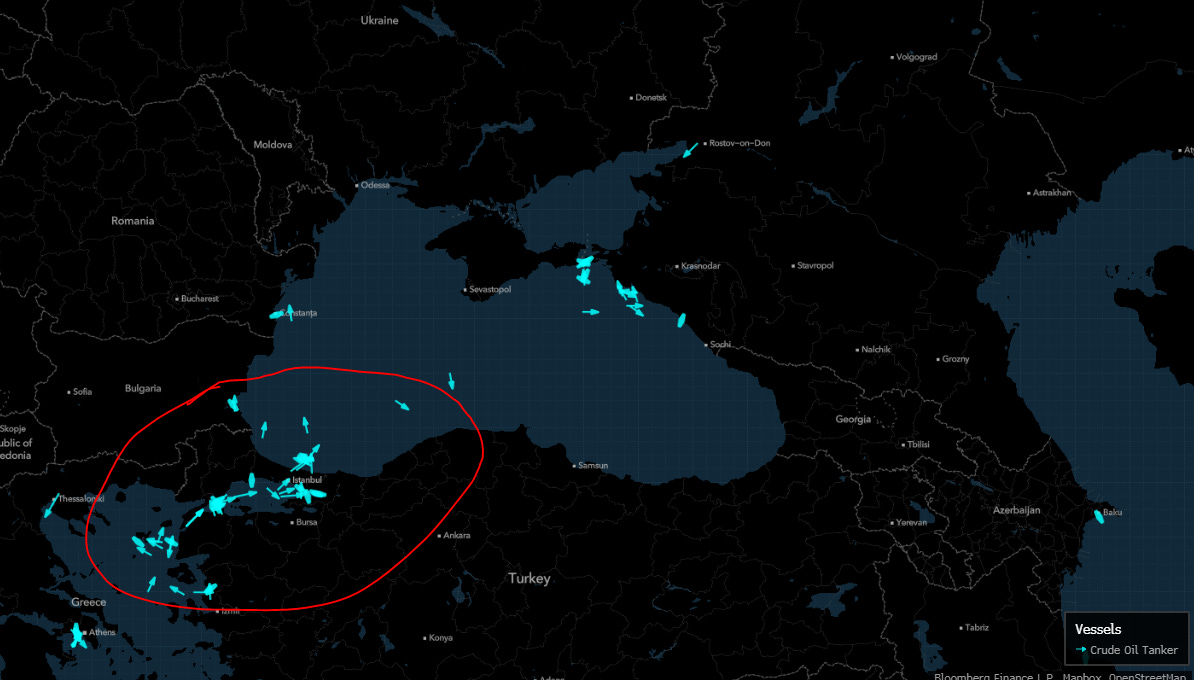

An estimated 7 million barrels of crude is stuck await passage through the Bosporus Strait.

Black Sea crude oil tankers

According to Bloomberg, for the past week a quarter of the Aframax vessels (avg 750,000 bbl capacity) in Russia’s state-owned Sovcomflot’s fleet have just been idling in waters off the European coasts after having discharged their cargoes. Normally, they’d head back to port to load more crude or products.

Sovcomflot Aframax fleet

We’re left assuming they’re not loading because they don’t know where to sell these future hypothetical cargoes - at least for westbound trade.

Western Russia crude oil (red) & natural gas (green) pipelines

Western buyers are concluding pre-invasion purchase commitments and clearly backing away from future purchases of Russian crude.

Even Russian Deputy PM Alexander Novak (begrudgingly) acknowledged that April crude oil exports are “facing some problems” after carrying out full contracting for March.

For now, flows continue, albeit with an order of magnitude higher uncertainty. Cargoes are today loading either without sales commitments or under tentative plans to trek to Asia.

The ultimate fate of 70% of Russian crude destined for seaborne markets is up in the air, thanks to widespread Western buyer ostracization. Not quite at “no-bid” levels yet, Urals discount of $30/bbl to Brent is a marked hit relative to historical levels.

Russian Urals price differential to Brent ($/bbl)

Pre-invasion crude exports to US/Europe of 3 mmbbl/d are headed much lower. Exactly how much lower remains to be seen. In the meantime, Russia faces an urgent need to place its crude elsewhere. With less than a month of storage in the country, Russia either finds new buyers or shuts in.

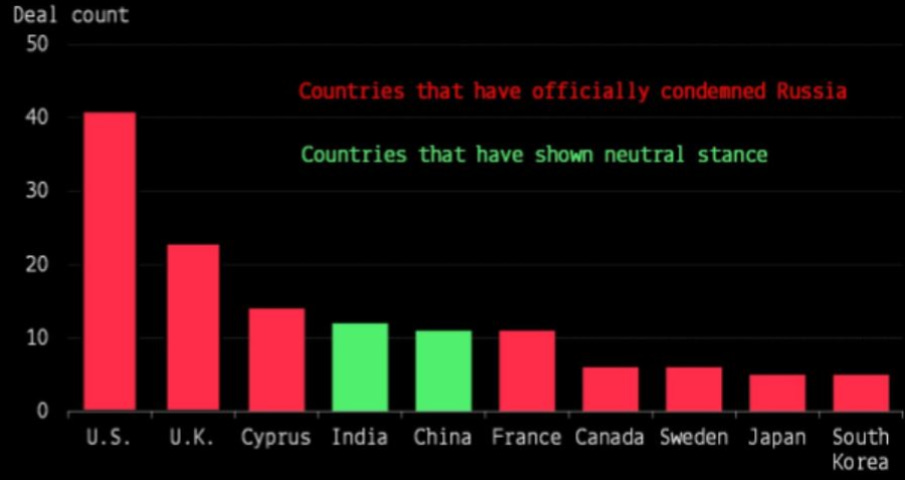

Where will the displaced barrels go? The list of consequential crude buyers that has not condemned the Ukrainian invasion is a short one. Pretty much China and India.

Investment in Russia oil and gas by investing firm’s home country (2000-2021)

China is the biggest target with 10-11 mmbbl/d total crude imports on circa 5 mmbbl/d demand.

China crude oil imports (mbbl/d)

Already importing 3 mmbbl/d of crude of similar quality (sour 31-32 deg API), China could theoretically displace 2 mmbbl/d of non-Russian imports to accommodate more Urals.

China crude imports by grade (deg API, mbbl/d)

Problem is, it’s not happening yet. When the home of the globe’s second largest refining capacity isn’t making room for Russia’s crude, it’s an issue.

With Asia as the only likely destination for a multi-million bb/d change in global crude flows, the dearth of new supertanker bookings for delivery to China is telling. Sinopec, one of the largest global purchasers of Urals crude, has added precisely zero new supertankers to its shipping commitments since the invasion.

China’s independent teapot refineries are facing commercial and legal uncertainties and are not seem positioned to absorb the now homeless Russian barrels. The teapots, already importing Russian crudes for 20% of their feedstocks, are said to be looking at run cuts in the coming months with margins dipping into negative territory.

China Shandong independent refineries run rates

Further exacerbating China’s refining pressure in the short term is the country’s system of regulated retail fuel prices. Meant to offer stability to consumers, China’s National Development and Reform Commission sets fuel prices twice a month. But in periods of rapid crude price appreciation, the downstream pricing mechanism serves as a deterrent to production. When crude costs more than refined products, don’t expect the refiners to run harder.

Chinese buyers are scrambling to modify commercial arrangements just to keep existing oil flows in check. Russian producers are allowing Chinese buyers to procure oil without traditional letters of credit backed by banks just to continue sales.

According to industry reports, Chinese and other Asian buyers are not yet considering new Russian crude oil purchases. Like the rest of the world, China is evaluating its exposure to Russia in the aftermath of global condemnation of the Ukrainian invasion. They’re approaching the newly-sanctioned Russia with a degree of conservatism. As of today, it is not eager to deepen commercial linkages to Russian crude.

We think it probable that China increases its purchases of Russian barrels over time, but not enough to offset losses elsewhere, and not soon enough for Russia’s liking. If a bailout is coming from Chinese buyers, it is not imminent.

As the third largest energy consumer in the world, India stands out as the next best destination for Russian crude, though at less than half of China’s import scale, it will be a tall order for the country to take a meaningful slice of the barrels lost to sanctions.

India crude oil imports (kbbl/d)

After a Urals buying spree in late February, Indian buyers haven’t aggressively stepped back into the market for Russian crude.

Russian efforts to build a crude bridge to India have not been rebuffed, nor have they yielded an uptick in orders. From India’s The Hindu newspaper:

Finance Minister Nirmala Sitharaman had reportedly said Russia had made an “open offer” to India to sell crude oil at a discounted price, but that many factors would decide the government’s final decision.

A decision to purchase more oil from Russia would also have to be weighed against the adverse reaction from India’s American and European partners who want to “isolate Russia” economically. External Affairs Minister S. Jaishankar had said last month that India does not follow “unilateral sanctions”, however, in 2019, India did bow to U.S. demands that it “zero out” all its oil imports from Iran.

Like China, we expect India to increase Russian crude purchases in time, but again not enough to displace lost barrels and not soon enough.

The new crude math becomes a challenge, even under the conservative assumption wherein the Western alliance continues to exempt energy from its sanctions regime. With sharply reduced sales to the West, China and India should be able to increase Russian crude buys 1.0-1.5 mmbbl/d, putting Russia at risk of having to shut in 1.0-2.0 mmbbl/d of production once domestic storage is fully utilized.

Russia crude oil production, exports, consumption (mmbbl/d) - post sanction base case

The situation further tightens if the West increases pressure and directly sanctions Russian crude oil sales. Russian production loss would exceed 2 mmbbl/d, a large portion of which would be at risk of permanent loss given the nature of Russia’s energy infrastructure.

Digging out of the hole

Bury me softly in this womb

I give this part of me for you

Sand rains down and here I sit

Holding rare flowers

In a tomb, in bloom

Down in a hole and I don't know if I can be savedAlice in Chains, “Down in a Hole”

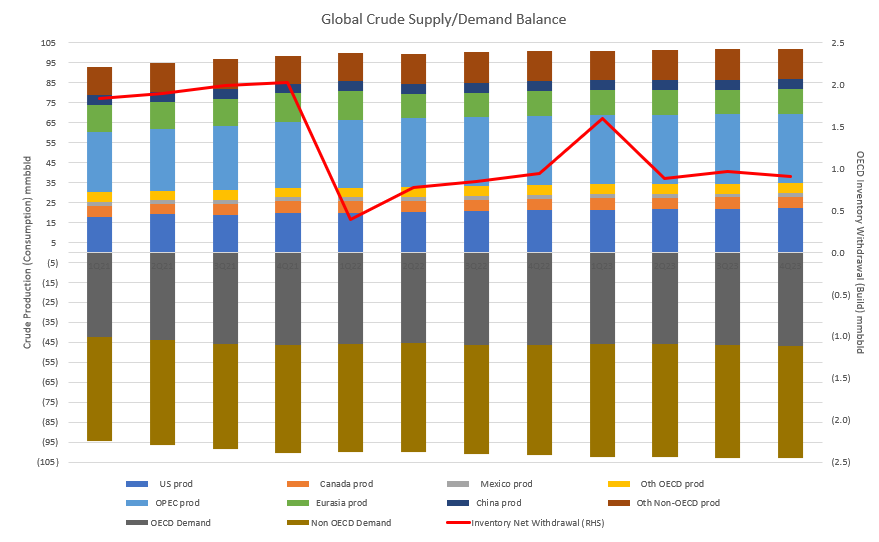

Pre-Ukraine invasion, market consensus expected a global crude market to transition from deficit in 2021 to a balanced/slightly long market in 2022 and 2023. In the chart below, the red line shows quarterly expectations for inventory draws or builds.

Production, Consumption, and Inventories - before Ukraine invasion

For a global market that was already navigating unseasonably low inventories, the imminent loss of 1.5 mmbbl/d Russian supply presents a material headwind in restocking.

OECD crude oil inventories

Atop this, we throw this weekend’s setback in Iran nuclear negotiations.

“Talks are being halted, European Union foreign policy chief Josep Borrell said on Twitter, after negotiators failed to bridge major differences over how to restore the landmark accord abandoned by the Trump administration in 2018.”

A quick 0.5-1.0 mmbbl/d uptick in Iranian supply on the market would have gone a good ways to soothe pending shock of Russian production losses. Alas, as of this weekend, the market must continue to wait.

In a nod to the art of subtlety, Iran’s Revolutionary Guard took credit this weekend for a ballistic missile strike in Erbil, Kurdistan that hit the US consulate among other targets. We’re thinking no Iran deal this week.

Ballistic missiles hit Iraq's Kurdish capital, Iran's Revolutionary Guard claim responsibility

Iran crude oil production (mbbl/d)

And what of the rest of (non-exempt) OPEC+?

14 of the group’s 19 members are producing below their quotas, raising questions about the aggregate deliverability. The consortium’s production last month fell 0.8 mmbbl/d short of target - again.

A moving target at best, “spare capacity” has been an overhang on the group since it began to unwind its 2020 production cuts. Only Saudi Arabia and UAE have (vaguely quantified) reliable spare capacity on the order of 3 mmbbl/d.

OPEC spare capacity

Until proven otherwise, the market will risk the group’s production surge capability. Uncertainties surrounding the ability of member countries apart from Saudi Arabia and UAE to grow volumes will find the market heavily risking any OPEC+ production greater than 2.0 mm bbl/d above today’s level.

Saudia Arabic & UAE production

US is growing at an amazingly measured pace. Recent commentary broadly suggests public players stick to their capital plans with no plans to aggressively ramp activity in response to stronger prices.

What doesn’t help goad the industry into more activity? Threatening windfall profits tax, urging some form of nationalization via the Defense Production Act, or crude prices that swing $25/bbl in a day.

Crude oil is a 100 mmbbl/d market that swings wildly on imbalances of 0.1-0.2 mmbbl/d. Precision is fool’s errand. But if the market must contemplate 1-2 mmbbl/d loss of supply from Russia, offset in part by higher Saudi/UAE production, other factors in the balancing equation are on the margin. The IEA’s coordinated SPR release will help a bit, just a bit. Incremental Venezuelan barrels (ironically dependent on again-stalled Iranian condensate) would help just a bit.

If Russia’s war continues and the West does not relent on sanctions, we expect crude buyers to continue to ostracize Russian crude. There is not adequate global supply to offset a Russian supply loss AND rebuild global inventories. We expect crude draws throughout 2022 - before we factor in the growing likelihood of gas-to-crude substitution in 2H22.

Production, Consumption, and Inventories - base case

The crude curve looks undervalued to us, particularly when viewed in comparison to the curve on the last day before Russia’s invasion.

Brent crude curve

Natural Gas

Where we find in oil a tight market getting tighter, we find in European gas a tight market getting progressively looser, albeit with an enormous tail risk.

Lest we forget, Europe is recklessly dependent on Russia for its natural gas supply.

Russia natural gas exports by destination (EIA)

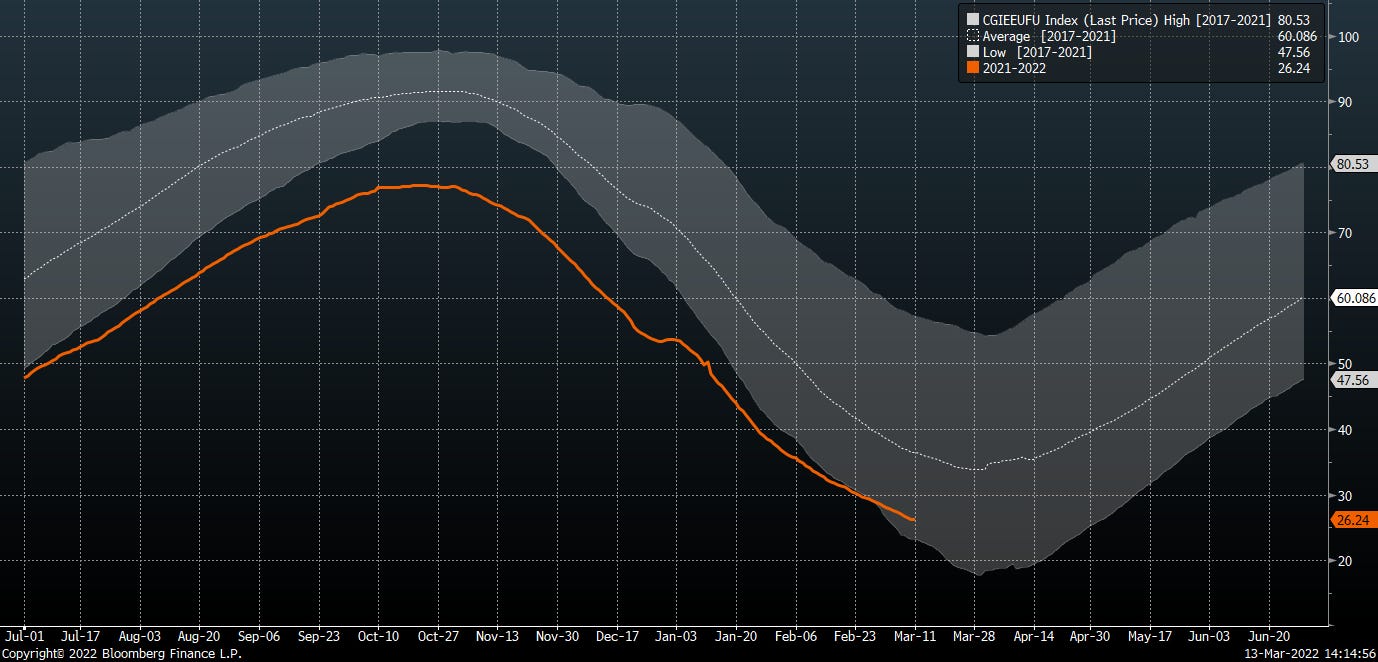

Europe entered Fall 2021 running at a deficit to normal storage inventory levels.

Europe gas storage % full

The storage deficit was largely attributable to lower imports from Russia, which dropped essentially to minimum take-or-pay levels beginning in 4Q21.

Russia gas exports to Northwest Europe

Interestingly, imports from Russia increased noticeably in the immediate aftermath of the invasion on 2/24 owing to a commercial quirk that incentivizes buyers to take more gas when spot prices exceed futures prices.

Russian gas imports to NWE by entry point

Bailed out in recent weeks by a mild end to winter and an influx of LNG imports, the storage situation has improved from frighteningly tight to just really tight.

LNG imports into Northwest Europe

Northwest Europe goes into this year’s natural gas restocking period with low inventories and faces an EU mandate of refilling storage to 90% capacity before the onset of next winter. From an already low starting point, this will be a daunting challenge. The next six months will see a fascinating experiment in meeting inelastic demand.

Europe Gas Storage (bcm)

Short natural gas, Europe is heavily dependent on natural gas imports to meet demand. Apart from Russia, Europe sources natural gas via pipeline from Norway, North Africa, and Azerbaijan, and brings in gas via LNG as well.

Europe major gas pipelines

The decision tree on how Europe refills storage this year is brutally short.

Gas flows from Azerbaijan and North Africa are near max capacity.

Norway, already supplying 40% of Europe’s imported pipeline volumes, is running about as hard as it can. Incremental supply will be limited.

Norway gas exports to continental Europe (bcm/d)

Europe needs to refill storage as fast as possible. The only upside for volumes is via Russia and LNG.

Regarding Russia, we turn to the European Commission’s March 8 REPowerEU announcement of a “plan to make Europe independent from Russian fossil fuels well before 2030, starting with gas, in light of Russia's invasion of Ukraine.”

REPowerEU calls for Europe to reduce demand for Russian gas by two thirds by YE22. Amongst several other proposals, the 2022 Russia cutoff will come in the form of 50 bcm LNG diversification and 10 bcm pipeline import diversification. For readers less accustomed to metric units, Europe plans in 2022 to displace just over 2 Tcf of Russian gas imports with LNG and new piped gas. That’s a lot of gas.

50 bcm of incremental LNG will be a tall (and expensive) order placed to liquefaction providers in Qatar, US, Egypt, and West Africa according to the report. Industry estimates that global LNG volumes available for trade in the spot/resale market are 130 bcm this year. The incremental 50 bcm demand announcement is the opening shot of a bidding war.

European buyers, under EU policy mandate, will be a large buyer in the already tight LNG market. To meet its storage targets, Europe will have to bid LNG cargoes away from Asia throughout the year. We expect price competition to be especially heated during the high demand summer season, when it’s likely Asia will have to resort to diesel for peak power gen needs. How Europe fares this summer in refilling storage will dictate how high prices go next winter.

Europe gas, Asia LNG, diesel price $/MMBTU

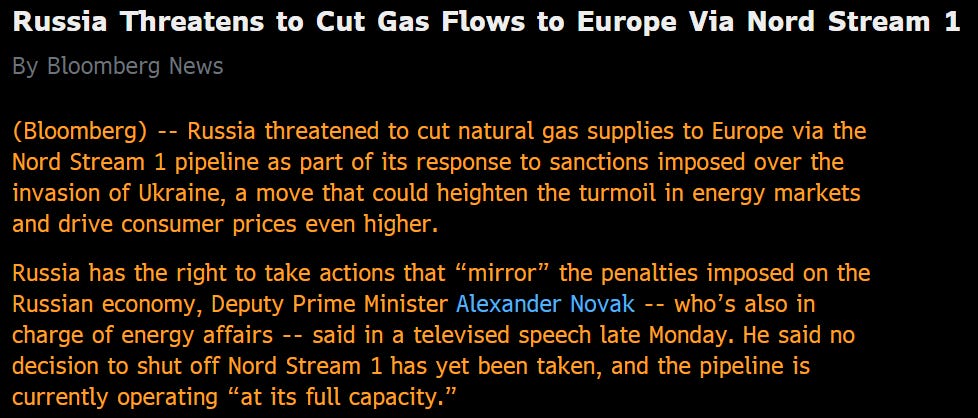

The fat tail scenario for Europe - Russia gas goes to zero. Russia’s oil sales are 30% of the country’s revenues, but the gas market is only 6% of the state’s budget. A total loss of Russian volumes into Europe would be catastrophic. As in - industrial shutdowns, blackouts, hypothermia catastrophic.

The one-sided balance of power with respect to natural gas leads us to expect that Europe will not sanction gas, but Russia will hold its volumes as a sword of Damocles over the continent to extract maximum value from its position. Just like it did last Monday.

In a worst-case scenario wherein Russia cuts all natural gas exports to Europe starting in April, the region can forget replenishing inventories. All gas in storage will be depleted in 3Q22 and the market moves into disaster demand destruction.

Lights out.

In the meantime, the gas flows and Europe urgently seeks new sources to refill storage over the coming six months. Fluctuating wildly between $20-60/MMBTU over the last few months, higher natural gas costs are already having an impact on industry.

Not only steel.

Widespread subsidies, including new ones proposed by the EU Commission such as price limits and fuel tax cuts, will shift the cost burden to the state and exacerbate tightness in the physical markets.

Once shoulder season turns to A/C season this summer, we expect tight global gas balances to push up prices for LNG, regional natural gas, and substitute fuel sources.

Conclusion

A global buyers’ embargo is forcing incremental tightness on crude oil and natural gas markets already struggling with tight supply/demand balances. These are the marks of the first turns in the Energy New World Order. It will be a volatile disruption of the status quo ex ante.

The energy tension between Russia and Europe will serve as the barometer for the speed and violence of the realignment of the global energy markets. Energy security matters more, marginal returns matter less.

Demand is the governor and for now, demand is holding in.

Global 11-city average congestion above baseline “traffic-less” 1 hr travel time

How demand holds up as spare capacity is whittled away and demand ramps seasonally will be the determinant on how long Energy can work and the global economy can slog through this disruption.

Darn nice article. Thanks for depth of research here. I am a writer myself and I respect the work and dedication to quality that went into this article. CHeers

Thanks for the write up; looking forward to your future posts