“There are decades when nothing happens; and there are weeks where decades happen”

-Vladimir Ilyich Lenin

Everything has changed and there is no turning back. Russia has forced a rude awakening.

Global Energy, through political necessity, global will, and economic mandate, is charting a new course.

Human nature holds a peculiar trait that makes it exceedingly difficult for one to appreciate the magnitude of history-altering developments that happen in the blink of an eye. In isolation, a momentous event is hard enough to process. Stack up several of these changes, in series, over the span of a just few days, and it’s impossible to grasp the magnitude of the disruption to the status quo.

The course of history has deviated and no one (your author included) has a full grasp on just what it means. We do know, however, that Pandora’s box has been opened.

The thesis laid out herein - unprecedented geopolitical change yields a new energy world order - will be a thematic cornerstone of our writing.

A quick note acknowledging the following persons whom I hold in high esteem for their energy expertise - each of whom contributed directly or indirectly to this report:

Find them on Twitter: @jrnd98biz, @crudegusher, @markfny, @ArnjunNMurti, @crudechronicle

A Series of Unprecedented Events

Russia has launched an unprovoked war of aggression and invaded sovereign European neighbor Ukraine, setting off the largest geopolitical crisis in the last three to four decades. This military action, unprecedented in the post-Cold War era, has in just a few days set off a chain reaction of events whose impacts will be felt for years.

Sanctions

A world shocked by Russia's decision to deliver on threats of an invasion of Ukraine has been equally surprised by the reactions from Europe, Great Britain, Canada, and the United States. The Western coalition has levied the largest package of economic penalties ever imposed on a country. The sanctions, unprecedented in scale, aim to inflict severe damage to Russia's economy, military, and kleptocracy.

The economic sanctions are designed to cripple Russia's financial means to prosecute the Ukrainian war. By targeting the financial plumbing of the system linking Russia to the rest of the world, the coalition aims to financially excise Russia from the global economy. Russian banks and businesses have been frozen out of the global financial to a large extent, now barred from participating in the SWIFT global interbank payments system, excluding (for the time being) energy-related financial flows. The Western alliance has also sanctioned the Bank of Russia to limit the country's access to nearly half of its $640 billion FX reserves that otherwise would have been used to backstop the country's banking system.

The group imposed a complementary array of non-economic sanctions. Government officials, military leadership, and Putin-adjacent oligarchs have been personally sanctioned and now are unable to access now-frozen financial assets in the sanctioning countries. Not that they can even try to access, since these persons are all subject to travel bans, apart from Vladimir Putin and Foreign Minister Sergei Lavrov, should they need to travel for peace talks. The personal sanctions are symbolic, but we suspect are more than a minor inconvenience for the billionaire oligarchs.

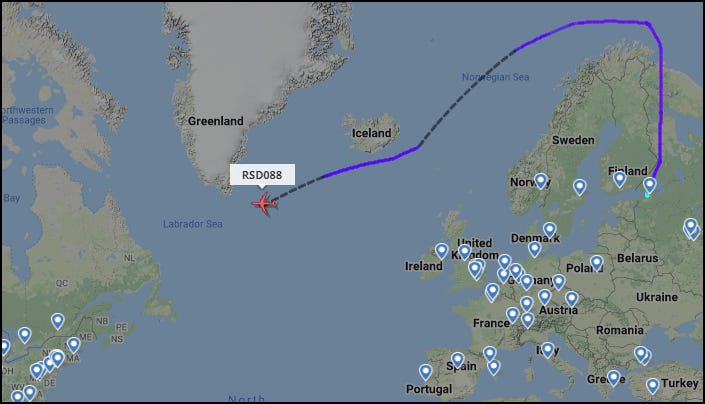

Also falling in the non-economic category is a prohibition on Russian aircraft accessing the sanctioning countries' airspace.

Russian flight from St. Petersburg to Dulles fetching expelled diplomats

The sanctions net casts even wider and includes bans countries from selling certain aircraft parts and equipment to Russia. Technology rounds out the list of prohibited sales, including restrictions on certain high tech hardware to Russia. In this final restriction, the sanctions exert global reach with Japan, Singapore, and Taiwan agreeing to participate.

Explicit military support for Ukraine is a new facet of a sanctioning regime. The European Union for the first time is facilitating the purchase and delivering of lethal military equipment to Ukraine for the country's defense.

The coordinated response to Russia’s actions is unprecedented. The European Union in the last decade has pinballed from crisis to crisis, never able to get its house in order. It never addressed the underlying causes of the Eurozone debt crisis nor did it implement the structural changes needed to reduce the risk of a Greek sovereign default toppling the entire currency. Brexit and the post-Syrian Civil War refugee crises exposed systemic weaknesses and threatened its stability. Aligning the disparate interests of 27 unique member states has proved impossible and thus the bloc rarely presented a unified front.

All of which makes the speed and scale of last week's sanctions package unprecedented. Separate from most EU-level decisions that require a simple majority, foreign policy decisions require unanimous consent from all 27 members. All or nothing, and the group managed to do it all. In less than a week after Russia invaded, the EU, Britain and transatlantic partners US and Canada, developed and implemented the toughest sanction regime on the planet. The EU is closer to functioning as originally envisioned than it been at any point in its history.

Europe is facing up to the fact that it has enabled Vladimir Putin and has been part of the problem. This changed last week. Why? Russia invaded Ukraine.

Economic Impact - Russia

This is economic war against Russia. Sanctions of this intensity have historically been reserved for rogue regimes like Iran, Venezuela, and North Korea. Never before have such severe sanctions before been placed on an economy as large as Russia's, which stood as the 11th largest in the world before its military crossed into Ukraine. The range of consequences, intended and unintended, stemming from Russia’s invasion and the globe’s response is wide and varied.

The first and most visible impact is the collapse of the Russian ruble.

US Dollar / Russian Ruble Cross

Russian assets lose value instantaneously - the closure of the Russian stock market for days on end reflects this fear of an immediate collapse of domestic capital markets. Inflation skyrockets. Western businesses cease operations and exit. Ordinary citizens face hardship, unable to participate in simple banking transactions. Living standards are imploding. Economically cut off from most of the world, a recession in Russia is all but guaranteed. A depression increasingly likely.

Economic impacts - Rest of World

No one knows, but it’s not a positive development for the global economy. The sanctioning countries, particularly those in the EU are painfully cognizant of the interconnections between their economies and Russia's. Every country participating in the sanctions, particularly those in Europe, will suffer serious economic harm themselves. Unprecedented in scale and reach, unintended consequences abound.

The West has chosen to try to navigate the economic fallout instead of avoiding it all together. There is a reluctant acceptance of economic self-immolation as the price of confronting Russia's threat to the liberal democratic order.

Europe is likely to suffer the largest absolute economic damage outside of Russia, but the rest of the world will not escape harm, owing to Russia's role in the production and export of many global commodities.

Share of economy exposed to sales to Russia

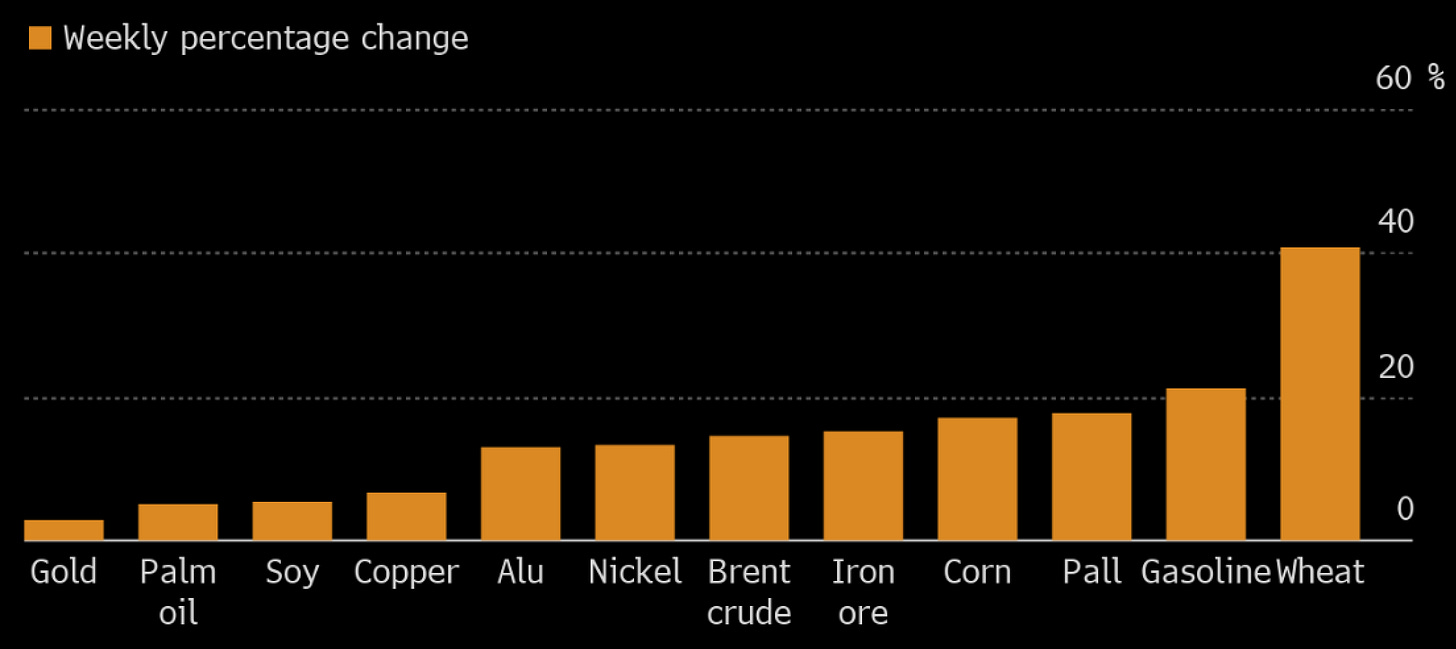

The sanctions are already starting to function as a global commodity shock - across markets that were already running tight. The severity of economic implications cannot be overstated.

Raw material weekly price change

Russia is a dominant producer of energy, in a near three way tie with Saudi Arabia and the US as the largest producer of crude oil. 2021 production of 10.5 mm bbl/d was 14% of total global production.

Top 3 Global Oil Producers

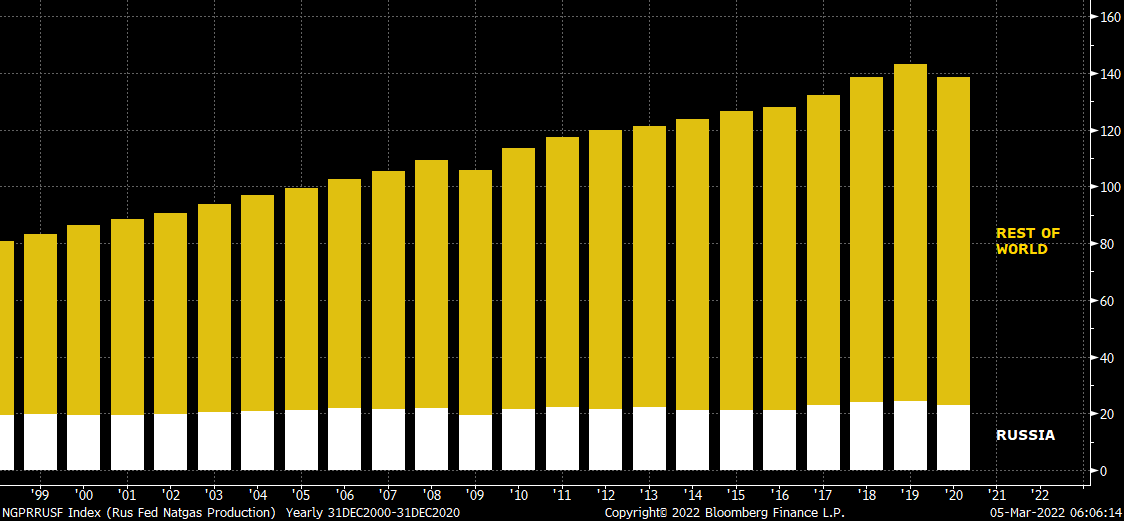

It produces nearly a fifth of global natural gas.

In metals, Russia produces 7% of global nickel, 10% of aluminum, 18% of grain, and over 25% of global copper.

Although energy transactions are for now excluded from the Russian sanctions, many energy market participants are behaving as though commodity sanctions are either implicitly in effect or likely to come in the near future. Uncertainty on the likelihood of future sanctions are leading purchasers to reduce exposure to Russia, introducing friction into the global commodity trade. This friction acts as a supply loss and increases global prices - even in the absence of explicit sanctions. Higher commodity prices in turn keep inflation levels elevated.

The globe is facing increasing risks of real loss of significant supply across multiple commodities, already running short, from one of the largest commodity producers on the globe.

Unprecedented.

Political Impact

As difficult as it is to opine on economic fallout from the Russian invasion, pontificating on political consequences is effectively rank speculation.

Will the sanctions even work? Work at achieving what objective? According to the Chicago Council on Global Affairs, sanctions have only succeeded in stopping war three times in the last hundred years, most recently during the 1956 Suez crisis when the US threatened the UK with severe economic sanctions if it did not stop its intervention in Egypt. Success in this instance has been attributed to the fact that both the US and UK sought to preserve relations. The case today between Europe/North America and Russia feels decidedly different.

Only a week into the conflict, the Western alliance is fixated on sanctions and not resolution. The alliance has not made a list of demands or expectations it seeks of Russia to begin lifting sanctions. There is no discussion of off ramps for Putin or a path for de-escalation. For now it's a game of attrition without a clear political objective.

The world is questioning the end game for the sanctions, trying to find the spot somewhere along the spectrum of ceding Ukraine and Moscow regime change. We expect continued military escalation. The longer the conflict continues unimpeded, the less likely a palatable resolution is achieved. Wars generate their own inertia that grows with time.

Commodity supplies at risk. Economic fallout yet to be internalized, extent unknown. Resolution distant.

Energy - Short Term Implications

We see outsized short term impact to three energy products: crude, distillate, and natural gas.

Crude Oil

In 2021, Russia produced an average 10.5 mm bbl/d of crude oil of which about 5 mm bbl/d was on the seaborne export market. The country is also a large producer of refined crude products, with 2.7 mm bbl/d of international sales in 2021.

Russia crude & condensate exports

European exposure to Russian energy is outsized. Over 60% of energy consumed in Europe comes from imported sources, of which Russia stands out as a significant supplier responsible for 20% of energy delivered.

European Union Energy Mix

A new term heretofore missing from the lexicon: self-sanction. This is the phenomenon wherein commodity purchasers and intermediaries refuse to finance or participate in the trade of a good for ethical, reputational, logistical, or financial reasons, despite ostensible legal leeway to do so. The fear of potential future sanctions on Russian energy is leading participants to price a risk premium into future volumes and price.

Sanctions today are already choking off a source of energy. Traders, banks, and marketers increasingly avoiding Russian supplies. Russian oil loadings have slowed to near zero. Buyers have all but disappeared.

Self-sanction in action

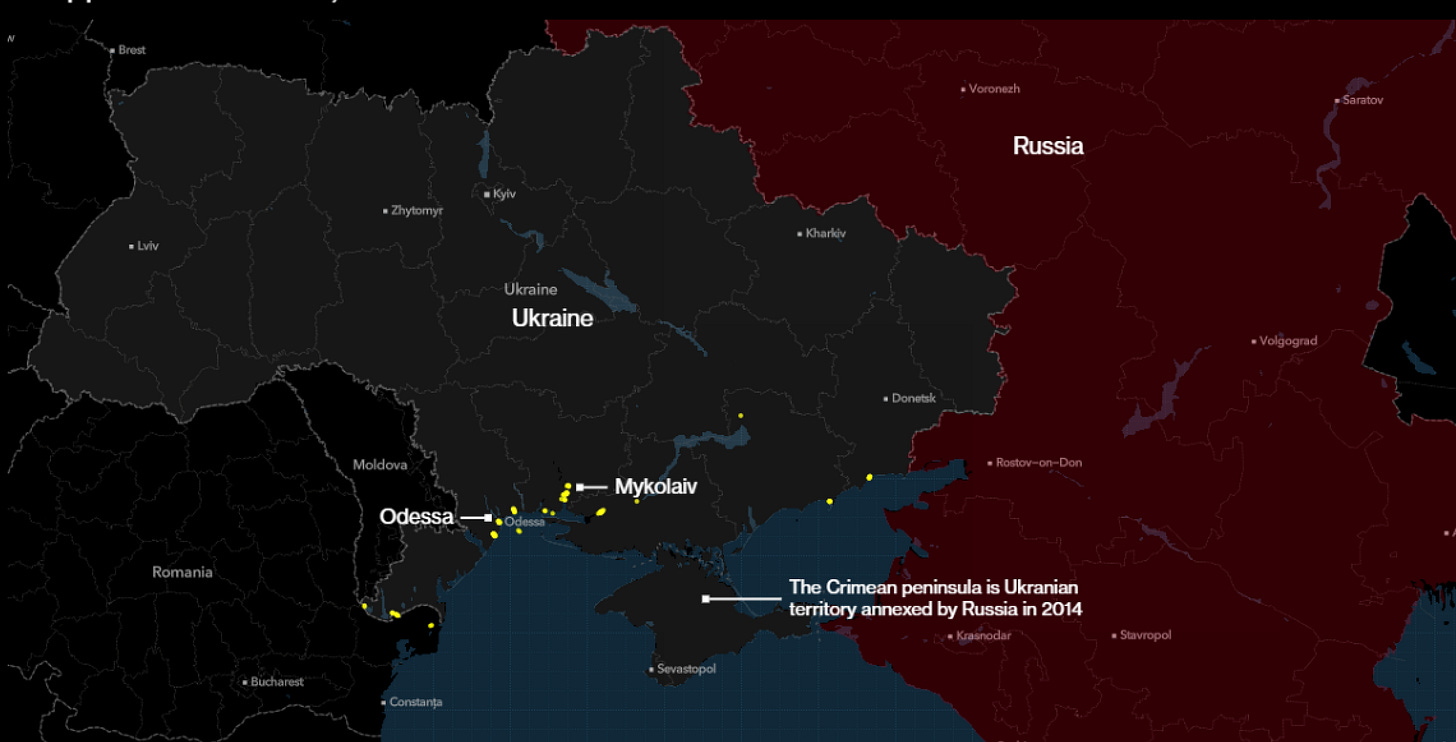

Nearly 200 ships are trapped off the coast of Ukraine carrying products ranging from oil products, agricultural commodities, and metals. Missing harbor pilots to guide them, subject to navigation restrictions due to mine risk, and facing general uncertainty around commercial viability of discharging cargo, seaborne commercial activity around the Black Sea is grinding to a halt.

Last know position of commercial vessels around Ukraine

For now exempt from sanctions, Russian crude is nonetheless being partially boycotted in the global market. Reports indicate that over two thirds of Russian oil sales are struggling to clear. Self-sanctions and intensifying calls for official sanctions have curbed 4.5 mm bbl/d of crude and product exports from Russia according to JP Morgan. Russia’s benchmark Urals crude blend, a widely consumed crude prior to the invasion, is being shunned by the market. From trading at near parity to Brent crude, sellers are being forced to eat enormous discounts just to place the barrels.

Russian Urals differential to Brent

So tainted are the Russian barrels that Shell felt compelled to issue a press/tweet release after catching flak for their bargain basement Urals purchase on Friday at $28.50/bbl discount to Brent.

Moral reservations aside, below is the reason why most market participants are still reticent to step into the Russian crude market. The risk of the Western coalition abandoning its week-old stance of exempting energy from sanctions grows by the day. If a bipartisan congressional bloc in the US convinces the administration to ban Russian crude imports, the probability of the rest of the sanctioning coalition doing the same rises meaningfully. Bipartisan consensus in DC is an endangered species. What nonzero probability should the market assign to the potential of the US and its allies banning oil imports?

70% of Russian crude exports went to OECD countries before the Russian invasion. Should the sanctioning countries add energy to the list of restricted purchases, we would expect the turmoil in crude oil markets to surpass last week’s as the globe repositions flows where it can, and rations demand via price where it cannot.

Simplistically, oil is fungible. Russian crude purchases abandoned in one corner of the world should theoretically be absorbed a buyer in another corner. Yes and no, subject to a multitude of moving variables, particularly cost, logistics, and capacity. India and China stand out as most likely contenders to step up purchases of Russian crude displaced by sanctions. But the transition from OECD consumers to China/India consumers is far from seamless. It is highly unlikely that the duo could completely absorb the full displacement of Russian crude and products.

Shipping has emerged as an impediment to redirecting Russian crude exports. Commercial activity with Russia’s largest tanker operators has plummeted. Even large non-Russian tanker companies like Maersk and Torm have stopped signing new shipping deals for Russian crude transport. Regional tanker rates have skyrocketed due to reduced ship availability and increased operational risk.

Black Sea & Baltic Sea oil tanker daily earnings

The spike in rates has therefore consumed much of the uplift that an Indian or Chinese purchaser might expect to net from acquiring the discounted Russian barrels.

Furthermore, even the Chinese and Indian purchasers are wrestling with risk aversion. Chinese banks including the Bank of China and the Industrial & Commercial Bank of China are restricting financing of Russian commodities. In India, the Indian Oil Corp has publicly announced it will not purchase Russian crude on an FOB basis. The most likely backup buyers of dislocated Russian barrels are hesitant.

The ongoing US vacillation surrounding a potential Russian crude ban, and the potential derivative impact on European purchases, we expect the global trend of eschewing Russian barrels to continue until market participants are afforded more certainty around commercial access to Russian volumes and safety and well being of operations in the region. Neither seems imminent.

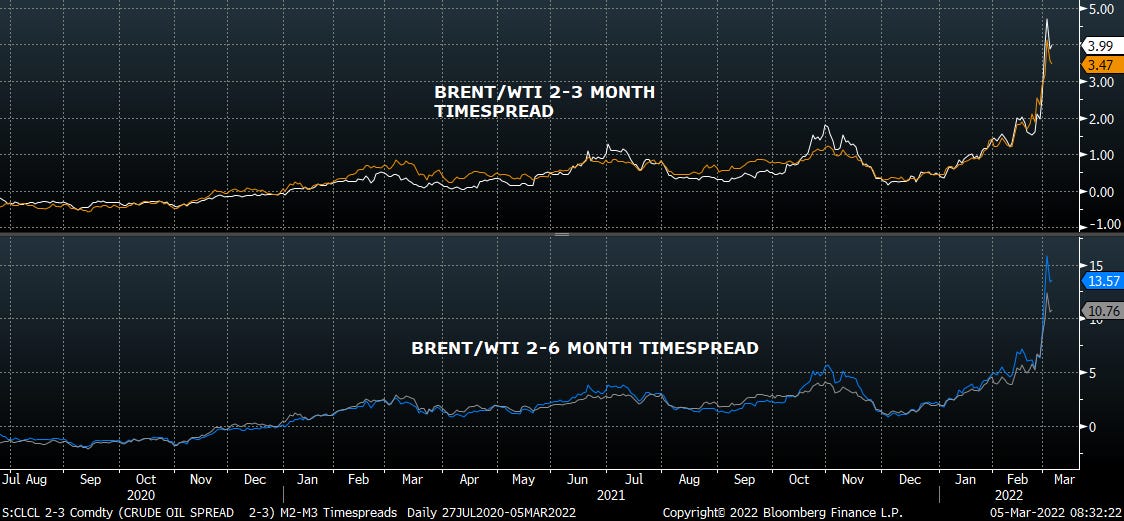

The market agrees, pricing in alarming levels of near term tightness in timespreads.

Brent/WTI Timespreads

Supply relief is conceptually possible in four vehicles: Iran, OPEC+, US, and Strategic Petroleum Reserve (SPR). None is enough to offset the loss of Russian barrels, though they could cushion the blow over the course of 2022.

1) Iran

When it comes to energy policy, we are convinced that the Biden administration loves a good tape bomb to gauge market sentiment. Biden campaigned on re-entering the JCPOA that the Trump administration abandoned in 2018. The administration has made halting progress in reinstating the deal since taking office last year, but the flurry of updates this past week suggests to us that a deal announcement is likely in the coming days, with an urgency imposed by the loss of Russian barrels.

Iran has been illicitly selling production despite US sanctions for years. The pace of exports has accelerated in recent months to levels roughly 0.25 mm bbl/d above 2019 and 2020. In the immediate wake of a signed deal with the US, we look for Iran to quickly discharge oil and condensate from storage and begin to ramp production. The storage surge could amount to up to 1 mm bbl/d increase to global supplies immediately, though we have questions on market appetite for its condensate.

Production should accelerate from current 2.5 mm bbl/d to over 3 mm bbl/d in the back half of this year. Having likely lost some production capacity since the US walked away from the JCPOA, consensus expects Iran would struggle to boost production beyond 3.5 mm bbl/d in 2023. In light of the country’s recent growth in export sales, we believe risk is skewed to the downside regarding incremental production Iran could quickly bring to market if a nuclear deal is (re)consummated.

Iran crude oil production

2) OPEC+

After a blistering 13 minute meeting this week, the 23-member coalition of OPEC+ borrowed a page from MAD magazine when it stuck to its plan of gradually returning crude supply to the market.

The group stuck to its long-established plan of adding 400,000 bbl/d production per month until the entirety of its 2020 curtailments has been unwound. Dismissing current crude price strength as more speculative than fundamental, OPEC+ punted a more difficult decision on whether to accelerate production restoration at least until its next meeting at the end of March. A single question raised on the Russian invasion was ignored.

“Overcompliance with quotas,” a euphemism for the group failing to hit its production targets for several months, continues to be the norm. This naturally leads to persistent questions surrounding how much production OPEC+ is capable of adding on short notice.

OPEC actual vs target production

Until proven otherwise, the market will risk the group’s production surge capability. Uncertainties surrounding the ability of member countries apart from Saudi Arabia and UAE to grow volumes will find the market heavily risking any OPEC+ production more than 1.5 - 2.0 mm bbl/d above today’s level.

OPEC spare capacity

3) US

Unless you’re DVN CEO Rick Muncrief or PXD CEO Scott Sheffield and you’ve publicly expressed confusion as to why the president of the United States hasn’t called you, there isn’t much to say on the trajectory of US crude output in the near term. It’s locked in.

E&P 4Q21 earnings have just concluded and producers have issued 2022 guidance that calls for extraordinarily (for the group) measured production growth this year. With bottlenecks in personnel, consumables, and logistics emerging, we believe there is limited opportunity for the group to materially change the outlook for domestic production over the next six months.

US crude oil production

In its most recent Short Term Energy Outlook, the EIA arrives at a similar conclusion.

4) Strategic Petroleum Reserve (SPR)

For the second time in three months, the US has spearheaded a coordinated release of crude oil from global SPR inventories. In response to the post-invasion crude price rally, the IEA announced this week that the 25-member consortium will release over 60 million barrels from stockpiles in the coming months. Half is to be sourced from the United States.

IEA 2022 SPR release

Notwithstanding the fact that the absolute size of the release would cover roughly two weeks of lost Russian production, the market is concerned about IEA members delivering even these modest volumes in light of recent precedent.

Last November, the US committed to releasing 50 million barrels from its SPR to mute ongoing crude price appreciation. Since then, only 20 million of the 50 million announced has been released, primarily due to limited purchaser appetite and logistical constraints. The market is right to risk the capacity of this newest SPR announcement to provide enough supply to address tightness in the crude market.

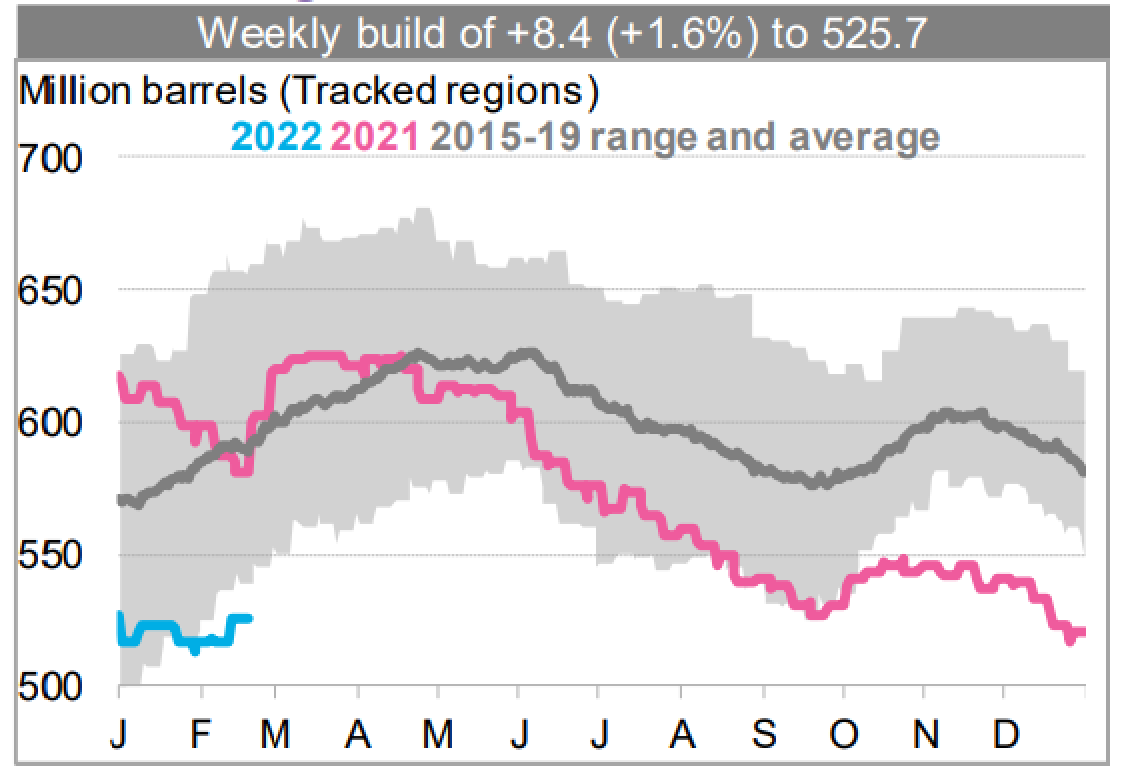

Global onshore crude inventories

For a global market that was already tight, the scale of the Russian supply losses today is enormous. Until the market builds comfort in the durability of resuming trade in Russian energy, incremental supply from global producers and SPR releases will mitigate, but not reverse, the ongoing deficit.

That part of the supply/demand balance the market cannot achieve through supply it will reach through demand via higher prices.

Refined Products - Distillate

The 2021 energy deficit started with acute tightness in the global distillate market. Even before Russian exports were disrupted, global inventory levels were well below seasonal norms.

Global distillates inventories

In Europe, inventories have been low like most of the world. Gasoil inventories were already at multi-year lows before Russia’s attack.

Europe (ARA) gasoil inventories

Sourcing 15-20% of diesel consumption from abroad, Europe is a sizeable net importer of the refined fuel. The region has historically been dependent on Russia for diesel supply, relying on the country for 40% of its diesel imports last year. Northwest Europe has for years been the primary destination for Russia diesel exports, thanks to its proximity and relative cost advantage.

Russia can offload as much of its domestic surplus into Europe as it chooses - providing up to 75% of total European diesel imports at times. European diesel demand always exceeds Russian supply, so imports are insensitive to market fundamentals - Europe has reliably bought all of the diesel that Russia wants to sell. Saudi Arabia and India provide the next tranche of imports to the region.

Russia vs RoW European diesel imports

Complicating Europe’s diesel imbalance over the last six month’s was the sharp rise in natural gas prices that pre-dated the Russian invasion. Local refineries dependent on natural gas for power, heat, and hydrogen were hit with a huge cost shock when local prices spiked in Fall 2021 as inventories drifted below normal levels, making the local production of refined products more economically challenging.

Northwest Europe natural gas ($/MMBTU)

Refineries use hydrogen derived from natural gas to crack (break longer molecules) and desulphurize (remove sulphur contaminants) the crude oil used as feedstock. According to the IEA, by 4Q21, European refiners’ cost of hydrogen had risen to 10x 2019 levels, imposing an incremental operating cost of $6/bbl of crude throughput. This incremental cost flowed through cracks into product prices.

Tightening diesel markets had a follow on impact on gasoil/diesel futures. Prompt timespreads rallied hard. When Russia invaded Ukraine and put its own diesel exports at risk, gasoil timespreads exploded to the highest levels seen since 2008.

Europe gasoil M1-M2 Timespread

Pricing in a risk to Russian import volumes, the market would historically look to secondary suppliers Saudi Arabia and India to make up the deficit. But the steep backwardation in the diesel curve is a headwind for this strategy as sellers realize better netbacks at markets close to home rather than placing product on a tanker and sacrificing time value. Northwest Europe is therefore receiving much less diesel by sea than it would otherwise - perpetuating the steep backwardation.

Singapore gasoil M1-M2 timespread

Refined product demand drives crude oil demand. With demand having outpaced supply for much of the post-COVID recovery, global distillate stocks were already low before Russia put its sizeable diesel exports at risk. In Europe, where refineries have been struggling with high costs and declining capacity, the risk is acute. The market is screaming for incremental diesel. A refined product shortage is causing product price strength, which in turn is pulling up crude prices as the market tries to find the right economic incentive for more product supplies.

Brent-gasoil spread

The change in the European gasoil curve over the last few months reflects the dramatic deficit today.

Gasoil futures

Running European refineries at record utilization levels wouldn’t be enough to make up volumes, even ignoring the risk that an official Russia energy sanction would pressure feedstocks further. Europe could import incremental product volumes from Saudi and India, but the sheer size of Russian imports means the two countries would need to triple their exports - at much higher prices of course.

If Europe loses Russian diesel imports for a sustained period, it’s exceedingly difficult to see how the volumes are replaced. Price will ration demand in what is arguably already the tightest energy commodity in the world today.

Gasoline is in the cost of personal transport.

Distillate is in the cost of everything.

Russian natural gas

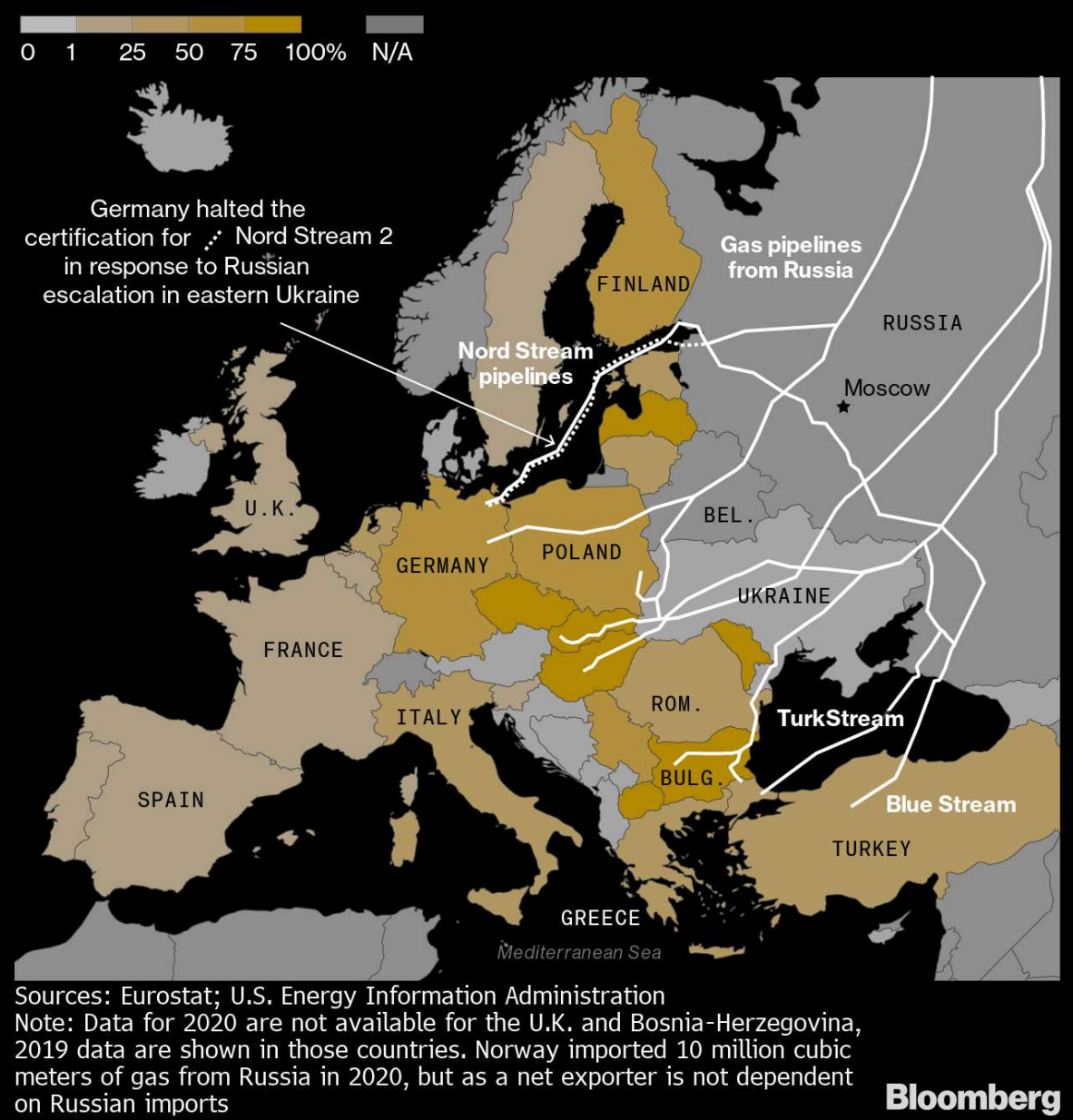

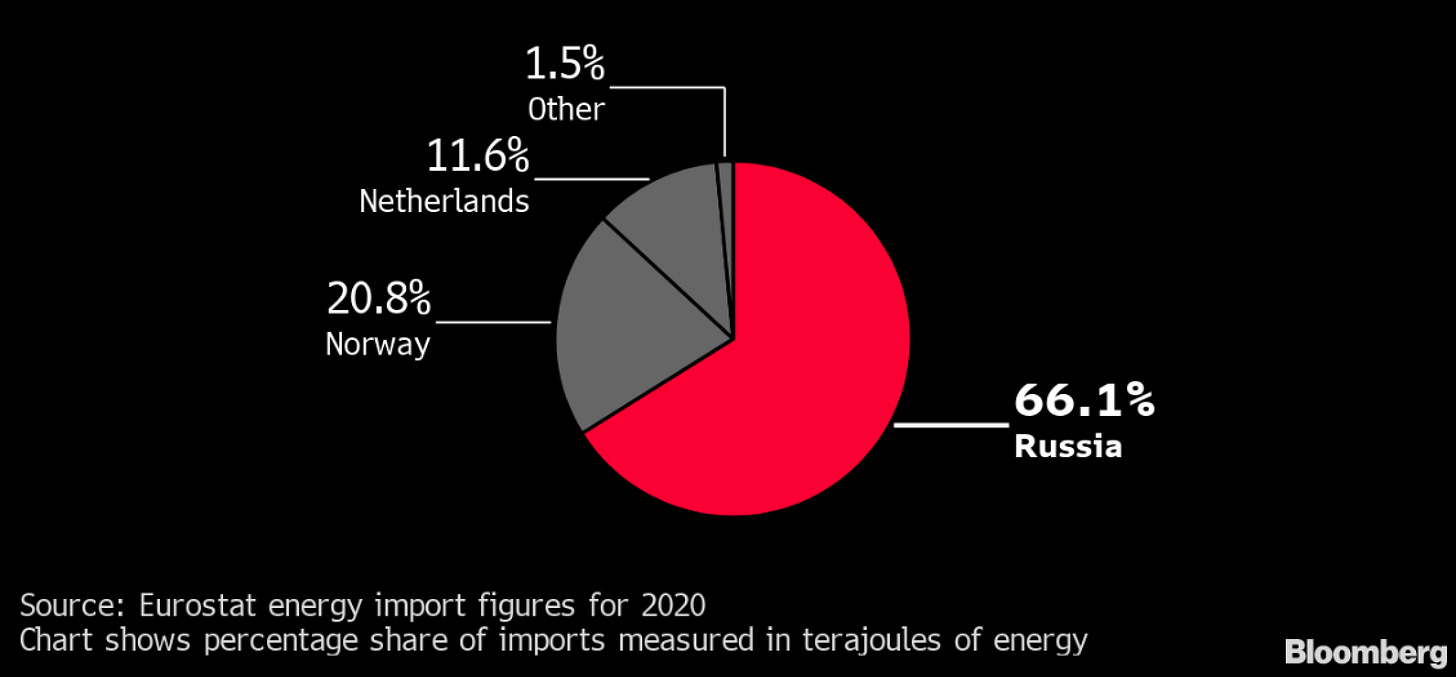

Having read this far, the enterprising reader should not be surprised to find yet again that Europe is overly dependent on natural gas imports to meet regional demand.

European gas supply by source

Amongst natural gas import sources, Europe is again exposed to Russian volumes.

Share of Natural Gas Imports Coming from Russia, 2020

Over half of Germany’s natural gas consumption and some 30% of Italy’s and France’s, is sourced from Russian imports.

German natural gas dependency

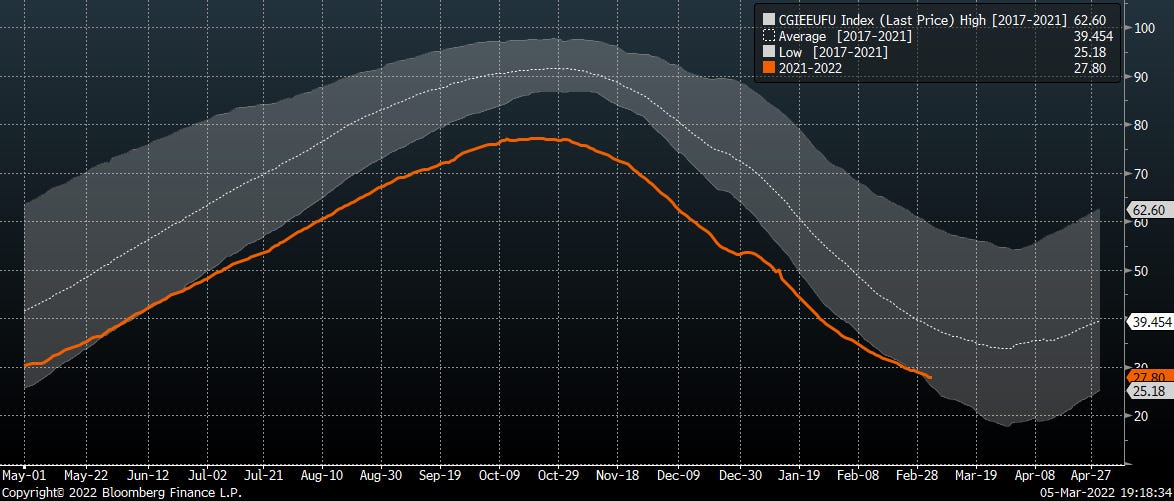

As was the case in crude and distillate, European natural gas inventories were seasonally low before the onset of Russian hostilities. Warmer weather of late has arrested the delta to normal levels, but the need to restock inventories persists.

Europe gas storage % full

Russia was partly responsible for precipitating the European gas shortage. Russian deliveries to Europe began a noticeable decline in 4Q21 and dropped further at the beginning of 2022.

Russia gas deliveries by entry point

Europe’s target of replenishing depleted natural gas inventories was going to be a challenge, itself contingent on the startup of Russia’s new Nordstream 2 pipeline. Then Germany responded to Russia’s attack on Ukraine by nixing the project’s approval. Losing future gas volumes from Nordstream 2 introduces further risk and complexity into Europe’s pressing need to rebuild inventories this year.

Russian gas is still flowing into Europe today, a welcome departure from the disruption seen in crude and product markets. However, European gas consumers are not only facing the prospect of a burdensome restocking period, but also the risk of future supply disruption. The more significant the hypothetical supply loss, the less likely Europe will be able to replace it.

The potential supply disruption permutations are too numerous to navigate here. We leave readers with BNEF’s summary chart. Europe can via incremental LNG imports backfill some degree of hypothetical Russian gas disruptions, but there are distinctly plausible disruption scenarios that find the continent unable to technically or commercially replace lost gas molecules.

LNG supply backfill based on Russian gas disruption

Asian consumers that compete with Europe in the global LNG market are well aware of Europe’s strains and have bid up available LNG volumes in anticipation of extended market tightness. A further challenge to Europe’s need to rebuild natural gas inventories ahead of next winter.

Awarded LNG spot tenders

March 8 EU Energy Policy Update

As if the risk of policy-driven, physical damage, or punitive retaliatory natural gas supply curtailments were not enough, EU administrators are fast tracking a revision to the region’s energy policies and are set to release recommendations next week. Pre-release rumors have not landed on how vociferously the commission will urge member states to transition to Russia-free energy, though reports suggests this is being studiously evaluated after the attack on Ukraine.

The commission is reportedly prioritizing a dramatic reduction in Russia gas imports that will be offset with increased non-Russian imports, accelerated renewables development, and increased efficiency mandates. A rumored 10 point plan is said to include:

No new gas contracts with Russia

Replace Russian energy supplies with alternate resources

Introduce minimum gas storage requirements

Accelerate wind and solar deployments

Maximize power gen from bioenergy and nuclear sources

Enact tax measures on windfall profits

Accelerate gas boiler replacement with heat pumps

Mandate energy efficiency improvements across residential and industrial buildings

Encourage thermostat reduction of 1 deg Celcius for consumers

Diversify and decarbonize sources of power system flexibility

“We need to wean ourselves of the dependency on Russian gas and oil and we need to do that much quicker than we had anticipated,” EU climate chief Frans Timmermans said on BBC Radio 4 on Thursday. “The European Commission will make proposals next week to make that happen as soon as possible.”

Absent an instantaneous cease fire and conditionless Russian capitulation, we see global risk vis a vis energy supply deteriorating further. Oil, refined products, and natural gas supply risks are skewed to the downside in the near term, with a very fat left tail.

The longer this war drags on, the more entrenched these ‘new normals’ become.

Energy - Long Term Implications

“We had all the momentum; we were riding the crest of a high and beautiful wave.… So now, less than five years later, you can go up on a steep hill in Las Vegas and look West, and with the right kind of eyes you can almost see the high-water mark—that place where the wave finally broke and rolled back.”

-Hunter S. Thompson, Fear and Loathing in Las Vegas

Russia’s attack on Ukraine is a global wake up call and is forcing a reevaluation of geopolitical priorities, alliances, and intentions.

West reprioritizes

Western-aligned countries have reached a limit on behavior they will tolerate, let alone condone. The bloc will accept neither Russia’s actions nor its leverage on global markets. Sanctioning countries have openly acknowledged financial burdens they are willing to bear as a result of their collective decision to punish Russia. They are using unprecedented tactics to honor their stated commitments and values.

This is the new normal.

European slows its roll

The Russian attack on Ukraine has thrown into sharp relief the continent’s dangerously concentrated dependence on Russia. Europe is today in the early throes of a structural reassessment of its energy policy that will temper the pace of fossil fuel phaseout even as it doubles down on its push for renewables.

Anecdotal releases reinforcing this theme are ubiquitous, and the widespread embrace of the revised philosophy should accelerate after the EU updates its energy study this coming week.

Europe is quickly moving to build a world that consumes less Russian energy. It will concurrently accelerate its plans to increase regional renewable power generation.

Germany renewable power outlook

Recognizing that a comprehensive accelerated renewables buildout will take years, Europe will finally accept the tautology that the Energy Transition is an energy transition. Transition of course being the operative word. Fossil fuels cannot be abandoned today. They must be reinvigorated in order to facilitate the transition.

Europe will expand non-Russian energy imports and storage. It will shelve plans calling for accelerated shut downs of coal-fired and nuclear power plants.

“ ‘There are no more taboos,’ (German) Economy and Climate Minister Robert Habeck declared recently. ‘In the short term we may need to hold coal power plants in reserve out of caution.’ “

“The Green party minister likewise did not rule out pushing back the closure of the country’s last three operational plants”

Europe, for years at the forefront of the green energy transition, is slowly taking its boot off the throat of the fossil energy. The globe will follow.

Russia Peaks

Hope it was fun while it lasted, because it’s over. We’re calling the peak of Russian production.

BP, Shell, and ExxonMobil have abruptly walked away from Russia in stunning fashion. Total Energies has taken a marginally lower high ground in vowing to cease new investments in the country. Whether the largest global IOCs are just handing over the keys or conducting an orderly wind down of their assets matters only in the short term. Starved of capital, resources, and expertise, Russian production will struggle to grow and is likely to settle into terminal decline.

Gone will be ambitions to eclipse all other OPEC+ members as the global oil producer. Best to dial down expectations. Think Venezuela, not Saudi Arabia.

Venezuela crude oil production

The new Russian oil outlook will leave a void in global crude production in the coming years in a world that suddenly will need more crude than it thought only a few months ago.

Realignment of global energy flows

Energy will join the list of industries undergoing a shocked move towards deglobalization since COVID. Consumers have assumed too much supply risk in too few concentrated suppliers. Russia’s actions are incompatible with democratic ideals and capitalist economies and place at risk energy supplies the world desperately needs. OPEC, whose purported lodestar has been “price stability,” has shown itself at best to be an intransigent, unreliable partner in global commerce.

A world forced into increased dependence on fossil fuels should, with a modicum of pragmatism, understand that reliable energy supply is not antithetical to goals of improving living standards and global stability.

Decrementally reliant on Russia and OPEC energy, the only alternative is North America. The call is inevitable. How will industry answer?

Everything has changed.

Post script: we write to connect. feel free to reach out. we hope to be a resource.

Thanks for this. Clear, comprehensive, concise.

Would probably be a bad time to say that shale isn't an infinite resource either. The US subsidized global energy prices through exports at below replacement cost for the past several years. The DUC's have been completed, now we're at full cost drill +complete operations, and if we boost drilling to increase production will need more infra in some areas. There are only so many locations to drill that can get at good rock. If we drill them now, production starts falling sooner. Any appreciable boost in volumes won't show up for 6-8 months, by which time oil prices will have done whatever they're going to do. Coulda/shoulda/woulda filled the SPR when oil was below $40 during the pandemic, didn't. The place with the real reserves is Canada, but we don't want pipelines. Short term decisions, very long term consequences. The ESG crowd was driving for this, hope they're ready for the backlash.