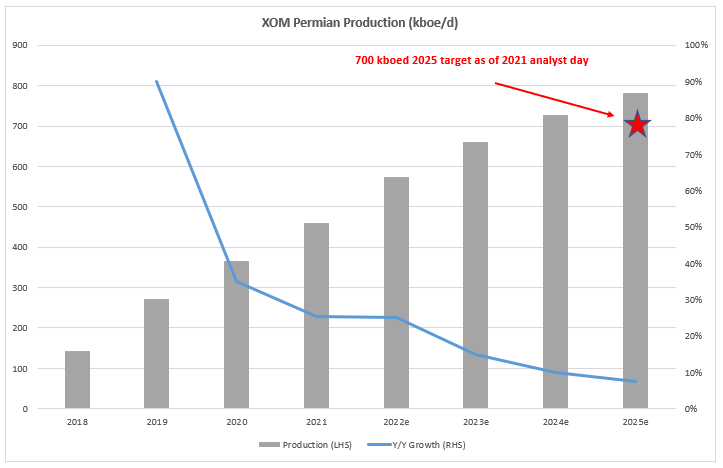

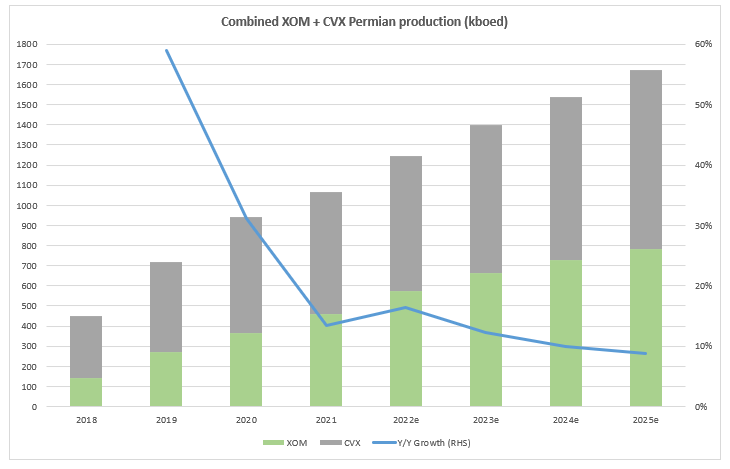

In their 4Q21 earnings report today, XOM reported that their net Permian production grew about 25% in 2021 to 460 kboe/d and is expected to grow at a similar clip in 2022 to around 575 kboe/d.

If we conservatively model much slower year on year growth rates for XOM Permian in 2023 onwards (realistic or dubious parameter? - we’re not sure) from 25% in 2022 and step down to 15%, 10%, and 7.5%, we get XOM approaching 800 kboed in ‘25.

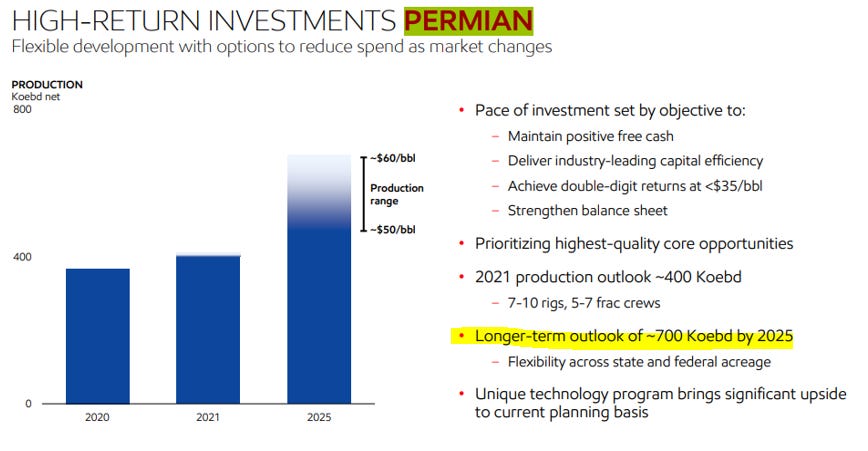

The 25% growth in 2022 equates to annual production growth of 115 kboe/d. The 2022 guided volumes of 575 kboe/d would put the company only 125 kboed shy of their long term 2025 long term guidance of 700 kboe/d as last advertised in their 2021 Analyst Day. Said another way, their absolute Permian production growth in 2022, if repeated in 2023, would put the company achieving their long-term production target two years early.

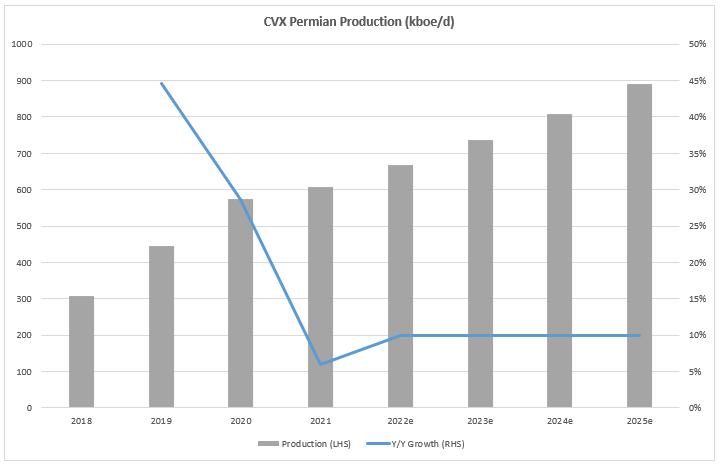

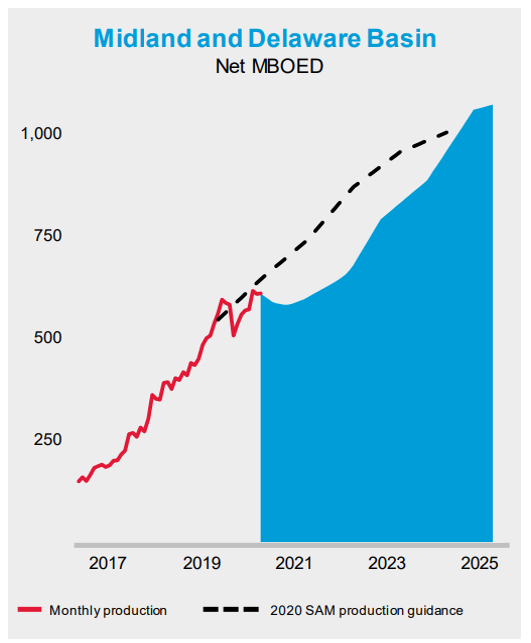

Peer CVX is also looking at Permian growth, albeit dialed down from XOM’s projected rates, though off a higher absolute production base. After a muted 6% growth in 2021 to 608 kboe/d, CVX is guiding to 10% growth in 2022.

We expect CVX to drive relatively steady growth rates for the next few years under current planning conditions to hit their 2025 goals last advertised in their 2021 Analyst Day.

The combined XOM/CVX duo should see Permian production in 2025 near 1.7 mm boe/d, up from about 1.1 mm boed last year.

It’s still quite early in the reporting season, so there’s ample disclosure to come on how the upstream industry will approach capital and production growth in 2022. There are few conclusions to be drawn solely from the majors’ disclosures.

We do want to highlight nuance in each company’s commentary during their earnings calls to highlight one of our thematics: a good portion of the “underinvestment” observed in the energy industry the last few years has in reality been cost deflation and capital efficiency. Upstream capital dropped in no small part because less capital was needed to develop the same unit of resource at better risk-adjusted returns.

To wit, from XOM’s call today:

Our expectation as we go into 2022 is to grow another 25%. And that's when you're doing that with a very tight control on capital, so that's how we're playing the game and we continue to look at within our, the approach that we outline a couple of years ago in the success that we've seen with that and bringing to bear a lot of the technology and application expertise in drilling and reservoir management that with the rest of the corporation has really seeing the benefits of that.

a bit more from XOM:

We're going to make sure that we stay in that (capital) envelope. And obviously, as we progress production and development … and we will progress those (opportunities) in the context of staying within that concept that we've laid out, which … allows us to bring barrels to market at a very low cost

Similar from CVX, articulating increased activity:

“But this is an asset that just continues to look as good as we've portrayed it to you and we're not going to get out ahead of ourselves chasing anything as we bring activity back up from $2 billion last year to $3 billion that's a 50% increase in capital spend. I mentioned that we're going to see a 50% increase in wells put on production in '22 versus '21, that is a meaningful step-up in activity and we want to execute that well… we get very, very strong returns out of the Permian. It's short cycle and we're putting a fair amount of capital into it. We are reducing costs across our business

The market today is telling the Energy industry that it is time to grow. How much it grows and how responsibly it does so will dictate the market’s reception to the evolution in strategy.

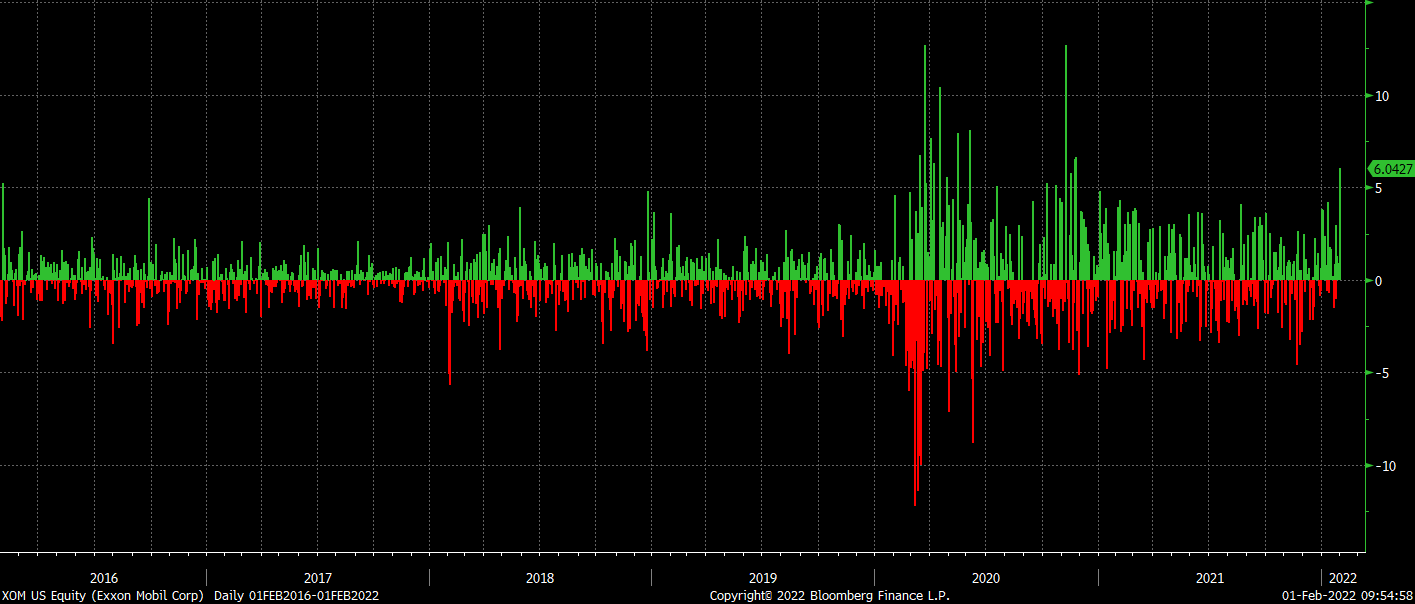

If XOM’s stock reaction is any guide, so far so good. The stock moved 6% on earnings today, a +3 sigma move - the largest outside of the post-COVID 2Q20 bounce(s) and the 4Q20 post-vax rally.