Earnings season is drinking from the proverbial fire hose. Almost the entirety of the energy sector reports in a compressed two week span. On some days - invariably a Thursday - market participants have to digest 20+ earnings reports ( like this coming Thursday, 5/5).

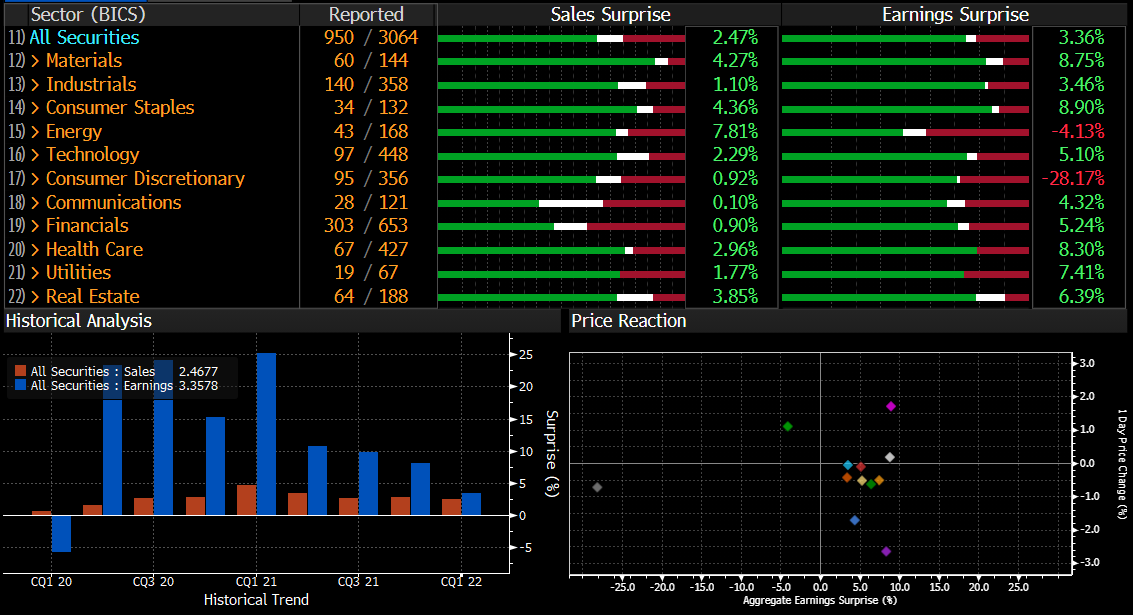

1Q22 Earnings Season Results by sector

Earnings season is valuable not only for the opportunity to capture alpha (a diminishing source of returns in recent years, whether you get the print right or wrong), but for the commentary. We see value in listening to management teams when they go off-script - as they often do during the Q&A portion of the calls.

The value of listening in varies by name and sector, though. If you’ve heard one E&P call, you’ve heard them all. Ditto OFS. But if you want to get a feel for the macro environment and where commodities are heading, you listen to refiners. With a grain of salt, of course.

1Q22 Energy earnings surprise vs stock performance

After all, you don’t burn crude in your vehicle, you use refined products gasoline and diesel. So don’t listen to what an E&P says about crude prices. Instead, listen to what a refiner tells you they’re seeing in gasoline and diesel.

We recap some relevant macro data points from last week’s refining reporters.

We’re overweight refiners and nat gas producers. We look forward to building positions in oily E&Ps and OFS names later this summer.

Remember the basic refining premise: the refiner buys crude oil and breaks it down into various products destined for use in the transportation and/or petrochemical sectors.

Basic refining concept

We are positive the refining group because the spread between refined products and crude oil is “strong to quite strong” and should remain so for a while. The globe is short refined products because refining capacity has shrunk and demand has rebounded. Every refinery that can run needs to run.

Gasoline inventories are seasonally low and distillate inventories are even lower - and the market is calling for refiners to produce more of each. Mandated and self-sanction activities have forced Russian refined products off the market quicker than crude, making a tight global market even tighter.

Refining cracks, measured below as the gross margin from turning 3 barrels of crude oil into 2 barrels of gasoline and 1 barrel of distillate, have exploded. The generic prompt month 321 crack is over $50/bbl. US refiners cost $5-10/bbl to operate. Discuss amongst yourselves.

NYMEX Cushing 321 crack spread

What are the big refiners saying about the environment?

Distillates

PBF: “The United States has become the marginal supplier of the diesel export barrel. In the wake of cutbacks in Russian production; and the inability of Russia to supply markets in the US; and in Latin America on the margin, the United States is now supplying -- the distillate exports particularly net exports out of the Gulf Coast and the country have been very high.”

Total US Distillate Exports (4wk mov avg)

PBF: “Everybody is going to do everything they can to make distillate and jet fuel.. Anybody who is not trying to figure out how to turn gasoline into jet fuel and distillate is not doing their job.”

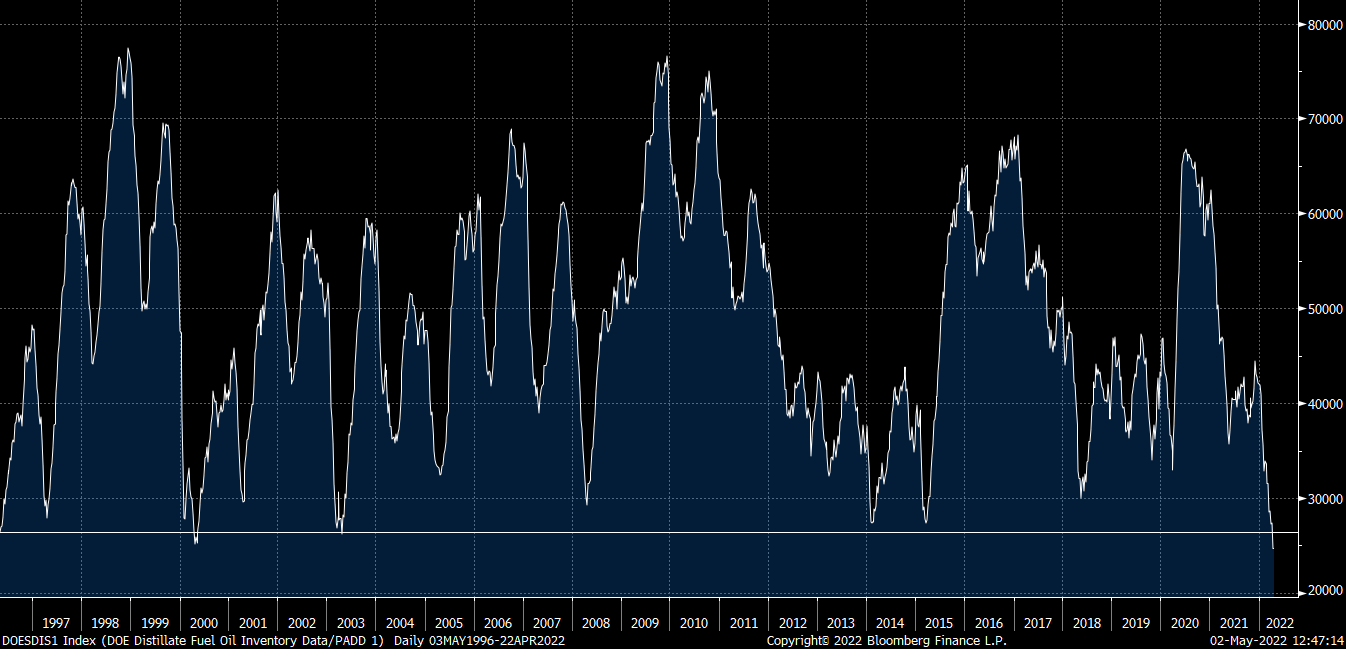

PSX: “We've seen very good demand on the distillate side, demand over 2019 globally. Inventories are really the driver distillate inventories are the lowest they've been since May of 2008 and Pad 1 is the lowest it's been since April of 1996.”

Distillate & Jet Cracks ($/bbl)

PADD I Distillate Inventories

Gasoline

VLO: “By the end of the quarter, we were seeing gasoline demand at or slightly above pre-pandemic levels… As we get into driving season and gasoline demand continues to pick up, you're going to have compression between gasoline cracks and diesel cracks… you'll have to start bidding molecules away from the distillate market and as long as the distillate market remains tight, it just going to keep pulling up both cracks.”

Distillate & Gasoline Cracks ($/bbl)

PBF: “There is going to be a time where if you don't have enough secondary feedstocks to fill all your cracking units, hydrocrackers, cat crackers, then you're going to wind up looking at, well, what's the diesel crack, what's the gasoline crack, and maybe at some point, if the gasoline is higher, much higher than diesel, well we're going to crack heating oil and turn it into gasoline.”

Natural Gas Impact

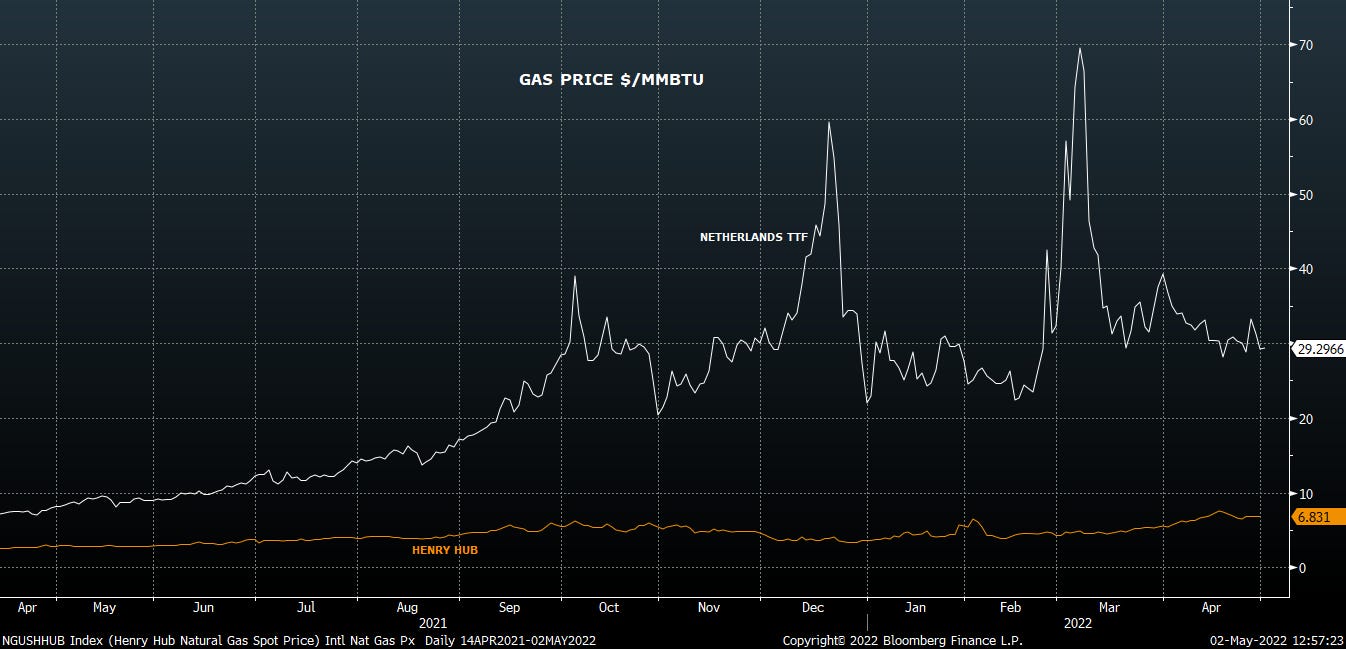

As always, the marginal unit is setting the price, or in refining’s case, the marginal unit is setting the crack. That marginal refiner today is in Europe where gas prices are 4-5x those in the US. Remember from VLO’s Basic Refining graphic that every refiner uses natural gas as a heat source and a feedstock for their operations. Natural gas is the single largest contributor to a refinery’s operating expense. The delta in natural regional gas price is an incremental expense to European refiners and pure gross margin uplift for North American refiners.

Europe vs US natural gas prices

PBF: “The advantage for US refiners or any refiner who has got access to relatively cheaper natural gas is going to be at a structural advantage, and it will be a disadvantage for refineries in Europe and Asia. In fact, they have to spend a lot more to buy natural gas, whether it'd be to power up their plants or to supply hydrogen in hydrogen plants… If we have $6 gas, and the parts of the rest of the world have $25- $30/MMBTU gas, that's a longer-term strategic advantage for us.”

PSX: “Gas prices are up in the US, but certainly not anywhere near what we're seeing yet in Europe, and it really puts us at a structural advantage… it does give us a cost advantage and one that should translate all the way back through improved kind of mid-cycle margins for US refining versus the rest of the Western Hemisphere… our guesstimate is about $8 to $9 (crack spread) benefit to the US versus the EU, given the price of natural gas here and the price of natural gas in EU currently.

VLO: “high natural gas prices in Europe are supporting product cracks to compensate for the higher operating costs. This in turn provides a structural margin advantage for US refineries, particularly those located in the Gulf Coast, where natural gas costs are significantly lower than in Europe.”

Russia & China

VLO: “We have seen, it looks like diesel coming out of Russia and M100 coming out of Russia have fallen off. Thus far we haven't really seen the fall off in crude exports from Russia… but certainly on the M100and the distillate you starting to see export falls off.”

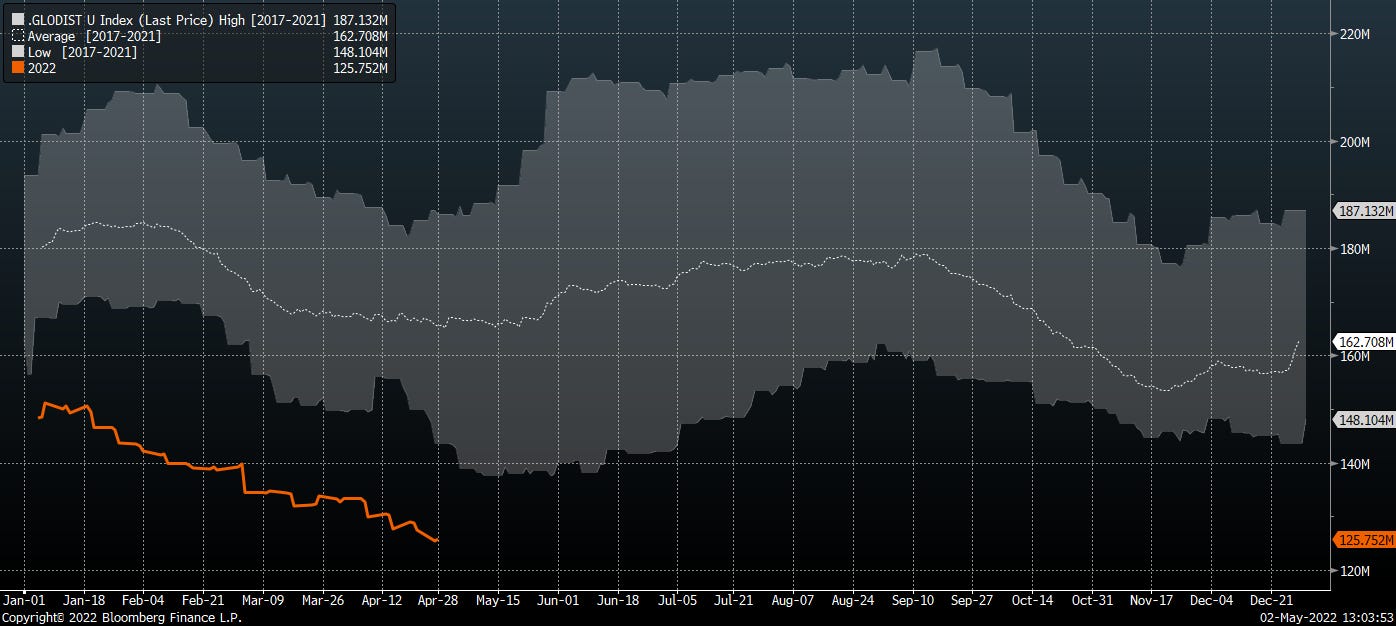

Global distillate inventories

PBF: “The constraints on Russia, while they may be selling a fair amount of their crude and they haven't seen the cuts as deep as perhaps people envision on a crude. The fact is, they are having to cut their refining production because they're running out of room to store products.”

Global distillate cracks

VLO: “although certainly the COVID restrictions have impacted demand in China. They are not exporting a lot of products. So I think if you had weak demand in China and high refinery utilization resulting in very high exports, that would be concerning, but we're not seeing that in the market today.”

We want to be long bottlenecks. We want to be long the producers of goods in short supply, particularly those with a structural advantage.

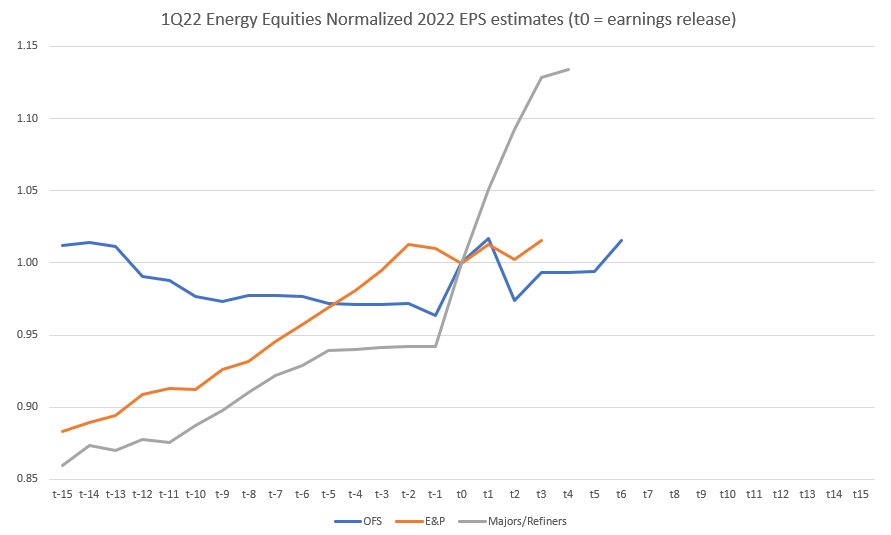

We want to be long stocks where numbers are going up. Below is energy subsector normalized earnings trends for 1Q22 results so far with a little under 50% of the sector reporting.

Look at the refiners: earnings were revised higher into the earnings release (t0) and were revised higher still after earnings.

Normalized earnings revisions into/out of earnings release (t0)

OFS a bunch of “meh” so far. E&P revised to fair value into the prints, then flat lined… so far.

Great analysis. Can you add ticker suggestions eventually ?

I hope you can cover thermal coal sometime. Although the root of the trend is natural gas itself(that you covered), but the supply response will be far muted compared to other hydrocarbons because of ESG.