This earnings season is going to be a fun one. This cycle will be nothing if not volatile.

We are adding nat gas names and refiners today.

How is it that some energy stocks are actually down since Russia upended the global energy market?

Russia’s invasion of Ukraine created a dual shock to the energy markets. Shocks that haven’t gone away. Europe’s sudden realization that it had staked an irresponsible amount of its energy needs at Russia’s largesse forced a sharp epiphany within a couple weeks of the invasion. We discussed in an earlier note: There are not enough BTUs

The EU committed in early March to reduce its dependence on Russian gas by 2/3 by the end of 2022. Its plan was in part to reduce aggregate demand and displace Russian molecules by importing more LNG and non-Russian pipeline gas - both in size. The move away from Russia and into LNG/non-Russia gas is a demand shock to an already-tight global gas market.

International Gas Prices

Concurrently, Europe’s evolving response to Russia is creating a slow-moving crude supply shock. Europe has been reticent to quit Russia cold turkey, but self-sanctioning of Russian crudes is gradually pushing the country towards shutting in production. Russia is for the time being selling as much as it can to Asia and buyers and Western buyers with active term contracts.

It’s on borrowed time. India and China cannot take the entirety of Russian exports. Western buyers with longer duration contracts winding down in the coming months have committed not to renew upon expiry. Europe is inching every closer to Russian energy bans with each day Russian troops stay in Ukraine. Russia has very little crude storage infrastructure, so when the country cannot export due to commercial or logistical barriers, it will have to shut in production. We believe this day is coming.

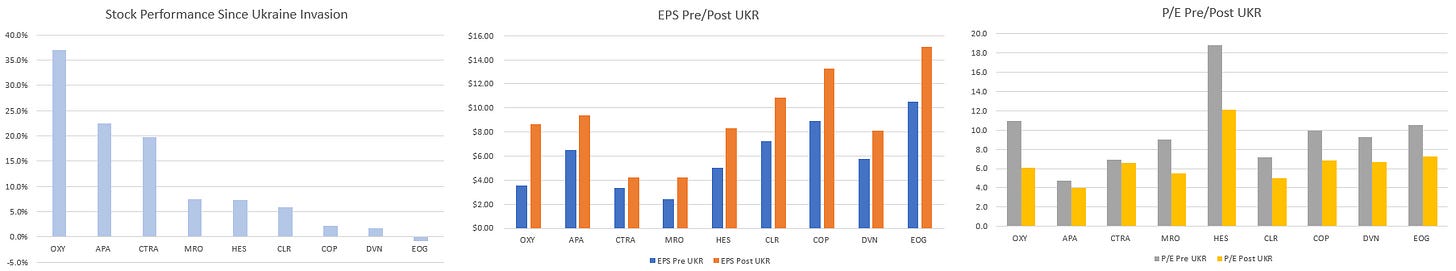

This brings us to an observation today: A number of energy stocks that have gone down since the Ukraine invasion. What gives?

Underlying fundamentals have strengthened since the invasion.

Normalized energy indicators since Ukraine invasion

How have these stronger fundamentals flowed through the equities and what is the market telling us it thinks about Russia implications on energy equities?

Stocks have generally gone up. Earnings estimates (apart from OFS) have exploded. Multiples have compressed for most subsectors.

Energy subsectors rice, EPS, P/E today vs pre-Ukraine invasion

Our read on price action:

EPS revisions have been quite positive for every sector save OFS

Market believes energy equities should be valued today at (low) peak multiples because fundamental strength will be short-lived

Market has high confidence in sustainability of gas strength and little in crude or products

If a company is near Russia, there is no discount that makes the risk worthwhile

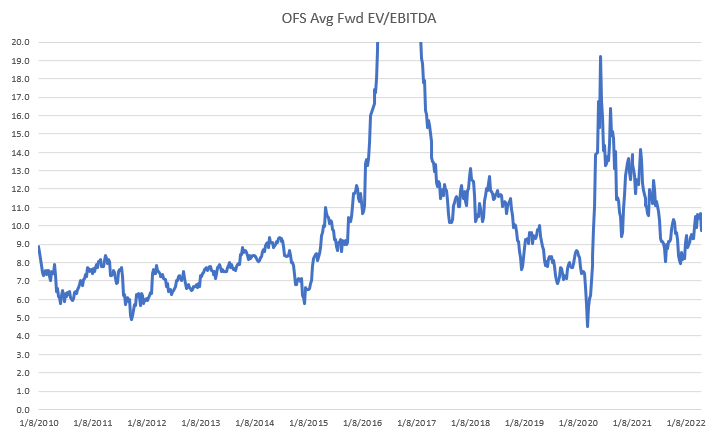

If most OFS can't make money under these conditions, how could they ever?

Our reactions:

We agree the floor for natural gas will in the next few years be higher than the prior decade. Europe’s pivot is a step change in global LNG demand. In the US, regional pipeline capacity restraints and (public) producer discipline are leading to more measured supply growth than pre-COVID days of yore

We expect the crude market to tighten throughout 2022 and 2023 barring an economic collapse. Brent today is $100 and has had just about everything but the kitchen sink thrown at it (China lockdowns, record SPR release, slowing eco growth), all of which we expect to improve by late summer when loss of Russia barrels and lack of OPEC+ growth will tighten balances

We see refined product strength through 2022 and into 2023 with the most pressing near term risk to supply additions coming with next year's projected refinery startups in Kuwait, Nigeria, and China - and we haircut the deliverability on Nigeria (consistent delays) and net impact of new China refineries on product market in light of tightening restrictions on teapots

We agree with the market on OFS - how can so many names still have negative earnings? Only those that can demonstrably prove net margin improvement today are worth consideration. No more "manana" promises - the rosy outlook in the face of … ahem… underwhelming results is a tired tope

We are broadly constructive energy equities on fundamentals and valuation. Risks are skewed to the upside. The globe is short today refined products and natural gas. The panic release of SPR volumes helps plug a hole during a China-led reduction in demand, only racking up the tab for more crude later.

Our favorite ways to play today are refiners, nat gas/LNG equities, with an eye towards oily producers and OFS names later this summer.

A few charts that tell us fundamentals are still favorable:

The crude story today is a refined product story, particularly distillates. The world still calling for more with higher and higher cracks.

Global middle distillate cracks

Because distillate inventories are low in Europe.

Europe ARA gasoil inventories

Ditto US.

US middle distillate inventories

We hate the noise around flagpoles - when prices skyrocket near instantaneously. It never holds and creates all sorts of noise when they inevitably correct only to grind it back out on fundamentals over time. We saw it earlier in crude timespreads after panic crude news on Russia invasion.

Crude timespreads

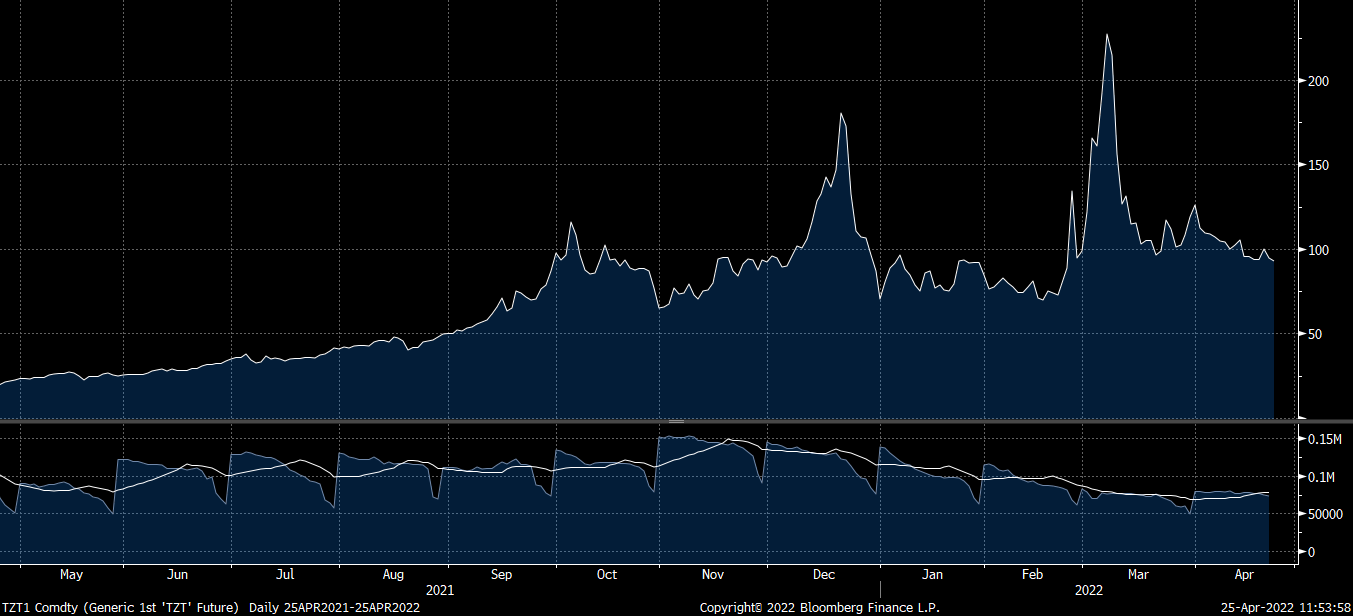

Just like we saw in Euro gas.

TZT 1st month (EUR/MWH)

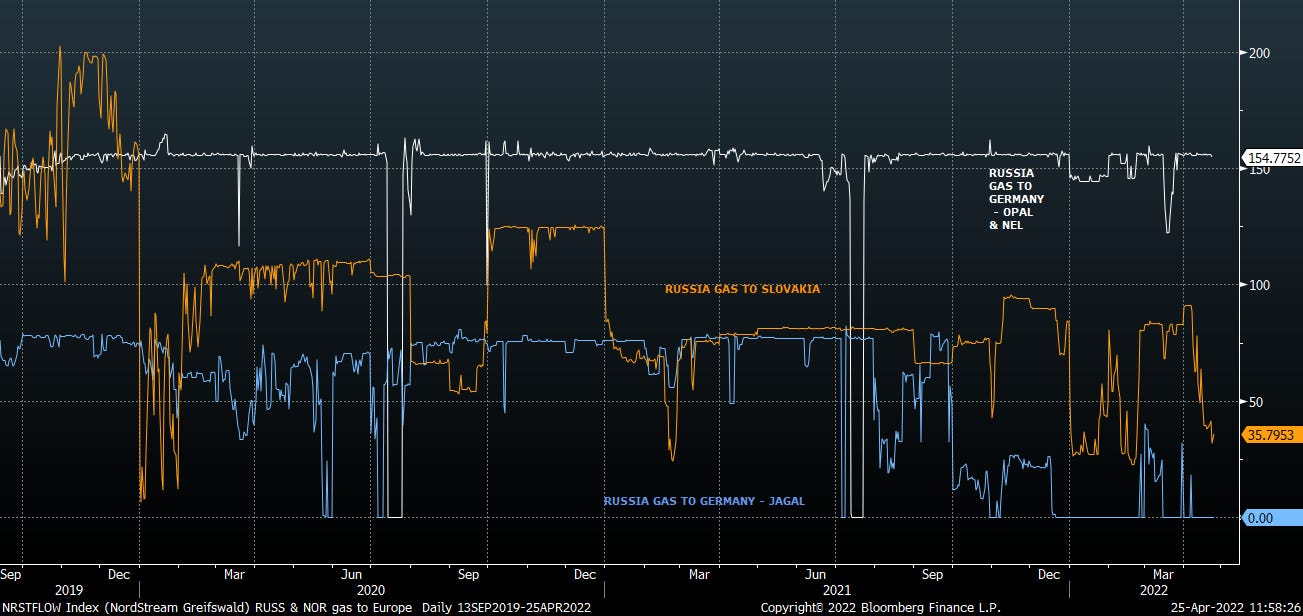

With literally no notice, we could see Russian gas flows into Europe disrupted, because it beggars belief that Europe is still paying Russia for commodities today only to finance a war against them at the same time. There is a non-zero risk that Russian flows go to zero for any number of reasons. They must fill gas storage, urgently, before winter.

Russian pipeline imports to Europe

The European storage situation has markedly improved, thanks to huge LNG imports. And it needs to stay that way to avoid a catastrophic winter.

Europe gas storage % full

US gas storage is seasonally low, an admittedly weird thing to say for us. On this path, US enters withdrawal season at one of the lowest levels in the last decade. Price needs to stay elevated to figure out some combination of increased supply or reduced demand.

US Natural Gas Storage

On the subsectors, upstream names are trading at trough multiples, in line with historical periods of peak earnings. We again think strong earnings are stickier this time and will trade at wider multiples as the multi-faceted global energy shortage is internalized.

IOCs have political risk, in and around Russia. This hair makes the group to us less compelling. It’d be great to scoop up the (good) refiners cheaper, because the next couple of quarters might actually be peak earnings. But the upside in 2022 earnings potential tells us we could miss a nice rally if we waited too long. It’s not inconceivable that a few of these refiners in 1-2 quarters this year earn more than they’ve ever earned in a year. We’re not cute enough traders to time this perfectly.

And then finally, the dogs. We think there might be a play in NAM markets with tight capacity like drilling and pressure pumping, but just aren’t in a hurry to get involved elsewhere right now.

And finally, some more granularity on the subsectors’ performance, earnings revisions, and valuation trends.

Lg Cap E&P

Permian E&P

Gas E&P

SMID E&P

IOCs

Refiners

OFS

Best wishes on earnings,

Great read. Would be even more amazing if it has tickers :)

Great Work!