Fundamentechquantioral

Weekend Review

We pithily once described our process with the quadruple portmanteau “fundamentechquantioral.” It rolls off the tongue so easily we kept it.

Framework Recap: The here and now is bullish

Fundamentals. Refined products are tight and costs to make them are high. These conditions are understandably mistaken for crude strength, but that doesn’t matter now. Bullish.

Technicals. Every chart is up and to the right. Sector, factor, equity, commodity, you name it. Except for natural gas of course. Bullish (excluding nat gas).

Quantitative. Rates up = Value up. Market is not complicating this simple conclusion. Bullish.

Behavioral (Narrative). This gets an asterisk*. The narrative is bullish, but it deviates pretty far from fundamental trajectory as we see it. Of the four categories in this framework, the narrative is first to be wrong and last to change and it will be in response to price. Bullish.

We try to respect the market and keep an eye on the horizon. The setup sure looks constructive today as detailed below, but we differ from consensus in that we do expect, later this year, macro conditions to turn into a headwind for the sector. We do not think this is a supercycle or a crisis. But we are not positioning for a crash today. We take what the market gives.

Fundamentals

Refined products, especially middle distillates are tight and well bid. This is what is driving price action. As long as product inventories are short and the cost to make them is high, prices will be resilient. When it changes, we will go bearish. Status quo for now.

How is the marginal refiner holding up? Quite well in Europe.

Northwest Europe Brent hydrocracking

Same in Asian hub Singapore

Singapore Dubai hydrocracking

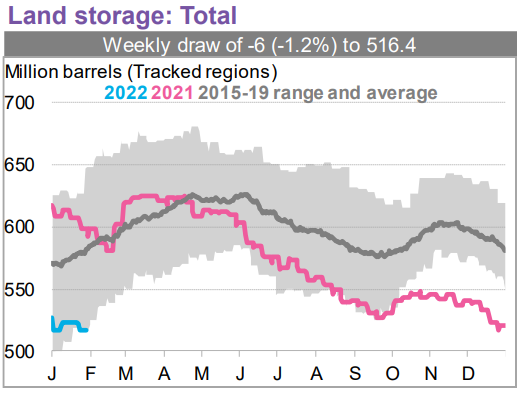

Total global crude land storage looks low and constructive.

Global crude land storage vs 5 yr

Partially offset by global floating storage levels well above normal.

Global crude floating storage vs 5 yr

Gasoline global stocks are back within the 5 year band and at normal levels. This isn’t what is driving the bus.

Global gasoline stocks

Here’s the outlier - global distillate stocks are really really low. Whether the deficit is driven by some kind of structural shortage (it isn’t) or is attributable to idiosyncratic events (it is) is beyond the purview of whatever this report is.

Regardless, this is certainly not the time for nuance or belabored explanations. There is a shortage of a product, and as long as there’s a shortage, the space stays bid.

How long does the shortage last? That’s the challenge, right?

Global middle distillates stocks (h/t @jrnd98biz)

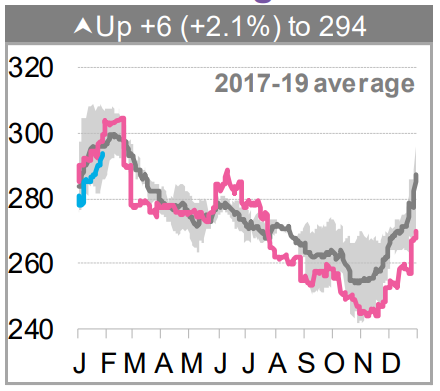

Will definitely need more product of course to fix the deficit. So, we watch refinery utilization. China running low.

China Shandong independent refinery utilization

US running in line with normal range.

US refining % utilization

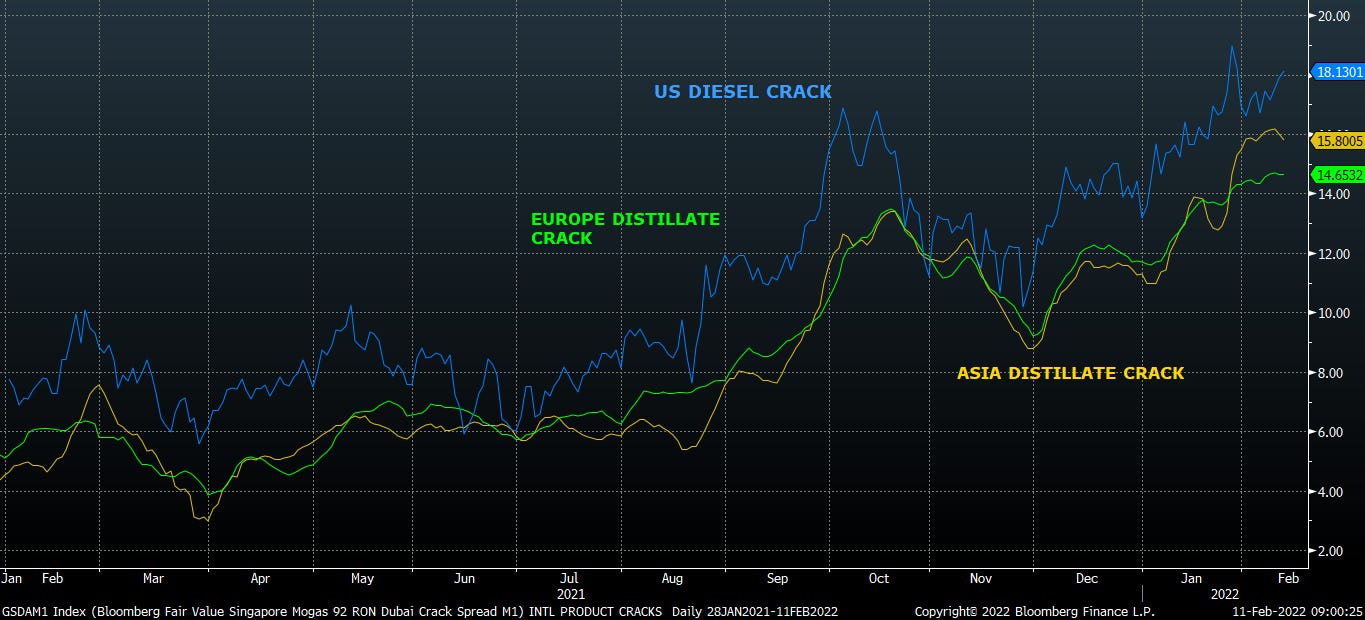

Refiners are getting the signal to make more diesel (often at gasoline’s expense - h/t @Markfny) so ….

Global distillate cracks

Global CDU outages are quite low today. Seasonality and a lack of maintenance done during COVID suggests outages step up from here. Less crude runs, less product made.

Global CDU Outage

Nat gas. We care about international natural gas price trends as the tip of the spear on global commodity prices. They’re a key fuel and feedstock.

European natural gas is still ground zero.

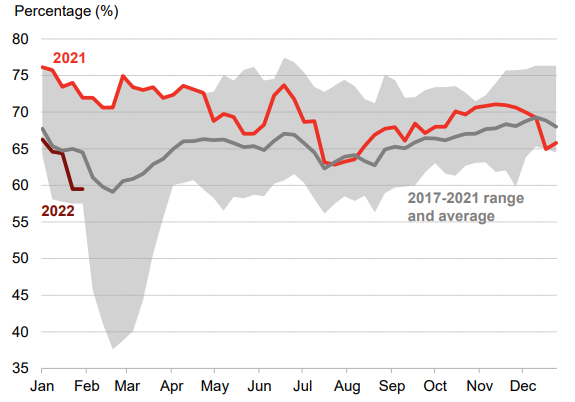

Europe natural gas storage % full. Still a deficit, but a shrinking deficit

European gas storage levels are slowly making ground thanks in part due to the influx of LNG arrivals.

European LNG imports

Though the situation doesn’t get truly remedied until Russian gas volumes into Europe pick up. After a hopeful spike in deliveries via Slovakia, their volumes have tailed off again.

Russia gas exports to Northwest Europe

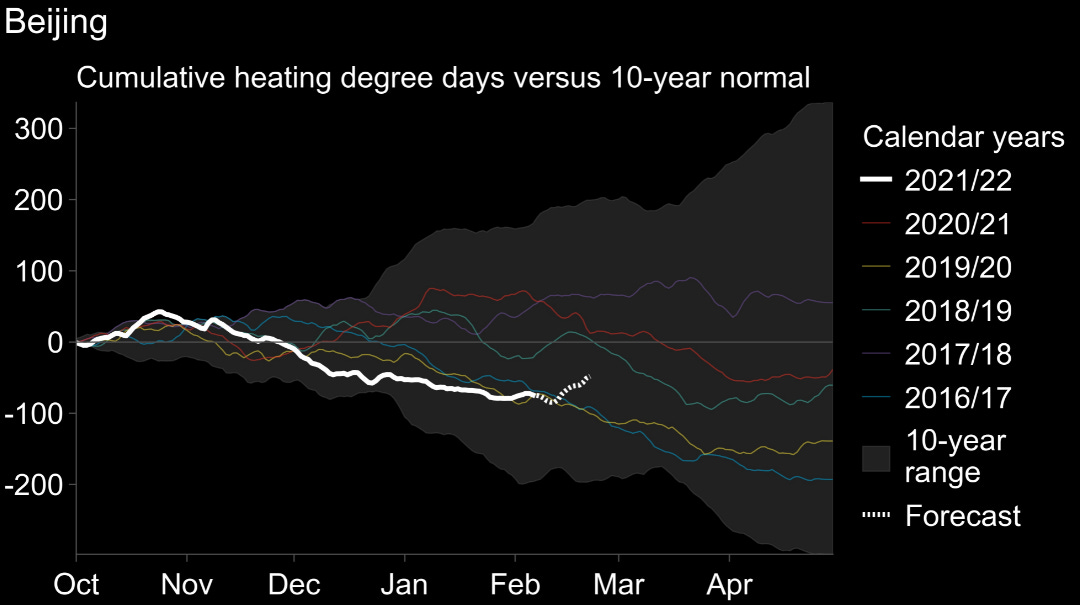

Seasonally, demand is about to drop with the end of winter, which should aid in stock builds. Warmer weather, like Asia has been seeing, will accelerate restocking.

Beijing cumulative HDD vs normal

As will the seasonal drop in LNG demand across the globe.

Global LNG demand forecast

Outlook: as long as product inventories are tight and international nat gas prices are strong, the fundamentals look good for energy. However, the prospect of crude, refined product, and int’l natural gas inventories rebuilding and normalizing is a high probability event. It’s not happening now, so it doesn’t matter now. But if and when it does, the space will lose momentum.

Technicals

Strong to quite strong.

Looks likely the sector tests the 2017/2018 resistance level about 8% higher from here.

Energy sector

Keeps hugging upper Bollinger band and won’t quit a high RSI or Z score.

Energy sector

Killing the S&P 500 (relative). Back at the level it sat at right before the COVID collapse.

Energy vs S&P 500

A little more ground to make up vs Russell 2000 to get to pre-COVID levels, but seems likely.

Energy vs Russell 2000

Crude timespreads are strong. And we’re not even going to paste the charts for product timespreads they’re so bonkers.

Brent & WTI timespreads

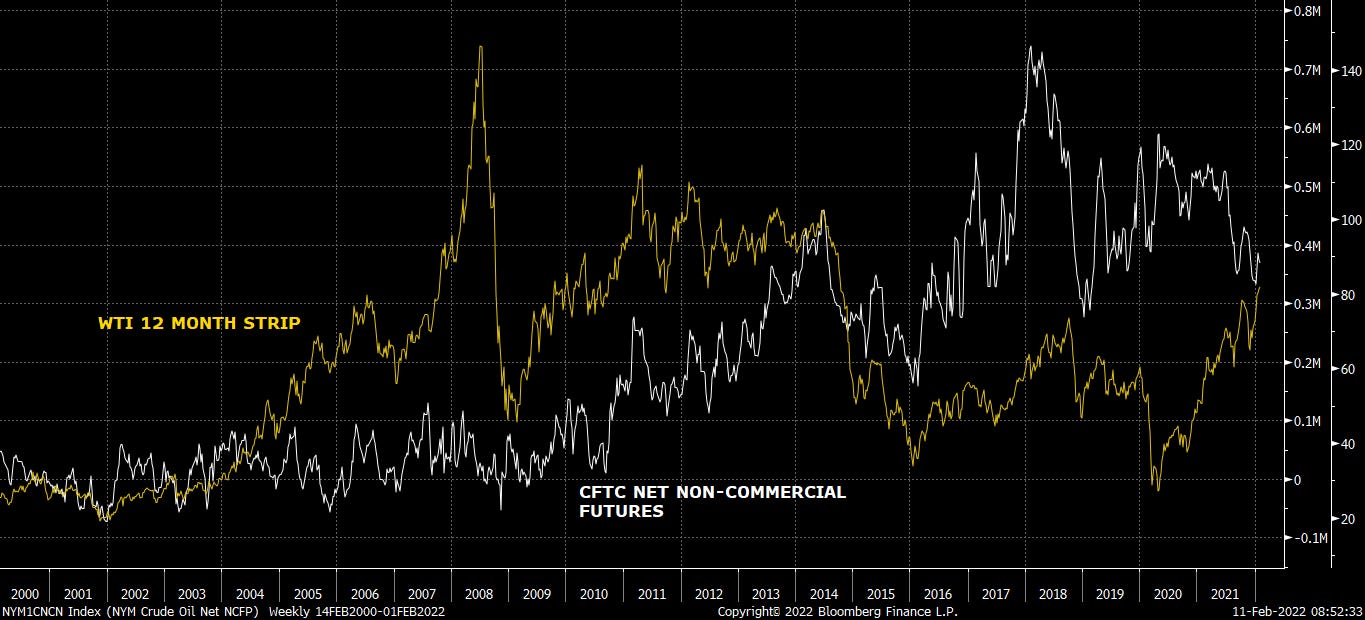

Net spec positioning is not stretched. Fascinating.

Non commercial net position

Outlook: The trend is your friend, until the trend changes.

Quantitative

Simplistically, Value is a polite term for low quality businesses. The energy sector is very long Value in quant models.

And the Value factor has been on a tear.

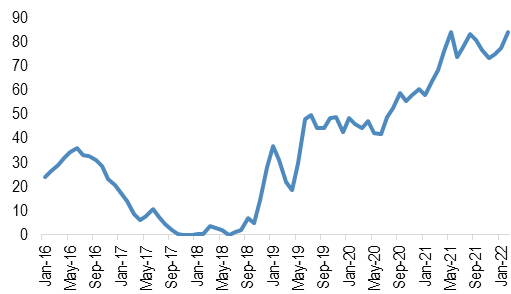

Factor performance - COVID vax to today

A portfolio long high Value and short low Value has crushed any other relative factor trade.

Long-short factor portfolio performance

We employ a multi-variable model we use to calculate fair value of the energy sector using several macro inputs. The space screens as undervalued vis a vis these inputs.

Viscosity Redux multi variable regression Energy valuation

Outlook: Absent a change in commodities or a change in rates or a change in inflation, this trend continues. Inflation should mathematically be peaking right around now, but the market seems unlikely to process a lower rate path or disinflation until it sees it. It’s coming, but not today.

Behavioral (Narrative)

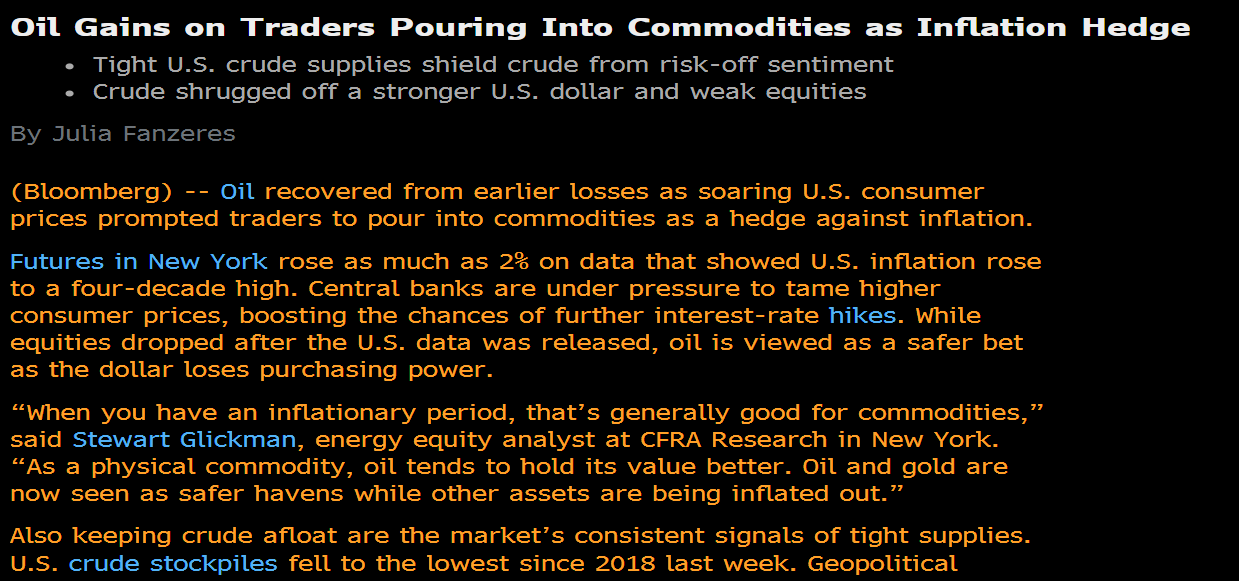

It’s an understatement to characterize the market narrative on energy as bullish.

The market is implicitly behaving as if high inflation creates high energy prices - as opposed to the opposite. But now is not the time for nuance on idiosyncratic disparities on underlying today’s inflation vs historical periods.

No one truly knows what to do in this environment. 99% of the market players who were around last time inflation was this high have long since retired.

CPI Y/Y

Same deal on rates. Rates have been declining for two generations. What the heck do we do with risk allocation when that trend inflects? (Side note: We don’t that structural trend is truly inflecting for good. But it is right now and that’s what matters)

US 10YR rates

So the market goes to the playbook. What worked last time inflation was high and rates were rising? Cyclicals. Energy. Old economy.

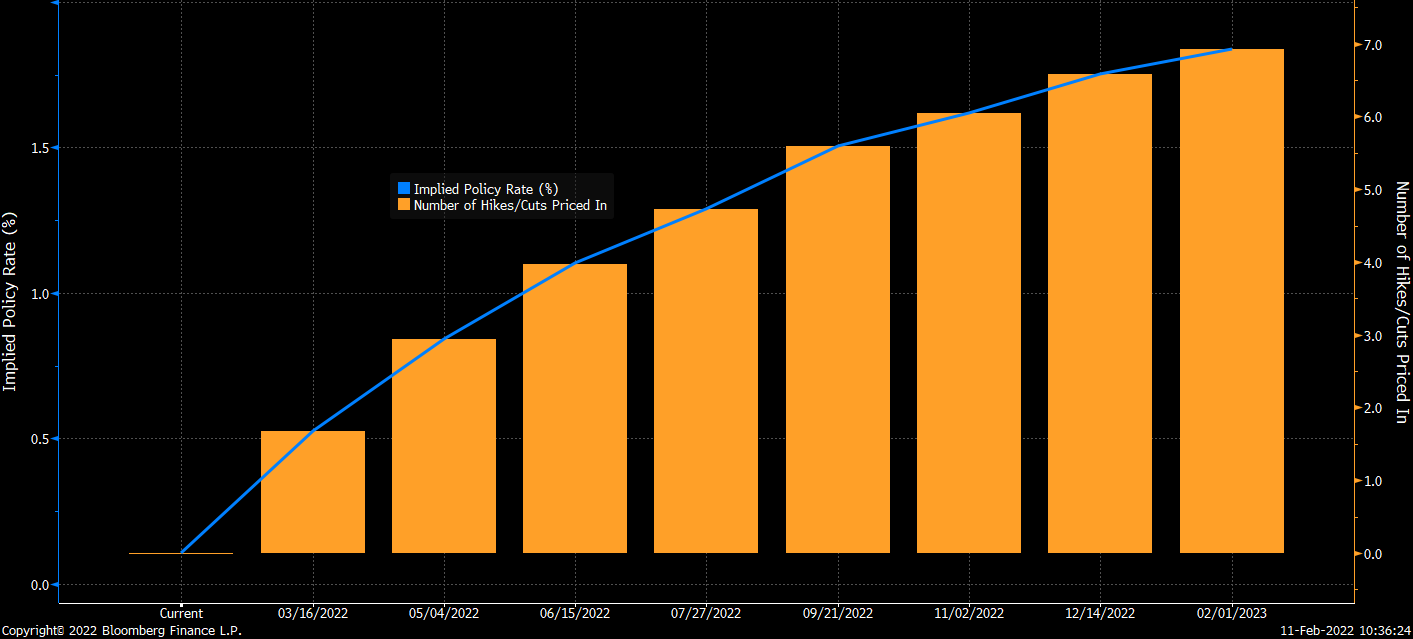

Market is in full-blown rate panic mode. There was even fevered market chatter this week of the Fed pulling an emergency intra-meeting rate hike Volker-style. Come on.

Market implied policy rate & number of hikes priced in

There is a legit concern, again for now, that the Fed is behind the curve. And, looking at today vs prior precedents that found the Fed hiking alongside rising inflation, those concerns do look to be well founded.

CPI Y/Y vs Fed Funds

Inflation measures no matter how you slice them are running hot.

Inflation Measures

Supply chains will ease (are easing already?) and will bring inflation down through the year. Timing that will be difficult, but we don’t believe it’s time to play for that yet. How the market responds to the first 200bps drop in CPI will be fascinating, later this year.

Other narratives we’re not touching with a 10ft pole today: underinvestment & OPEC spare capacity.

Suffice it to say “underinvestment” is in our minds a simplistic attribution of massive capex deflation and capital efficiency gains over the last decade

OPEC spare capacity - we will NEVER know OPEC spare capacity, only actual production. Asserting conviction or arguing numbers is a fool’s errand and matters more to the narrative than the fundamentals

Outlook: The bullish narrative is deeply entrenched. Risks to a change in narrative will, as always, first stem from change in price. We think biggest risk to narrative is the first big drop in CPI or a more dovish Fed, neither of which are imminent in our minds.

Biggest overall risks:

Iran. Back from the dead, the JCPOA nuclear deal probability went from near 0 to well over 50% this week. Iran is widely understood to have been selling barrels illicitly, so the true uplift in Iranian volumes is hard to pinpoint. Nevertheless, if they reconsummate the nuclear deal, the market would get hit hard with a drawdown of their storage almost immediately. Questions abound regarding the quality and appetite for these volumes, but there will be more crude/condensate on the market.

Iran floating storage

Ukraine. Who knows what happens here or if there is a disruption to global energy flows? We would expect an invasion to result in crude strength given likelihood of sanctions that may impact Russia’s energy exports. Too little definition to know, but we’d expect commodity strength to accompany news of a Russian invasion.

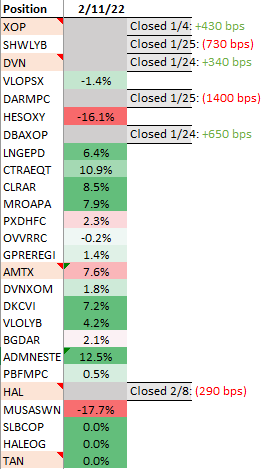

Trades 2/11

Added OFS length vs E&P. New positions:

SLB-COP

HAL-EOG

TAN short

Not dissatisfied with portfolio performance. Wish GPRE hadn’t hedged away their upside in 4Q - that hurt the earnings report. Our MUSA-SWN trade was clearly put on too early for a bearish gas trade, but we’re sticking with it this close to end of winter. HES-OXY is in the hole, but we’re similarly sticking with that as we want a relatively defensive pair within the overall higher beta long oil-short gas positioning in the portfolio.

Viscosity Redux

viscosityredux@gmail.com