Come for the comments on capex, production, and shareholder returns. Stay for the “wait, what?” portion of the recap.

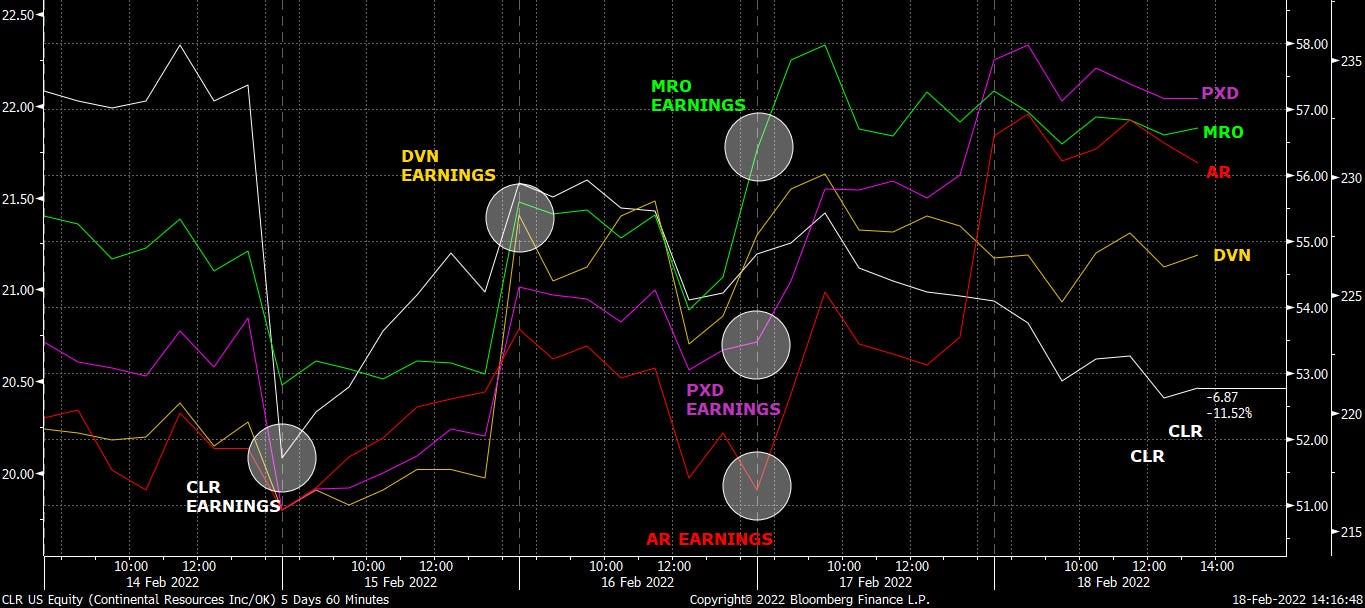

Market emphasis right now centers around capital discipline for the producers (whether it holds) and how capital returns are shaping for 2022. From their respective earnings calls this week, we’ve grabbed a few quotes from PXD, MRO, DVN, CLR, and AR.

TL;DR:

The biggest public independent producers are holding the line on capex and are not putting the pedal to the metal

Production growth, where it can be found, is low single digits

Hedges are gone and cash flow is rising

Stock performance & earnings

PXD

Capital Expenditures & Production

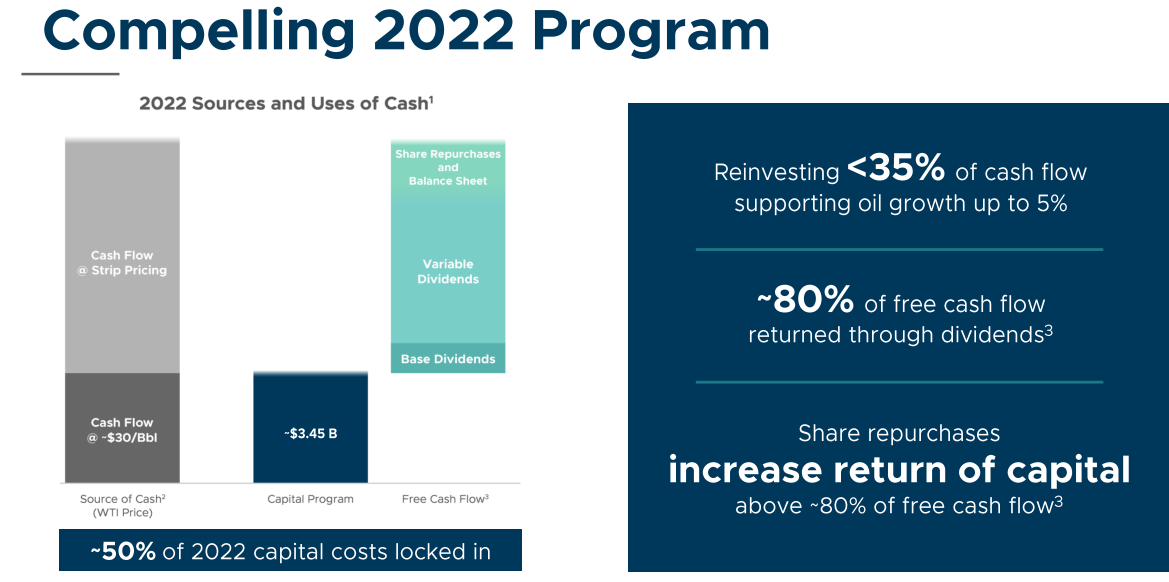

Capital for 2022 is forecasted to be $3.3 billion to $3.6 billion or $3.45 billion at the midpoint. Of the total capital budget, roughly 50% is locked in and not subject to any further incremental inflation. The remaining 50% of our capital budget includes approximately 10% of forecasted incremental inflation, which is embedded in the midpoint of our guidance range.

Long term, we're still zero to 5% (production growth). It's going to vary. We're not going to change, as I said. At $100 oil, $150 oil, we're not going to change our growth rate. We think it's important to return cash back to the shareholders.

we're going to need another 2 Bcf a day pipeline every couple of years in the Permian Basin. And so, I think that -- the Basin, even at the modest growth rates that we talk about, you're still going to need that level of capacity takeaway

The private independents, a few of them, as we all know, are growing -- they've announced growth rates in the 15% to 25% per year range … The privates need to be reined in

Capital Return

our Board has authorized a new $4 billion share repurchase program, replacing our previous authorization

This is the second-straight quarterly base dividend increase and represents 40% base dividend growth since the third quarter of 2021. And going forward, we will continue to increase the base significantly

After backing out capital, this results in over $7 billion of forecasted free cash flow for 2022.

the primary provider of return to the shareholders is going to remain the dividends

Obviously, after these last two transactions, we have no need to do anything on a material large scale M&A. We're not looking and do not plan to look. We think the strongest return we can realize at this point is to repurchase our stock.

Wait, what?

Pioneer continues to bring low emissions barrels to the market, producing some of the lowest emission barrels in the world

You have to realize, it's totally different. I think you've seen enough articles. Oil could easily go to $150. Demand is stronger than it ever has been in the world and OPEC and OPEC+ is going to run out of capacity by the end of 2022…. Yeah, it's only tension is that the world doesn't need the extra oil … And so, we may need the extra barrels today. The question is, will we need them in 2023 and 2024 and what do those companies do.

MRO

Capital Expenditures & Production

I want to make clear, that share commodity prices continued to surprise to the upside. We will remain disciplined and have no plans to allocate production growth capital with our balanced exposure to oil, natural gas and NGLs

relative capital allocation waiting stays essentially in that same range throughout that five year view, Josh. So, no radical movement, you'll see some capital move them between basins, but kind of that 20% to 30% going to Delaware and Oklahoma, that's pretty consistent across that five year benchmark maintenance scenario

our strategy is predicated on really generating outsized free cash flow, when we are in a constructive pricing environment.

While we expect our full year 2022, average production for both oil and oil equivalent to be roughly flat versus the prior year

We will remain disciplined and will not add production, growth capital to our budget in 2022. Our focus will remain on free, cash flow generation, return of capital and per share financial metrics.

Capital Return

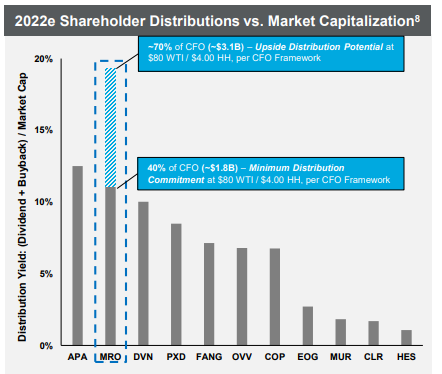

our objective there for the with the base dividend is to have a competitive yield when compared to peer average and the S&P 500. And also, in addition, it competitive we needed to be sustainable.

We have now executed $1 billion of share repurchases, since October driving, an 8% reduction to our outstanding share count in just four and a half months.

we must deliver truly outsize free cash flow and return of capital versus the S&P 500, when we experience constructive commodity price support, as we are seeing today

We expect to deliver over $3 billion of free cash flow and the reinvestment rate of less than 30% assuming $80 WTI and $4 Henry Hub prices at a discount to the current forward curve.

Our current outstanding buyback, authorizations, is $1.7 billion and we continue to believe that buyback our stock in a disciplined manner, is a good use of our capital.

For the whole year upside potential at the same $80 WTI, and $4 Henry Hub, deck could be as high as 70% of our CFO, the level at which we executed during the fourth quarter. That would represent a return to equity investors are around $3.1 billion equivalent to 20% of our current market capitalization

Wait, what?

while our equity value has appreciated, since we kicked off our buyback program in October it continues to trade at a free cash flow yield of 20% and that's at $80 WTI, which is a discount to the current forward curve. That's roughly 4x the free cash flow yield the S&P 500. And even using a more conservative say $60 WTI price assumption, our free cash flow yield on our current equity value is around 10% and it still 2.5x that of the S&P 500

CLR

Capital Expenditures & Production

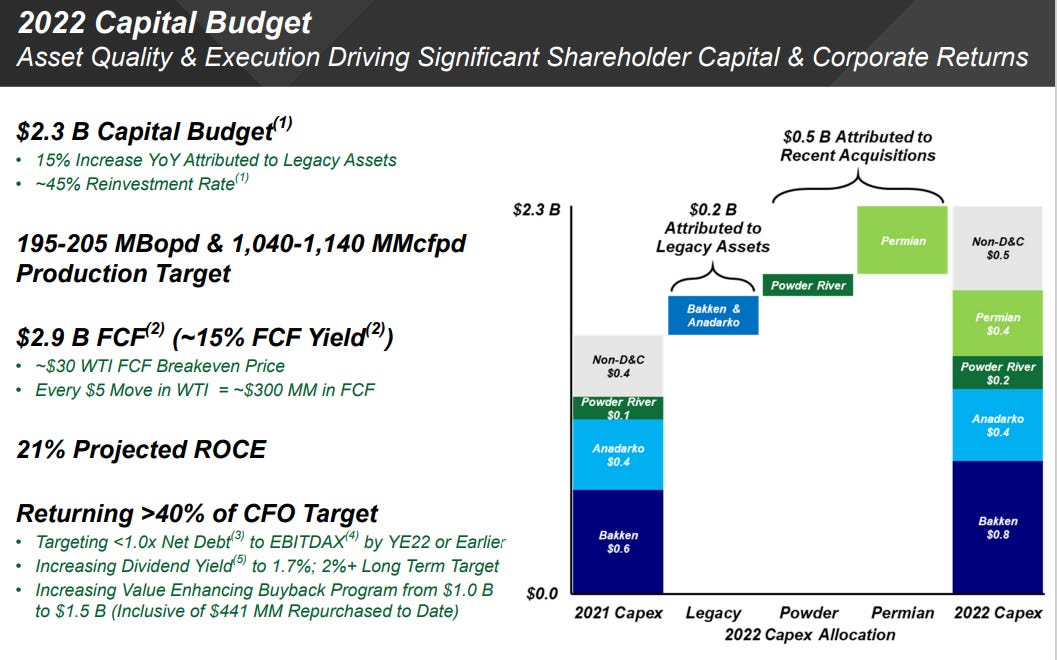

we expect 2022 to be even stronger with a projected $2.9 billion of free cash flow.

With $2.3 billion of CapEx in 2022 excluding Franco- Nevada's share of mineral costs, this program represents a 45% reinvestment rate at $80 WTI

excluding our recent expansions to the Powder River and Permian, our legacy CapEx is up only 15% year-over-year due to minimal growth CapEx and inflation

And you see us moving from commodity to commodity, oil versus gas at some time, we'll move it back and fourth as far as the BOE of production basis, but we're real comfortable in that 0% to 5% range if that's probably the appropriate range for us to be looking at a long-term.

Capital Return

We have increased our quarterly dividend by 15% to $0.23 per share and are targeting a 2% or greater yield long term. We have increased our significant buyback program from $1 billion to $1.5 billion, which includes $441 million repurchased to date. $1 billion is approximately 30% of our float

we are targeting in 2022 returns well in excess of 40% of cash flow from operations through debt reduction, future dividends and share repurchases.

As far as the split between a debt reduction and buybacks, we've got some maturities in '23, we'll certainly take those out by the balance of this year and we've got a little bit in '24 as well, but we've got a lot of optionality, and we're going to keep that optionality between buybacks and debt reduction as we see opportunistic opportunities.

Wait, what?

In the oil window, we completed a company record oil producer that flowed at an average initial 30 day rate of 4,000 BOE per day from the Sycamore reservoir and 82% of the production was oil ... Based on public records, this well ranks as the number one most prolific horizontal oil well in Oklahoma's recorded history

I know you would have seen some of the comments from the Federal Reserve came out that this morning about, do you want to go and target industries. And so I think, that's why you're seeing us and probably the industry at large, we are very focused on getting that net debt down because there is potentially targeting of this industry to not be friendly toward the lending money

So the (acquired) Chesapeake assets are not baked into our guidance now in terms of production

Up and to the right capex trajectory - not well received

AR

Capital Expenditures & Production

In 2022, we are targeting a maintenance capital plan with average volumes of 3.2 to 3.3 Bcf equivalent per day. We expect production to increase through the year as completion activity accelerates in the third and fourth quarters

This second half growth will result in 4% to 5% exit-to-exit growth in 2022 versus 2021.

Our drilling and completion capital budget of $675 million to $700 million reflects an impact of approximately 5% from service cost inflation.

we are fully unhedged on all oil and NGL production as of the start of 2022

Our 2022 development plan is expected to generate $1.5 billion to $1.7 billion in free cash flow with a similar level projected in 2023 based on current commodity prices. we have the highest free cash flow yield whether you look at it relative to the market cap or enterprise value. we lead our peer group in 2022 with a 16% yield.

Capital Return

We intend to initially return 25% to 50% of free cash flow to our shareholders.

The combination of highest free cash flow yield and lowest trading multiple makes share buybacks the most accretive use of free cash flow at the onset of our capital return program

the midpoint of our free cash flow guidance is $1.6 billion. So $600 million of that is to call the 2025 notes. So in addition to that, we hope that we have the ability to repurchase on the open market .. a couple hundred million plus further debt reduction. And so if you think about that, that gets you up to the $800 billion, $900 million level. Above and beyond that, we'll probably be focused on share buybacks

I'll start the share repurchase this Monday. So, we're starting as soon as we can. We've reached that $2 billion target that we mentioned, we are essentially added at the end of January. So got there and so that's why we're initiating right now and we'll start it in the first quarter.

Wait, what?

So, more opportunities we do see, prices being bid up at places like ANR and southeast head station to be a premium to Henry Hub

DVN

Capital Expenditures & Production

We are growing in the Permian, at the same time, we're keeping our overall production flat

there is so much uncertainty probably as you look out in the outer years. I think for us, we'll stick to our knitting and maintain that max, that 5% growth

this strong outlook translates into a free cash flow yield of 14% assuming an $85 WTI price

there is no change to the upstream capital budget of $1.9 billion to $2.2 billion as we disclosed last quarter. The relatively steady level of activity in 2022 is projected to sustain our production throughout the year ranging from 570,000 to 600,000 BOE per day

Based on today's industry activity and commodity price projections, we've baked in around 15% higher costs than we saw in 2021

Capital Return

the top priority for our free cash flow is the funding of our fixed plus variable dividend.

With the board expanding our share repurchase program to $1.6 billion, we now have roughly $1 billion remaining on this authorization and we expect to continue to opportunistically buyback stock in 2022. At a multiple of less than 5 times cash flow, we believe our business trades is a substantial discount to the intrinsic value, especially given the structural improvements we've made to expand margins and returns

there is a high likelihood that will have the opportunity to grow that fixed dividend further as we move forward. And so it will likely gravitate towards the higher end of that payout range, somewhere closer to 10% as we walk it forward.

Wait, what?

As we look at the share repo, we believe we continue to trade at a discount to the broader market, a discount to the historical multiples, and a discount to our closest peers

we do put a lot of faith into the shape of the curve and sometimes you can debate where the absolute point on a curve are. But when you see such deep backwardation and you start thinking about trying to add activity by the time you bring oil barrels on, I mean, let's face it, it's going to be a while down the road

Recently you saw Exxon and Chevron talk about ramping some volumes up. I believe they're probably going to be working down their DUC inventory to some degree

Every company has this chart. When do we ask WHY the “yields” are so high?

Viscosity Redux

viscosityredux@gmail.com

On you last point (why yields so high), does this setup for a generalist bull trap if they get people to price their stocks into 10-15% yields at strip? It's like mgmt forgets this is a cyclical business.

That means the return of cash taxes then, at some point....IDCs were always the treadmill that kept giving, hence the attraction of growth capex...