The EIA released its monthly Short Term Energy Outlook (STEO) today. A good read for a state of the (energy) union, we provide some points of interest below.

EIA Short Term Energy Outlook Feb 2022

EIA increased its 2022 Brent price by $8 to $83/bbl after a stronger-than-expected January.

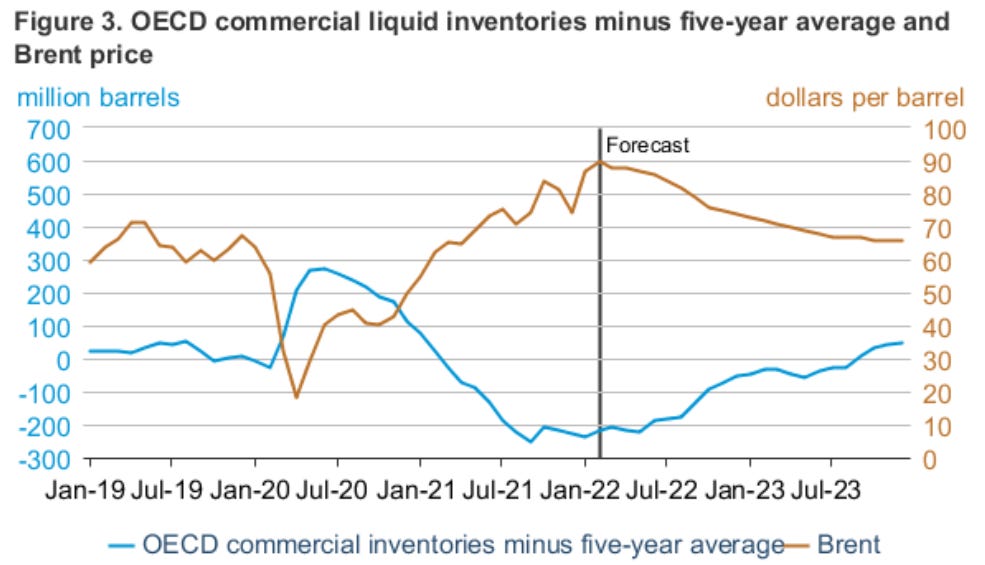

We estimate that global oil inventories fell further in January—compared with our expectation of an increase in last month’s STEO—and that commercial inventories in the OECD ended the month at 2.68 billion barrels, which is the lowest level since mid-2014.

Within a wide potential band of error, EIA is forecasting inventory builds from March ‘22 onwards.

We expect downward price pressures will emerge in the middle of the year as growth in oil production from OPEC+, the United States, and other non-OPEC countries outpaces slowing growth in global oil consumption. This dynamic leads to rising global oil inventories from 2Q22 through the end of 2023, and we forecast the Brent spot price will fall to an average of $87/b in 2Q22 and $75/b in 4Q22. We expect the Brent price will average $68/b for all of 2023. However, low inventory levels create an environment for potentially heightened crude oil price volatility and potential risk

Rising US & OPEC+ supply and slowing demand growth lead to forecasted inventory builds.

Inventory growth in the forecast is driven by rising global oil production, largely from OPEC+ and the United States, along with slowing growth in global oil consumption. Our expectation of falling oil prices, particularly beyond 1H22, is contingent on our forecast of oil production and inventory growth. However, oil production might not meet our expectations because of possible changes in production targets from OPEC+, continuing technical issues among some producers, and changes in the investment decisions of U.S. tight oil operators, among other possible reasons

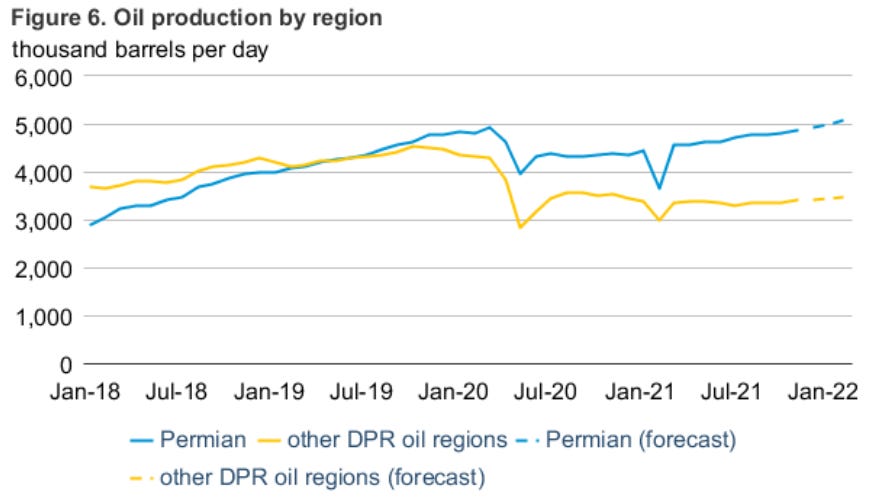

Permian growth and flat “other basins” in the forecast

Increases in well completions and rig counts in the Permian Basin have led to record production in that area, with forecasted oil production in the Permian Basin exceeding 5.0 million b/d for February 2022. The region’s favorable geology combined with technological and operational improvements have supported the record production levels. In contrast to the record production in the Permian Basin, we expect production in other shale basins to average almost 3.5 million b/d in February, which is nearly 1.1 million b/d less than the record for production in these regions set in October 2019

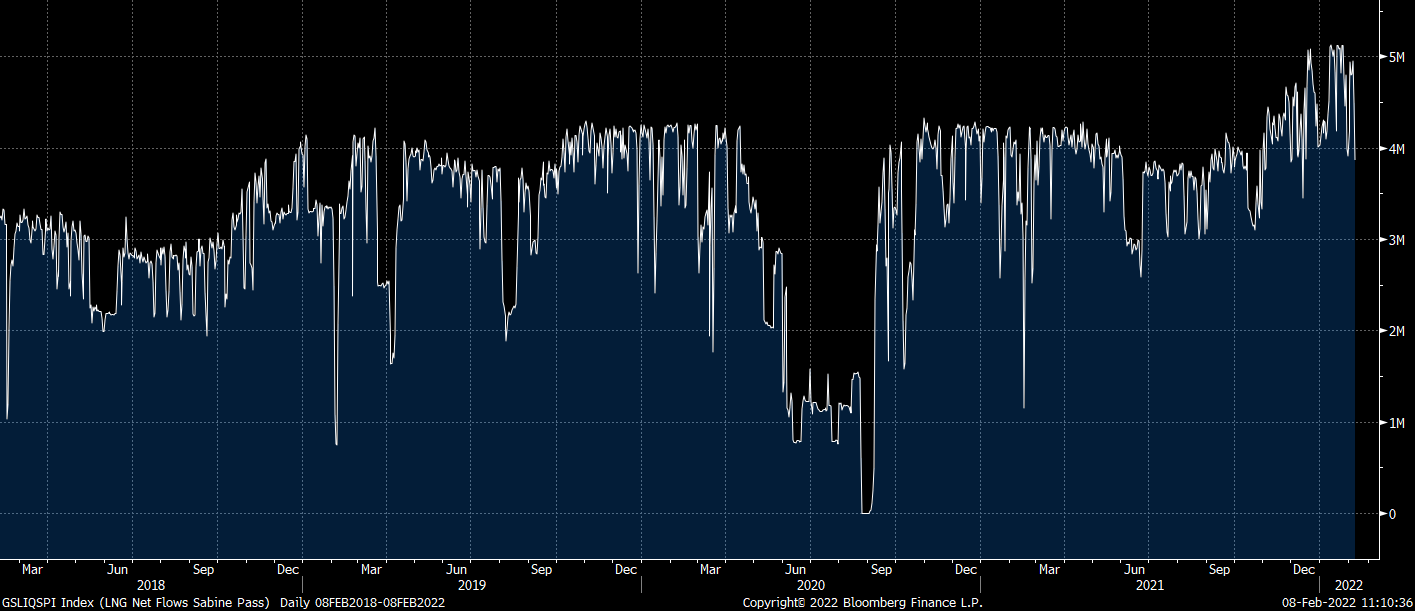

Yesterday, Cheniere (LNG) announced that commissioning of its 6th train at Sabine Pass was completed ahead of schedule. According to Cheniere,

“With all six trains complete, the aggregate nominal production capacity of SPL is approximately 30 mtpa of LNG, and we process more than 4.7 billion cubic feet per day of natural gas into LNG.”

Total flows at the front of plant hit 5 Bcfd a few times in January as commissioning was progressing. We expect steady state operations at the plant to run 4.5-5.0 Bcfd with all six trains running.

Sabine Pass Inlet Flows (Bcfd)

With Sabine Pass Train 6 up, the US is down to Calcasieu Pass for the remaining LNG export startups for a while. Calcasieu will be interesting to watch as it is an 18-train facility with staggered startups. Each train is reportedly 0.1 Bcfd inlet capacity.

Calcasieu Pass will reportedly be loading its first export cargo this week. From the looks of it, the facility has been working on commissioning its 2nd train in the last few weeks.

Calcasieu Pass LNG inlet flows (Bcfd)

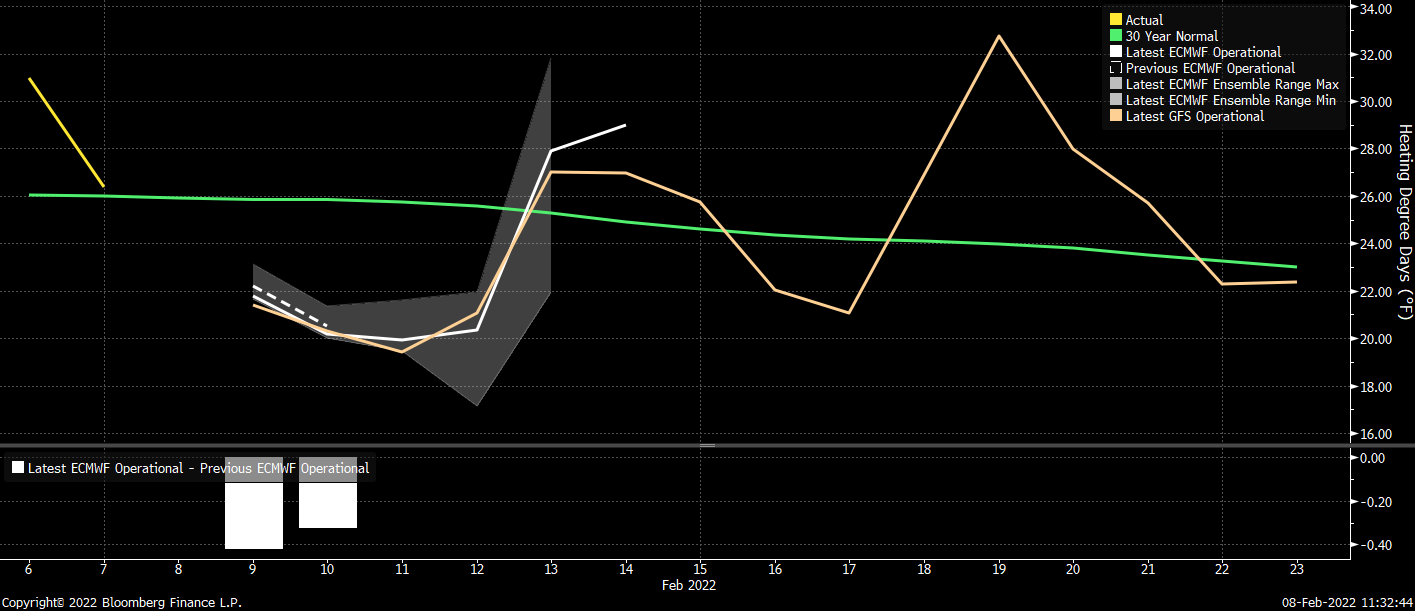

As the US recovers from this latest and perhaps last deep winter freeze storm, we’re watching recovery of US natural gas supply.

US Heating Degree Day Forecasts vs 30 Yr Normal (Green)

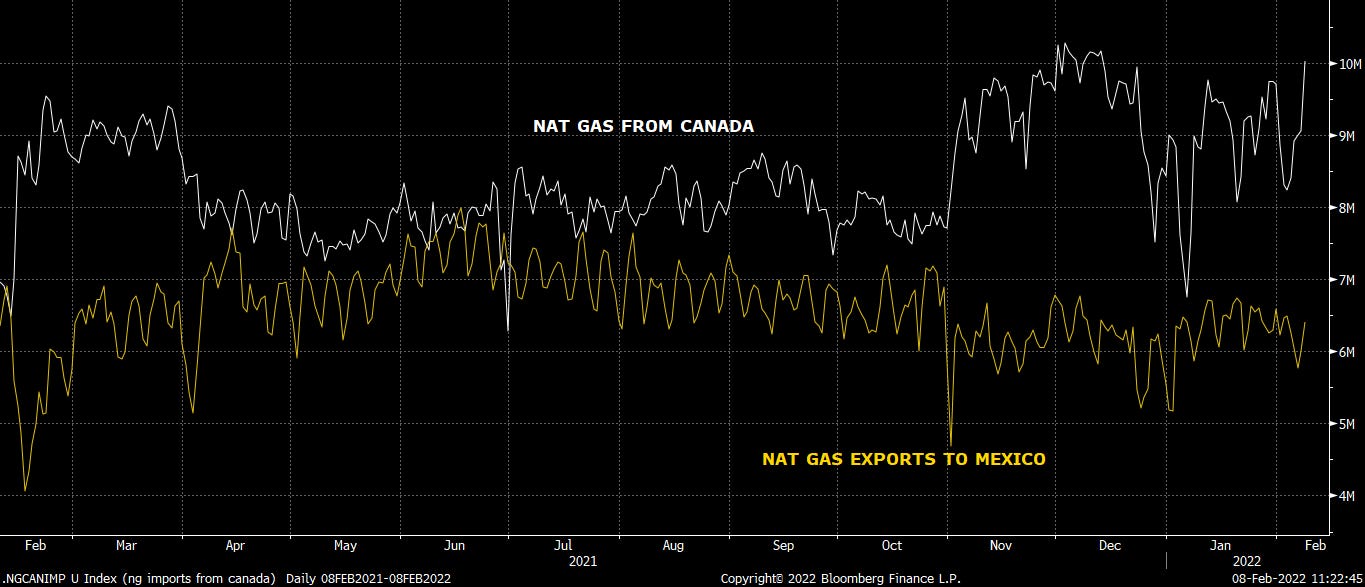

Imports from Canada have bounce some 2 Bcfd to 10 Bcfd while exports to Mexico have ticked up to 6.5 Bcfd.

US natural gas pipeline imports & exports

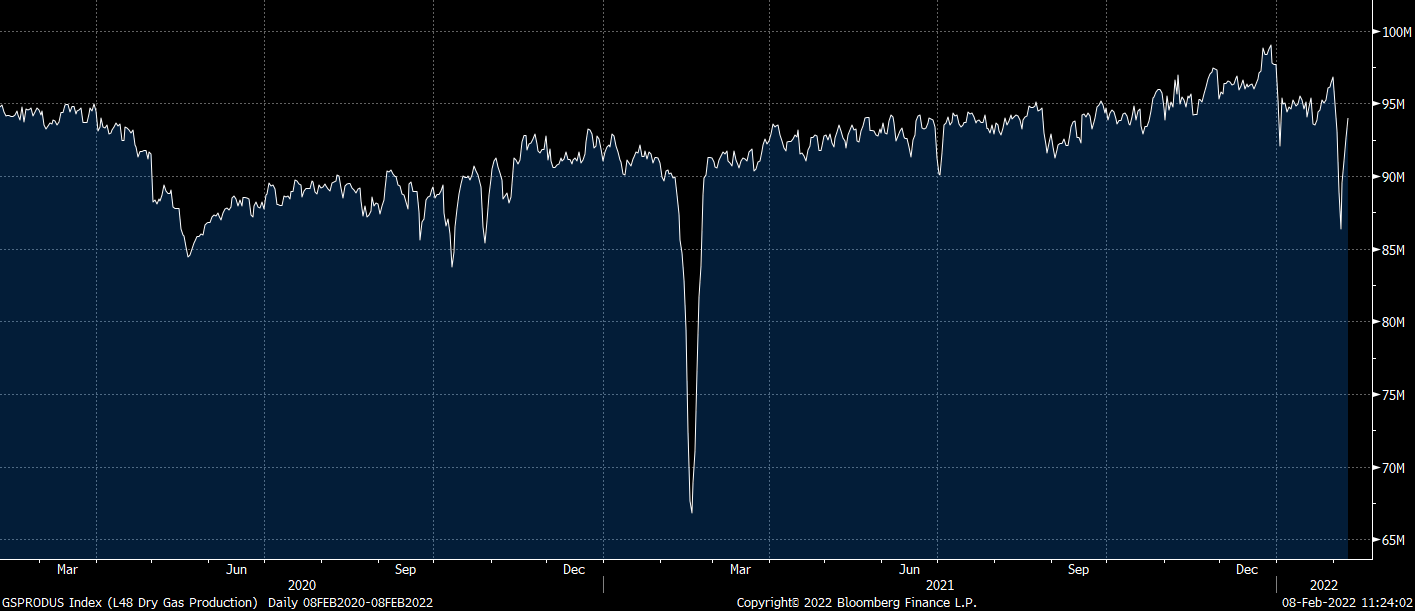

Total Lower 48 production seems to be on the mend now as well. Last report was 94 Bcfd, up from a storm low print of 86 Bcfd.

Lower 48 natural gas supply

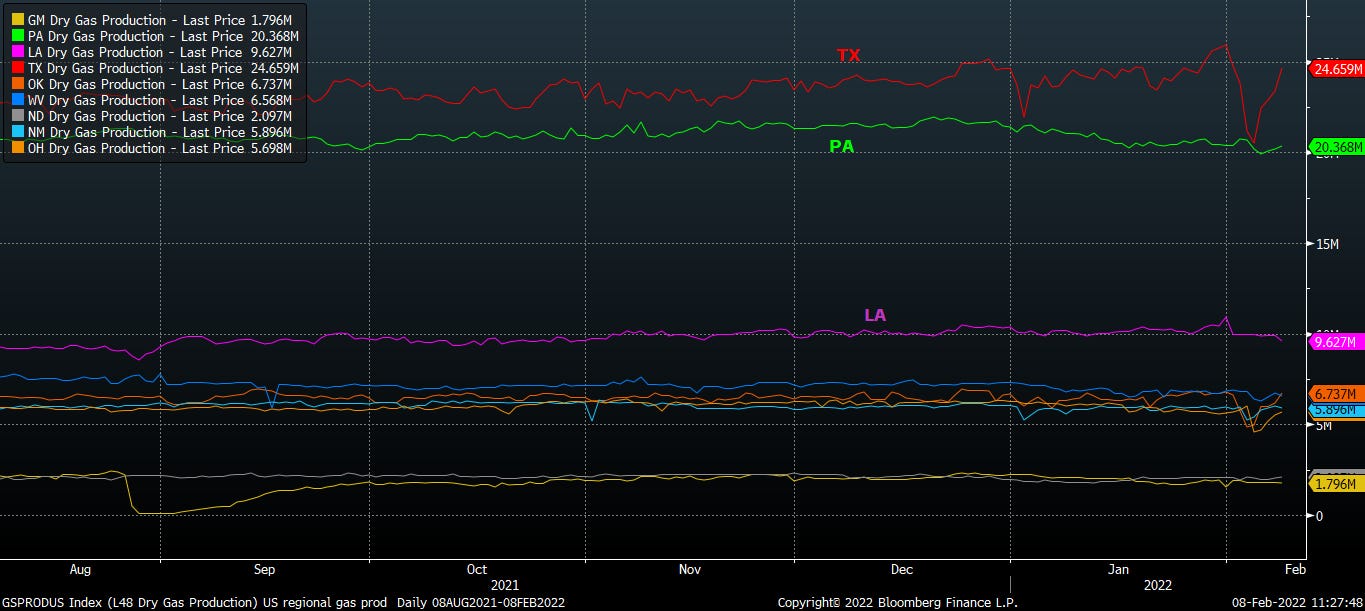

Amongst the upstream hydrocarbons, we’re least constructive natural gas as supply recovers and the demand boosts the sector has enjoyed will slow this year. With the rebound in oil drilling of course, will come associated natural gas. By region below, we see Texas production is recovering from freeze-offs and is challenging all time high levels again. The drop in PA production bears watching; if it continues to drift lower, it will be a headwind to our thesis.

Natural gas production by state

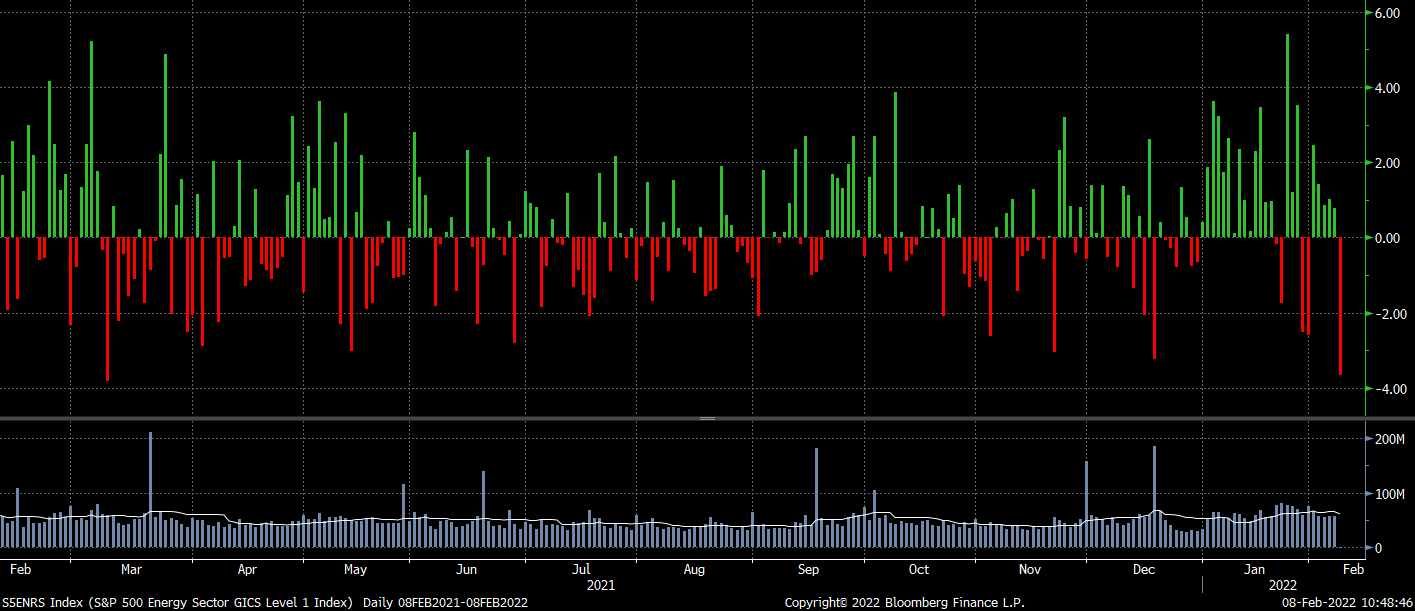

Trades 2/8

Looking for a “sell the rumor, buy the news” type reaction if either Iran or Ukraine rumors in market today come to fruition. Adding small net length on weakness - covered HAL short

Daily Performance Energy Sector - Russell 2000

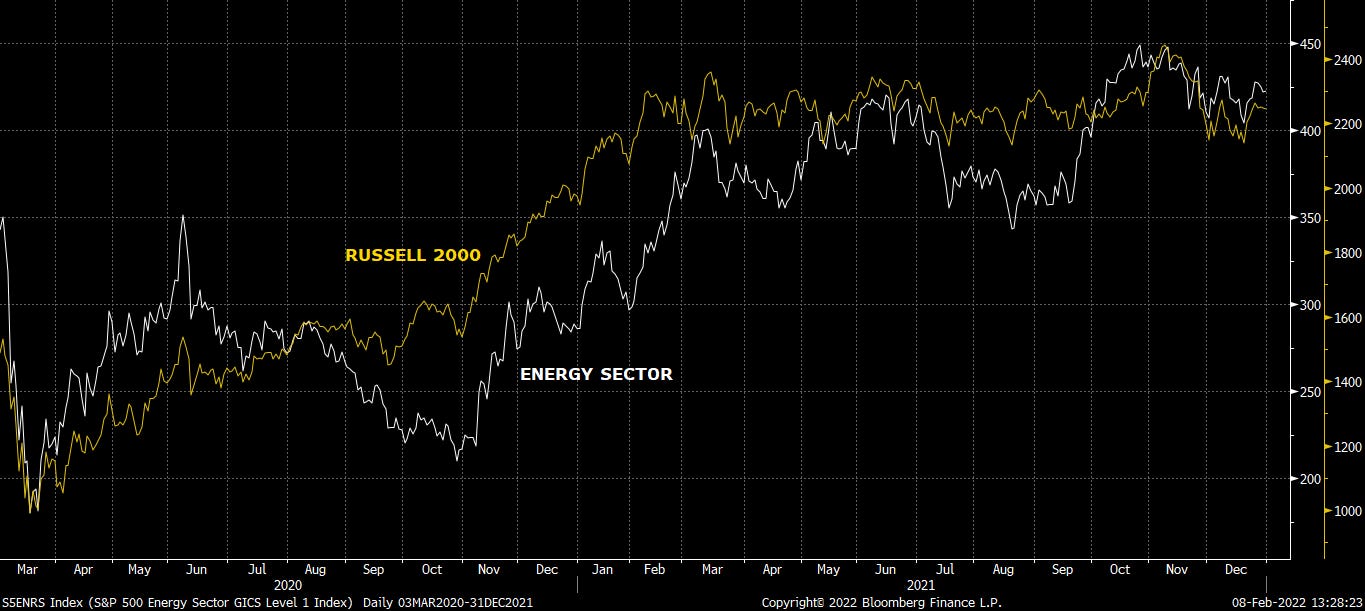

This is related to a nagging inconsistency, the relationship between Energy and the Russell 2000. The two traded atop one another from the COVID lows to YE21.

Energy vs Russell 2000: March ‘20 - Dec ‘21

But since 1/1/22, the relationship has broken down.

Energy vs Russell 2000: March ‘20 - Feb ‘22

We’re of the mindset the correlation picks strengthens again. In which manner? Shrugging shoulders emoji. Most likely from both directions in our estimation. Price will change sentiment in Russell and Energy will trade more in line with market than an idiosyncratic outlier immune to most macro inputs.