Last week Sankey Research (@crudegusher on Twitter) put out a note on refiner Delek we think was the opening salvo in a round of positive earnings outlook for the refiner group. Great micro implications of some of the macro topics we’ve been focused on.

Intro to Delek (DK)

Delek is a small cap downstream company with four PADD III refineries, a midstream logistics affiliate (DKL - 79% owned by DK), and a retail arm.

The company has been building out midstream and retail businesses in an effort to diversify, though as the chart below illustrates, Delek’s fortunes are still quite tied to refining.

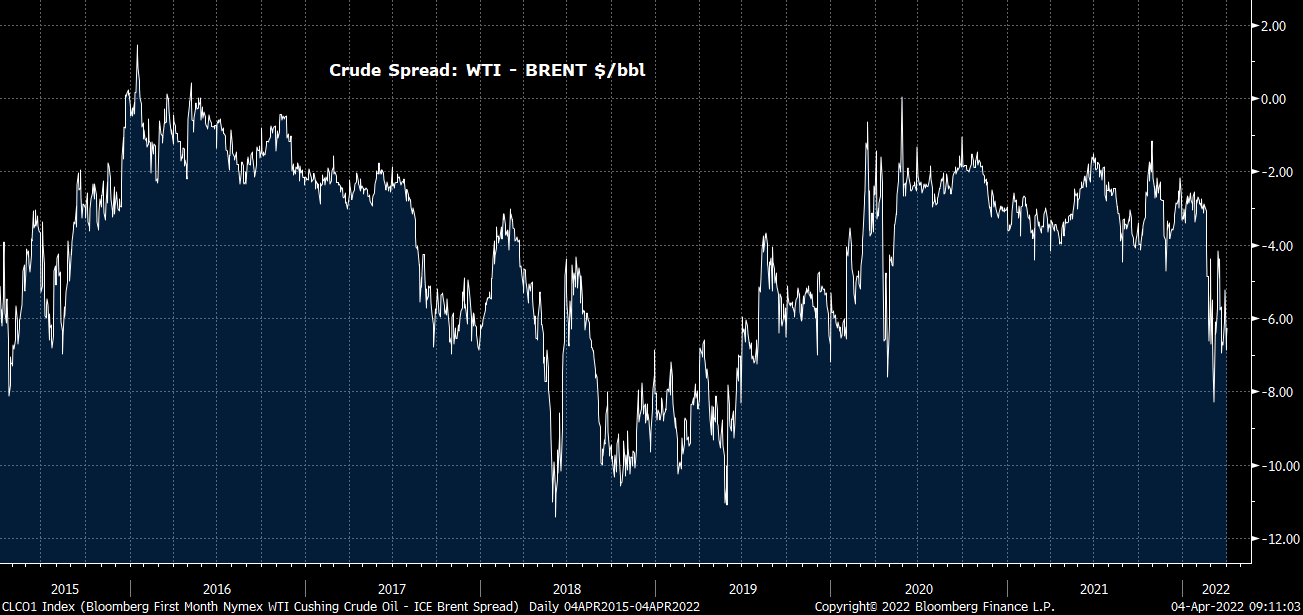

The refining group at large did well during the pre-COVID shale boom. As E&Ps drilled excessively, production volumes often exceeded pipeline capacity. As a result, their regional crude traded at a discount to the benchmarks, shown here as the spread between WTI and Brent crude futures.

Inland refiners, with feedstock linked to WTI crude, captured much of the value in that discounted crude.

Delek crude sourcing

Refiners bought their feedstock regionally at a discount to global crude grades, then refined the crude into finished products like gasoline and diesel whose prices were linked more to global crudes than regional US grades. With disproportionate exposure to Permian crude, Delek’s financial performance was broadly tied to the discount at which Permian crudes traded vs global benchmarks. The wider the Permian crude discount, the better it was for DK’s earnings.

DK EBITDA vs WTI Midland - Houston Light Sweet crude

As US crude production growth reversed then slowly resumed after COVID, crude differentials across the board narrowed. We paid less attention to inland refiners, like DK, whose prior well-being was dependent on these crude diffs.

Misc NAM crude differentials

Until the world started running out of distillate, that is.

What Sankey said on DK

“Profitability is huge right now. For refiners, we are in an unprecedented $40/bbl distillate margin environment.

Furthermore, Delek has no turnarounds this year and is running well. Several major refineries have been shut down, shut as Phillips 66 Alliance (250kb/d), and Shell’s Convent (211kb/d). Huge Gulf Coast units.

Additionally, the bottom of the barrel, typically a profit disaster, is extremely strong, with high asphalt and carbon black prices. Margin capture is high.

Utilization in refining remains surprisingly low given margins, which is further strengthening the distillate story.

Refiners trade at a low multiple, and make cash on the day. That is, if the distillate margin is $40/bbl today, they cash $40/bbl tonight. Running 300kb/d, of which say 140kb/d is distillate, Delek might be making over $5m a day in distillate markets. The current Street estimate for entire Q1 EBITDA is $100m. Delek is at a $400m+ quarterly run rate; if this lasts. We think it will, going into driving season with low unemployment.

Why it matters to DK

Since North American crude differentials started narrowing, inland refining hasn’t been a great business. Oscillating between slightly negative and slightly positive at the asset level, Delek was really dependent on logistics and retail to provide any kind of story.

DK Refinery Performance

Then the world started running low on distillate inventories.

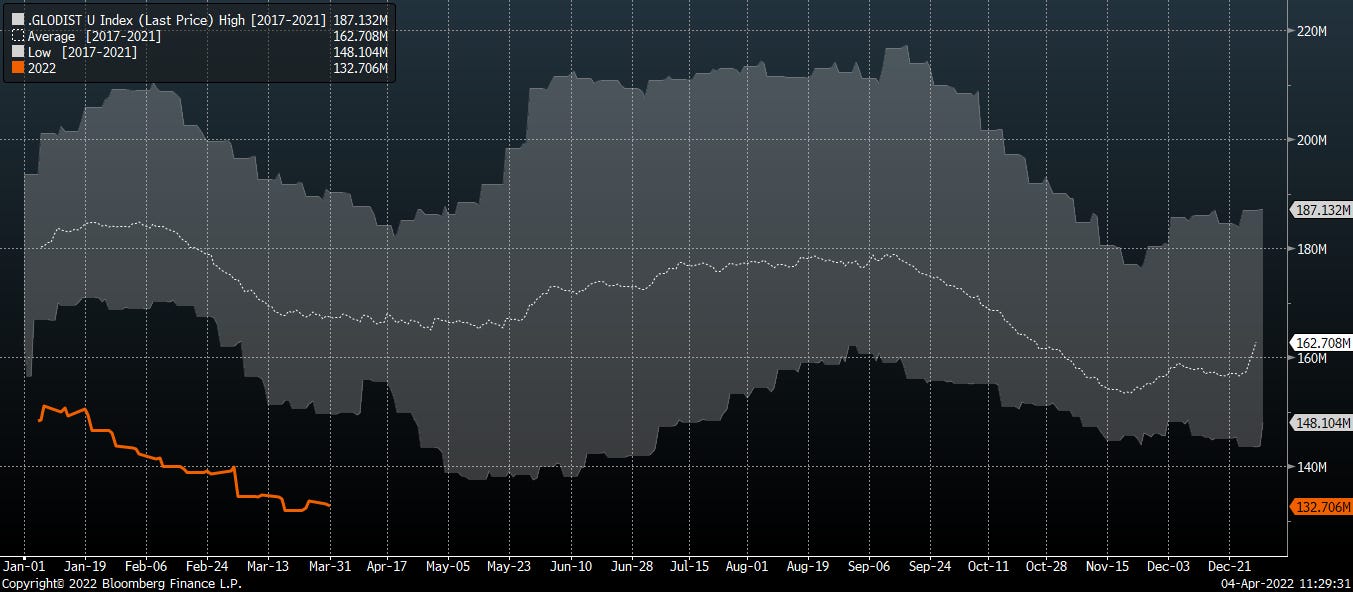

US + Europe + Singapore Distillate Inventories

Inventories today are well below seasonal norms - and the market has yet to feel the impact of a loss of 1+ million bbl/d loss of Russian distillate exports.

Global distillate inventories vs 5 yr range

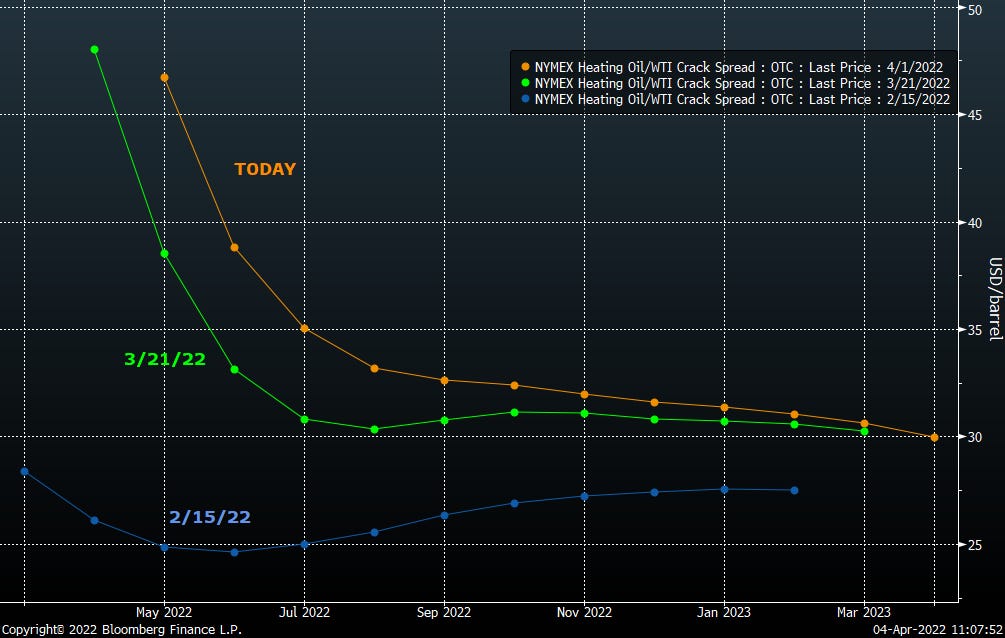

Generic distillate cracks (price spread between diesel and crude oil feedstock) have rallied to multiyear highs.

Distillate crack spread

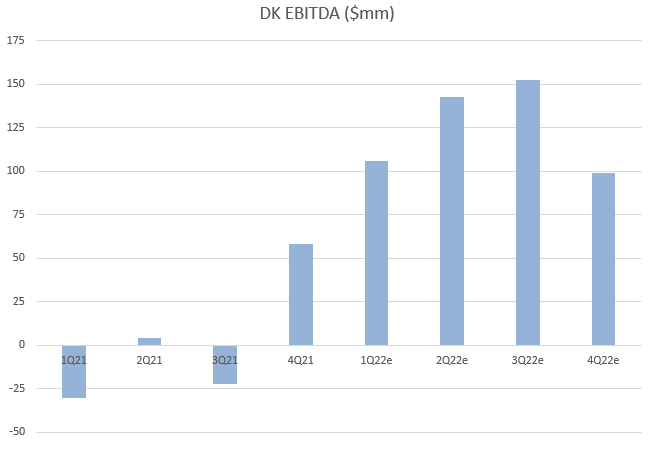

Now, the street is aware that diesel cracks are good, so DK’s 2022 quarterly estimates do reflect improvement throughout the year.

DK actual/consensus EBITDA estimates

But the street is reluctant to get aggressive on the outlook, especially for notoriously volatile refining earnings. Instead of extrapolating today’s diesel crisis over the next few months, analysts are broadly following the curve for diesel cracks - which assume that cracks compress throughout the year.

Diesel cracks curve: pre Ukraine, 2 weeks ago, today

What if that isn’t the case? What if today’s distillate shortage is further compounded in the coming months by the loss of Russian distillate exports? What if crude holds around +/- $100/bbl while distillate inventories continue to struggle to rebuild? What if $40/bbl distillate cracks persist?

In that case, consensus would need to move up. More than a little bit.

DK actual/consensus EBITDA estimates & upside sensitivity

Recall Sankey’s note saying DK current EBITDA run rate is as much as $400mm per quarter. It’s not that outlandish when considering DK CEO Uzi Yemin’s comments from the 4Q21 earnings call - before distillate cracks exploded.

“The rule of thumb … under the scenario of $15 crack spread without RINs and no backwardation and no Midland (differential) we are around between $800-900 million EBITDA. So that's what we call mid-cycle. That's how we look at it. We look at it on a regular basis and I think we are pretty much there”

Our premise here being that energy equities follow the numbers.

Energy index vs index fwd EBITDA

The same holding true for DK. If estimates go up, history suggests so too should DK stock.

DK price vs fwd EBITDA estimates

To be sure there are some headwinds. Cracks are higher, yes, but so are costs. Natural gas, the largest operating expense for refiners is up.

Henry Hub gas price $/MMTBU

RINs are still a nagging burden on refiners.

D3-D6 RINs

And the backwardated crude curve doesn’t help refiners’ economics either.

WTI Futures Curve

But the sum total of these headwinds is nowhere near enough to offset the improvement in refined product cracks.

DK hasn’t scheduled a release date for reporting 1Q22 earnings, tentatively looks to be around the first week of May. The stock is nothing if not volatile on earnings releases.

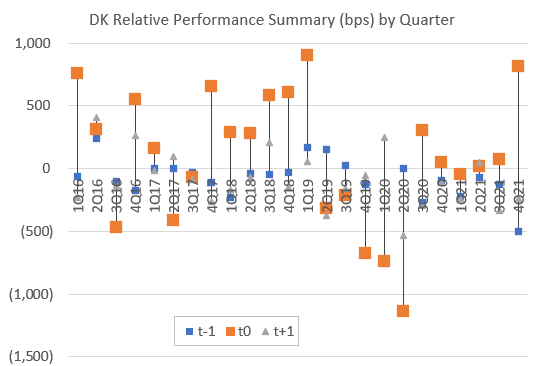

It demonstrates a decent track record of outperforming the peer group on the day before (t-1) and day of earnings (t0), with some performance give-back on the subsequent day (t+1).

We don’t expect a blowout on 1Q22 earnings, but we do think there’s strong probability of positive earnings revisions in the runup into the 1Q report. Historically, the stock has responded well to positive revisions into a release, with some sluggishness afterwards - buy the rumor sell the news Hedge Fund 101.

Normalized stock performance & EBITDA estimates around earnings (t0 day)

Does the DK upside potential translate positively into other refiners?

It should, for the most part. They all buy crude and turn it into refined products.

Generic gasoline & distillate cracks

Again, we don’t think 1Q22 reports knock the cover off the ball as the stronger crack environment really didn’t start to show up until the end of the quarter. Though, the 2Q setup is looking good.

You’ll of course have your one-offs like perennial negative revision Holly (DINO).

DINO price vs 1Q22 EPS

But the refiners’ own disclosures are confirming the rapid strength in refining cracks. It’s great, you can just grab this stuff off their website, they do the math for you.

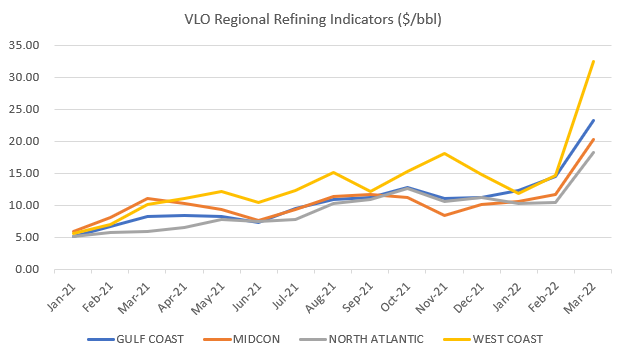

VLO disclosed regional indicators

Same trend seen with MPC disclosures, though they don’t net out RIN costs like VLO kindly does - artificially inflating net realizations to MPC by a few bucks.

MPC regional indicators

So we use RINs as reported VLO. $6-7/bbl RIN burden needs to be taken off MPC reported margins.

VLO reported RIN expense

Holly Sinclair’s disclosures show strength as well, though the combination of downtime at their just-acquired Puget refinery and startup costs associated with their renewable diesel project startups will keep them from realizing the generic margins disclosed.

DINO refining indicators

If you’re watching crude, you must watch distillate.

And while you’re watching, keep an eye on refiners in addition to the go-to E&Ps and OFS names.

Running a plant at $5/bbl expense to capture a $40/bbl spread doesn’t sound like a bad business today.

Reading your last piece, I started to wonder if there was a small cap refiner to play this and in days you served DK on the plate. Muchas Gracias!