CLR: Reserve Revisions Break a Losing Streak

We look in the 10-K and have a few questions with pos & neg implications

No hot takes on CLR’s 4Q21 results on 2022 guidance. Plenty of that elsewhere. We did however, spend some time going through the 10-K.

We like the reserves and SMOG data to look for longer term trends.

CLR has always been an anomaly within the E&P universe. Very concentrated ownership, uber-cowboys. Drill fast, grow fast … returns should be fine in the powerpoint slide deck, but often fall short.

They’ve been plagued with persistent inventory issues in the Bakken that were not ameliorated with their move into the MidCon gas/NGL plays in recent years. Last year saw more acquisitions outside their core areas, this time in the PRB and Permian.

After writing off some 3.4 Tcf of proved gas reserves 2015-2020, CLR at long last posted positive revisions in 2021 with a net revision of 235 Bcf as the price used in their reserve calculation jumped from $1.17/MMBTU in ‘20 to $3.46/MMBTU in ‘21.

Interestingly, the price related reserves were 458 Bcf but were whittled down with delays in PUD scheduling and outright PUD reserve writedowns, partially offset by the “other” category that includes change in ownership interests, operating costs, anticipated production, among other criteria. Scheduling we get as drilling cadence slows. Outright reduction, we have questions.

Oil saw a similar inflection in revisions with a 15 mmbbl positive revision in 2021 after writing off 840 mmbbl 2015-2020. SMOG price nearly doubled y/y from $34/bbl to $62/bbl.

Though these revisions don’t look encouraging at all once the contributors are disaggregated. 92 mmbbl of positive revisions was nearly entirely wiped away by negative revisions to PUD timing, PUD writedowns, and other. Again, scheduling perhaps makes sense, but the absolute PUD writedown raises questions along with the buried “other” losses.

Total proved reserves grew handily y/y with growth from the drillbit and acquisitions contributing meaningfully.

The acquisitions last year helped address a knock on the stock in the last few years, namely that it was slowly becoming a gas name as its core oil Bakken inventory was shrinking.

As far as proved reserve life, we stopped using it years ago as PUD % was all over the place and E&Ps were so inconsistent and aggressive with bookings that PUDs became near meaningless. We do like to look at proved developed reserve life. CLR was running pretty lean the last couple years at 5.5-6 years, not quite GOM level, but low for a shale company. The 2021 acquisitions and the price revisions have given a big boost to PD/P. Can’t help but wonder about the proved developed bookings on the acquisitions…

We like the SMOG report to give some outside, (more) independent assessment of the company’s reserve base and economics therein. Ryder Scott covered 91-98% of CLR’s reserves in the last several years.

We first wanted to look for trends in the annual assessment of future production costs and future development costs - the latter because we’re looking for ways to test our thesis that costs have been deflating in energy and that’s been mistaken for “underinvestment.”

Future production costs, opex, took a big jump in 2021 after the commodity-price led drive in 2020. But at $11.50/boe, it’s the highest level it’s been at for our time sample. Operating costs are rising.

Future development costs have indeed been trending down. At $4.50/boe in 2021, the costs to bring PUDs online has come in a good bit from the $6.50/boe level hit in 2018.

CLR has been getting gassier, which may explain part of the FDC deflation, but at 52% in 2021 vs 50% in 2018, the difference isn’t terribly meaningful. Unless the PUD inventory is disproportionately weighted towards gas - but again not the case. 2018/2021 crude PUD % was 54% and 46% while gas PUD % had gone from 57% in 2018 to 43% in 2021. Can we count this as evidence that costs have been deflating?

What’s the company’s reserve base worth? CLR’s pre tax PV-10 value has recovered and eclipsed its 2018 level and now sits at $20B. On a unit basis, it’s back at the 2018 peak of $12.50/boe.

Questions from us after going through this:

CLR had acquisition costs incurred of $3.8B in 2021 and acquired a total of 237 mmboe proved reserves. Paying for future bookings to be sure.

In oil alone, they acquired 175 mmbbl, but lost nearly half that amount elsewhere in PUD issues and “other.” What’s happening to the base oil assets?

What does the development cadence in the acquired asset portend for the reserve mix and PV-10 value going forward?

How can we build comfort around the proved develop and PUD bookings for the acquired assets?

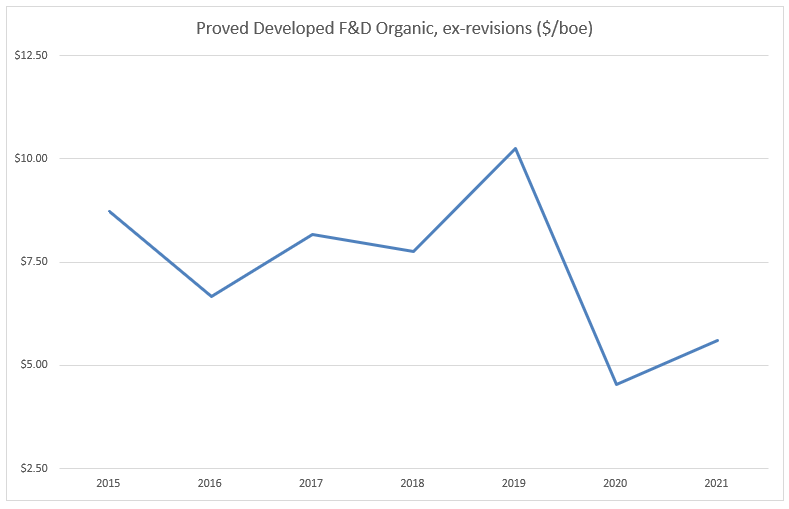

Is this drop in proved developed F&D sustainable? Because if so, wow…

Viscosity Redux