How to make the weekly DOE inventory report fun? No can do.

But we do urge readers to look at all of the relevant data - not just crude.

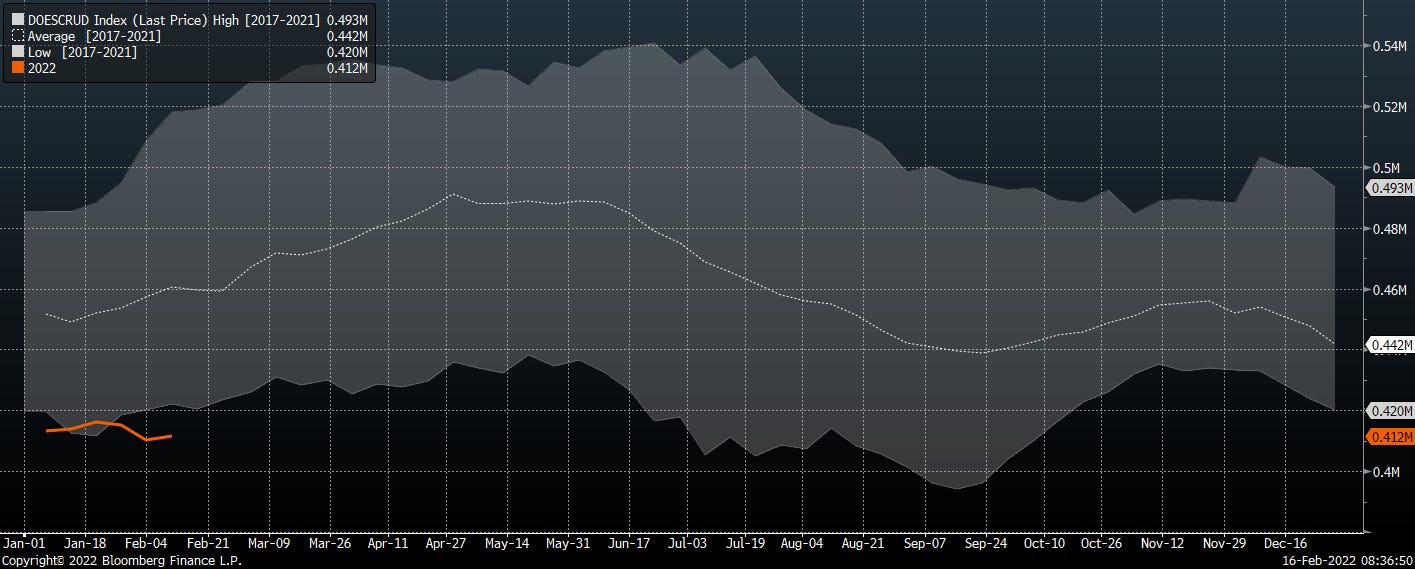

All crude, not just Cushing (which is now a way-station en route to the Gulf Coast).

And all products. Who cares what crude is doing if you aren’t looking at what’s happening on the refined product side?

As the title suggests, as long as product inventories stay tight in the US and abroad, we think it’s constructive for the crude market and energy equities.

Crude inventories - below 5 yr range

The pundits keep talking about Cushing, which just doesn’t matter to markets like it used to - now that the US is overpiped and a big crude exporter. Why isn’t anyone talking about low inventories in Minot, North Dakota? Because it doesn’t matter.

Cushing inventories - well below 5 yr range

Cushing - who cares?

Cushing - where the refineries aren’t

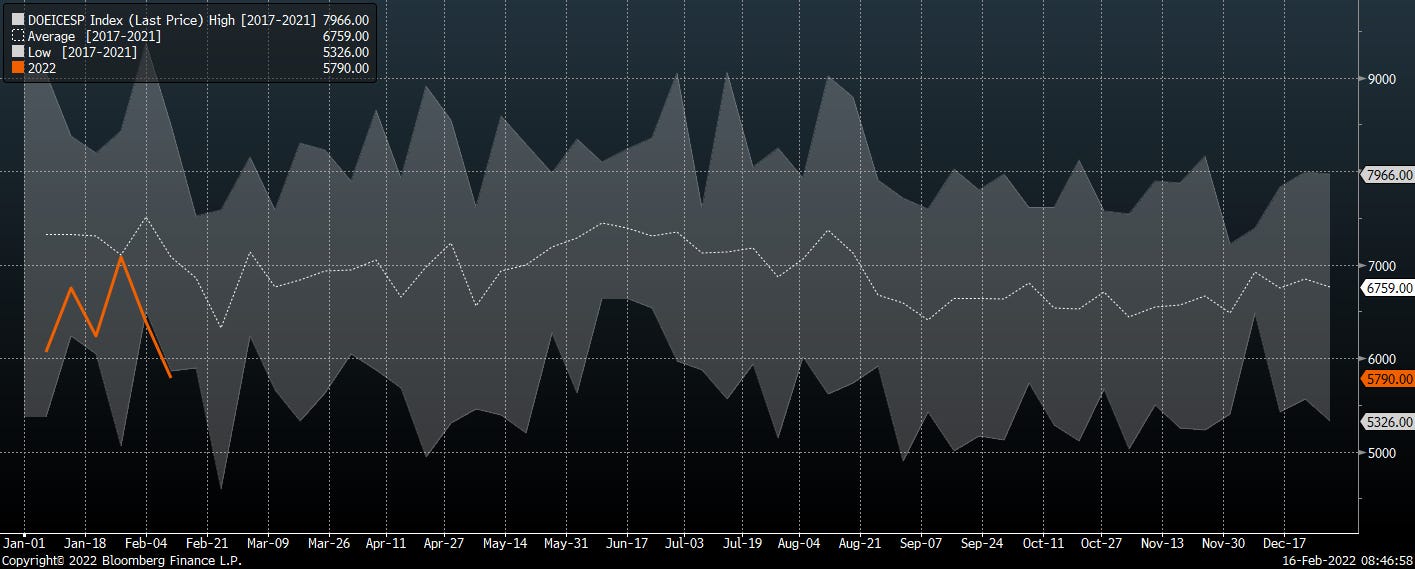

Gasoline

Gasoline inventories, after a few weeks of big builds recently, are drawing counterseasonally

Gasoline inventories - below the 5yr range

Demand hanging in and recently closing the gap to the 5yr average.

Gasoline implied demand

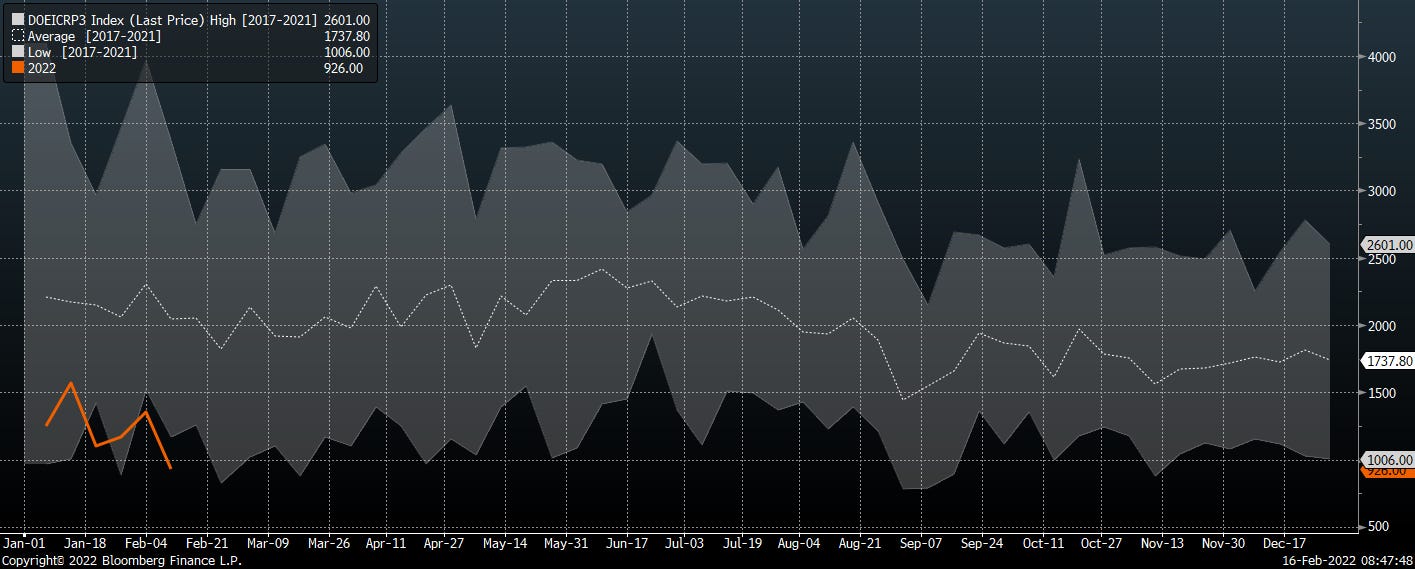

Distillate

We reiterate - this is ground zero globally. Where distillate inventories go so to will crude markets.

Distillate inventories still way below 5 yr range - and drawing

US East Coast is short distillates, acutely during winter weather as they use distillate for heating in addition to road transport. They’re calling for imports.

PADD I distillate imports

The US is staying stingy on distillate exports. We’re not too inclined to help the globe replenish their inventories when we’re short here.

Total distillate exports - back below 5 yr range

Demand remains robust - though has come in a bit from January levels about the 5 yr average.

Distillate implied demand

Other Liquids

Propane/Propylene still very tight

NGLs ex-propane similarly short

The “other oils” EIA categorization is predominantly NGL plant liquids and liquefied refinery gases. Think C2-C5+ sourced from gas processing plants and refineries. Often a feedstock for petchem facilities.

Other oils implied demand - robust

Refining

Utilization - down a tick due to winter weather downtime primarily in PADD III.

US Refiner Utilization %

On an absolute basis, runs were near the bottom of the 5yr range due to lower domestic capacity (closures) and the aforementioned weather impact.

US refining crude oil input

More Crude Charts

Again, it’s the products that matter most to us. But emphasis continues to be on the upstream crude side.

For grins, here’s a quick look at crude charts the next level down

US Crude Imports

PADD III imports running low - outlier

Crude exports steady

Which is impressive considering North American crude differentials aren’t screaming for exports.

Crude diff: Midland vs Brent

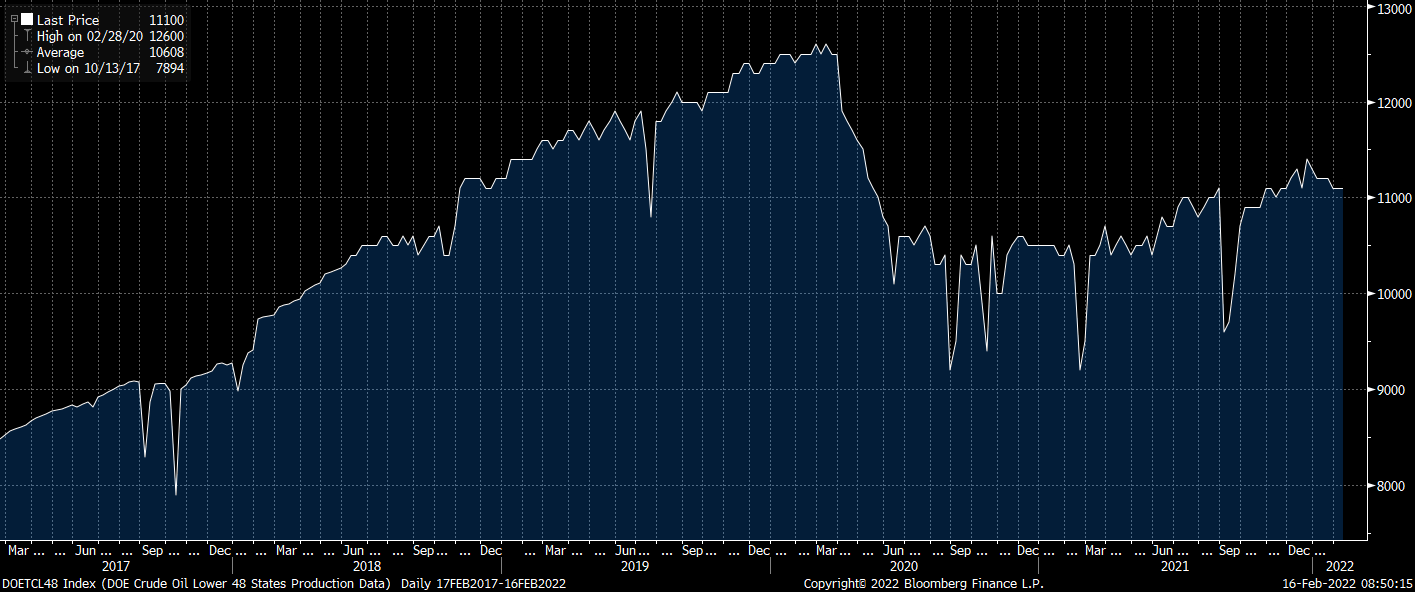

L48 production flat

If you made it this far - congrats. Here’s a bonus nugget for tomorrow:

Did you know PXD has European nat gas swaps? 30 mmcfd at $5.07/MMBTU.

We’re not exactly sure how this swap was structured, but on our math, TTF averaged about $32/MMBTU in 4Q21.

So is it as easy as - stay long until inventories are up to at least the 5 yr avg and watch distillates for a change in trend?