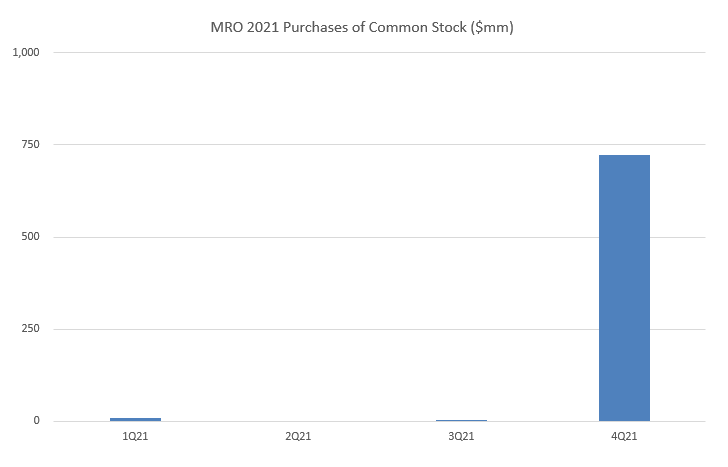

Marathon Oil (MRO) caught the market a bit off guard today when it disclosed that it had bought back $724mm of its stock in 4Q21. Halfway through February, it further disclosed that the buyback is still running hot with ~$375mm repurchased year to date.

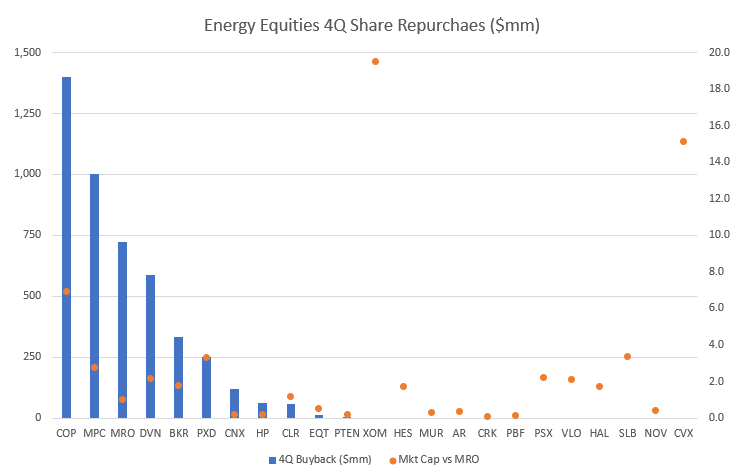

Measured as a % of market cap, MRO’s repurchase activity is heads above the rest of energy, beating CNX who took advantage of 4Q price strength to step up its buybacks, and MPC who is in the midst of a laborious return of capital after selling its Speedway business for $21B last year.

Energy 4Q21 Share Repurchase % Market Cap

Even on an absolute basis, MRO’s 4Q activity stands out, falling behind only COP (7x market cap) and MPC (3x market cap, distributing asset sale proceeds).

We learned a while ago to follow the capital, not the narrative.

Energy 4Q Share Repurchases

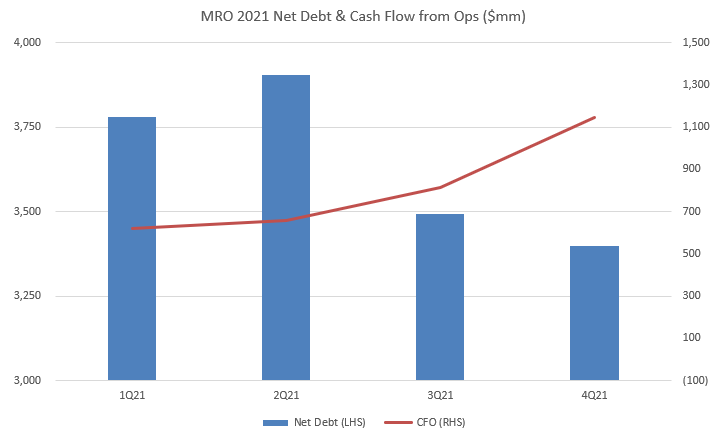

As commodity prices rallied and MRO’s cash generation accelerated throughout 2021, they took the opportunity to take in some $1.4B in debt.

MRO Net Debt & CFO

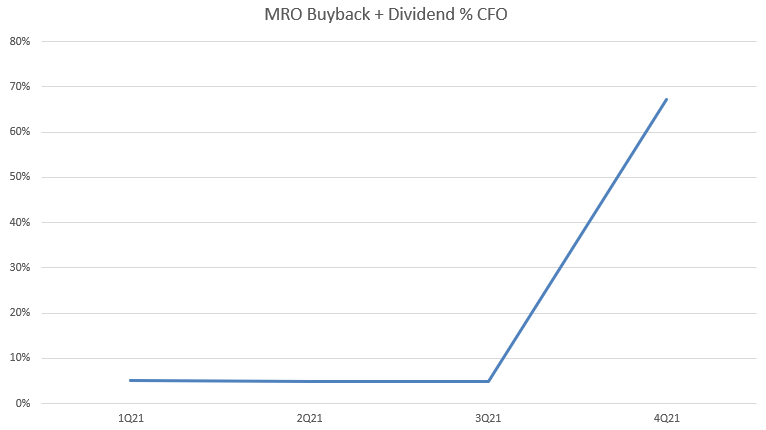

With their target debt reduction complete at the end of 3Q21, the fourth quarter saw a “transition to a focus on returning a compelling amount of capital to our equity investors.”

MRO Repurchase Activity

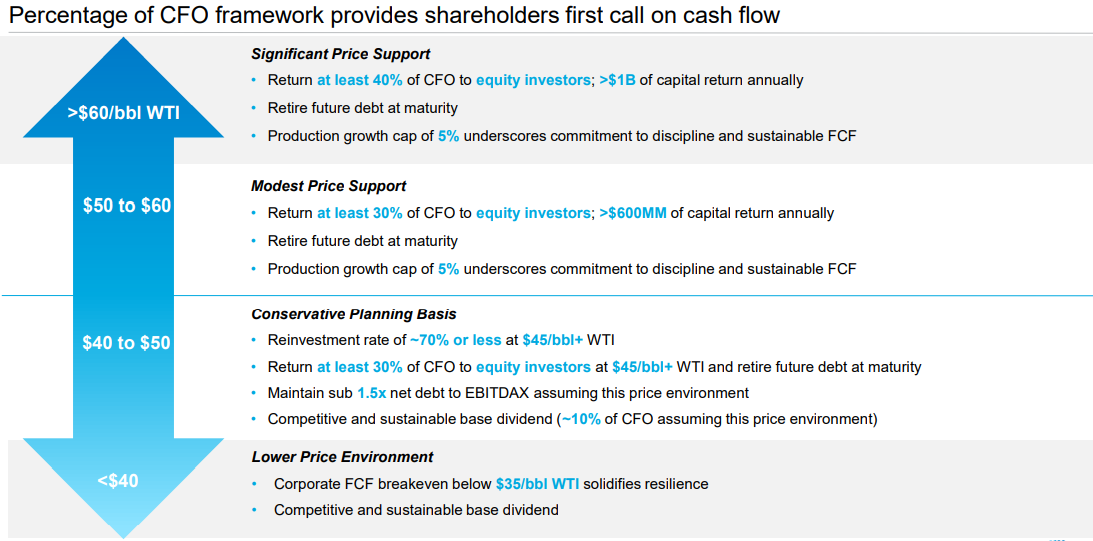

MRO has a handy framework which lays out priorities for capital returns depending on the commodity prices. With 4Q prices >$60/bbl WTI, the plan was to return at least 40% of CFO to equity investors

In their own words:

“we returned over 70% of our cash from operations, significantly exceeding our minimum 40% commitment”

As they note - MRO’s cash return is a function Cash Flow from Operations NOT of free cash flow like most peers.

MRO Capital Return % CFO

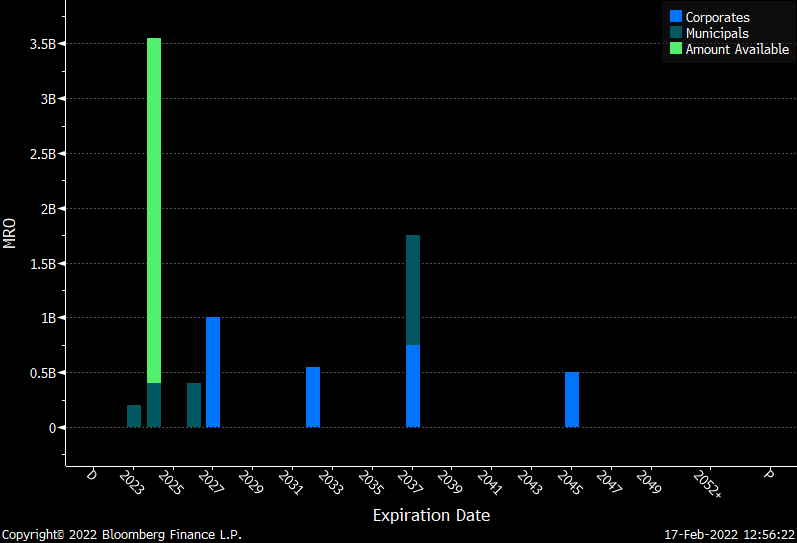

With higher prices on tap in 2022, cash flow generation is set to increase and they have little in the way of near term debt maturities to address.

MRO Debt Distribution

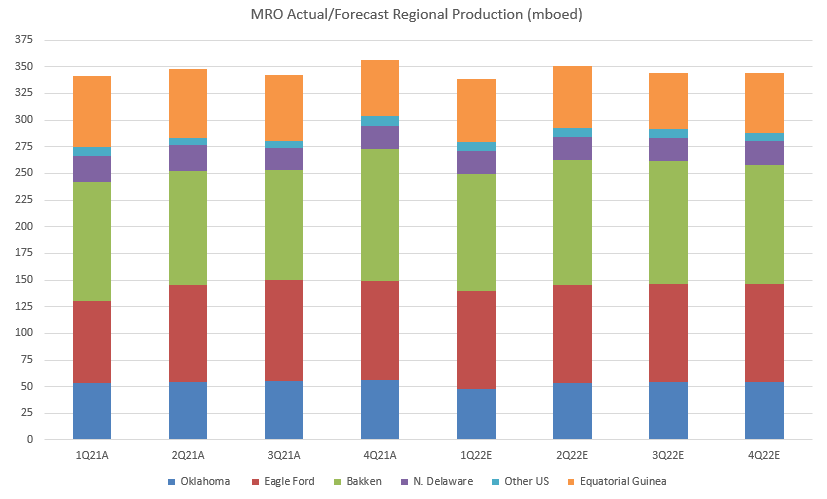

It’s not going to growth capex per management.

“We will remain disciplined and will not add production, growth capital to our budget in 2022, our focus will remain on free, cash flow generation, return of capital and per share financial metrics.”

and in case you needed to hear it again:

“We are not allocating any production growth capital in 2022 and expect our total company oil and oil equivalent production to be flat with 2021 full year averages”

Prices up - production flat.

MRO Production

This is where the math gets interesting. MRO won’t be retiring debt early and will wait until maturities, so no gross debt reduction this year. They’re also reticent to increase the base dividend to a point where it could be at risk of a cut during a downturn.

“Our objective there for the with the base dividend is to have a competitive yield when compared to peer average and the S&P 500. And also, in addition, it competitive we needed to be sustainable. And we think of that in the context of a pretty conservative planning basis price deck sort of in a $45 to 50 $50 world”

S&P 500 dividend yield: ~1.5%

MRO base dividend yield: 1.3%

Maybe a token increase from here, but we don’t look for the base dividend commitment to grow materially.

MRO & S&P 500 dividend yield

They are clear about preferring share buybacks as a value proposition versus increases to base dividend or introduction of a variable dividend.

Buybacks will be the flywheel, in our opinion. But how much?

The MRO framework again:

“As a reminder, our framework calls for delivering a minimum of 40% of cash flow from operations to our equity holders when WTI is above $60”

If they realize prices well above $60 WTI, like 4Q21, they express a willingness to return well above the 40% CFO minimum they’ve laid out

“We see potential to meaningfully outperform our minimum 40% of CFO commitment. We’ll return over 50% of our CFO to equity investors in the first quarter. For the whole year upside potential at the same $80 WTI, and $4 Henry Hub, deck could be as high as 70% of our CFO, the level at which we executed during the fourth quarter. That would represent a return to equity investors are around $3.1 billion occurs to 20% of our current market capitalization.”

At the strip, we would expect MRO to return via dividends and buybacks closer to 70% than 40% of CFO if they don’t intend to build a cash pile.

MRO Cash Flow Sources & Uses

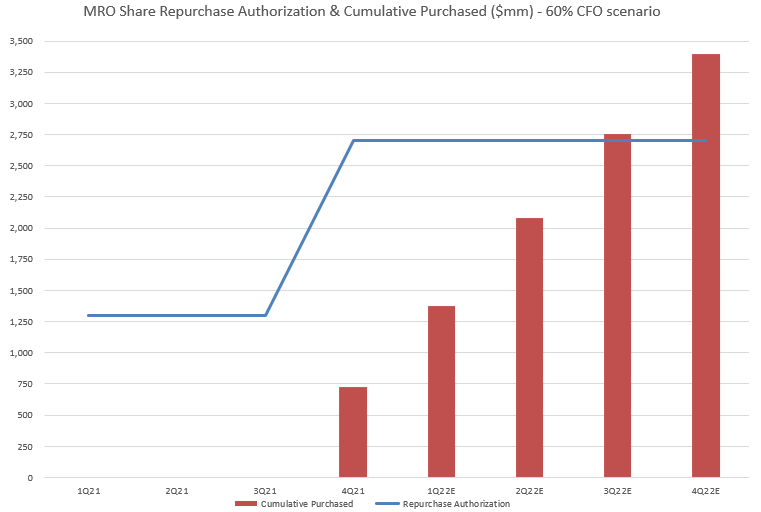

MRO has $1.7B remaining on its authorization, after receiving an increase in November 2021. With the base dividend running about 4% of CFO we test a scenario where MRO gets to a consistent 60% returned to shareholders via dividend & buybacks.

MRO Share Repurchase Authorization & Activity

MRO’s remaining repurchase authorization at 9/30/21 was $1.3B. It was increased to by $1.4B in November when the company was only $200mm into its newly resumed buyback program. We think the writing was on the wall as management and the board knew $1.1B would be consumed in very short order.

If commodity prices hold, we wouldn’t be surprised to see MRO call for another increase in buyback authorization around midyear.

Don't think we'll know the true answer to that question until the market responds to the first sequential reduction in variable dividends. Until then, it's hard to see energy base+var yields converging down to market levels.

How do you think market participants are viewing buybacks vs. variable dividends (DVN)? Trying to wrap my head around upside with respect to total shareholder return and incentives for generalists